Agricultural News

Certified Angus Beef Insider Market Update

Wed, 15 Jun 2022 13:23:06 CDT

Volatility in futures contract prices is a common theme in the modern era, but this past week was particularly exaggerated. The June Live Cattle contract leaped $2.45/cwt. higher last Wednesday to close at $136.85/cwt., close to the prior week's cash fed cattle weighted average price.

Volatility in futures contract prices is a common theme in the modern era, but this past week was particularly exaggerated. The June Live Cattle contract leaped $2.45/cwt. higher last Wednesday to close at $136.85/cwt., close to the prior week's cash fed cattle weighted average price.

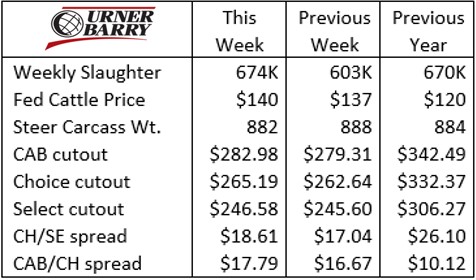

Thursday held the prior day's gains and the cash fed cattle trade capitalized on the positivity, generating a $3/cwt. increase for the week, with the weighted steer price averaging $140/cwt.

June 13's incredibly bearish day in the equities markets spilled negatively to commodities, pressuring June Live Cattle right back down to close at $134/cwt. This week's early cash trade has shrugged off any negativity with fundamental demand taking over. Confirmed sales in the north are sharply higher from $144 to $149/cwt. while southern packer bids trail much farther behind at $138/cwt. so far.

The quick uptick in price signals that market-ready fed cattle are fairly tight in the country. As well, the premium in the northern feeding region remains indicative of the quality-starved market in the short term.

Excessive heat is the theme this week, with several days in a row of temperatures near and above 100 degrees across several latitudes in cattle feeding country. High costs of gain in the feedyard do not pair well with sultry temperatures, halting efficiency. The weather will have cattle feeders building a fairly deep show list for their negotiated sales this week.

The boxed beef trade last week saw firmer prices with the CAB cutout increasing $3.67/cwt., Choice up $2.55/cwt. and Select up just $0.98/cwt. In the past 10 years, the CAB cutout increased from May into the first week of June just four times and further price hikes into the second full week just three times. The 10-year average trend beginning in early June shows a 10% price decline through late July before boxed values reverse and move higher again.

On a cut-by-cut basis across the beef carcass it was the short loins that hoisted the largest price increase last week. In preparation for Father's Day (think "T-Bones") the short loin price has increased 10% in two weeks. Not far behind and sourced from the same exact point on the carcass, strip loins are charting a perfect seasonal price pattern, looking for their June wholesale price high most recently at $8.83/lb., up 9% in four weeks.

Rounding out some of the additional price-surge highlights last week were the thin meats, such as flanks and inside skirts as well at tri-tips. In sum total, the chuck primal posted big gains but incrementally for each individual cut.

PRIME PREMIUM REFLECTION

Seasonal factors in the wholesale carcass market are firmly in place this year. The percentage of high quality grade carcasses in the northern mix continues down an exaggerated decline. Nebraska packing plant averages show a six-week downtrend, culminating in a 31% decline in Prime carcasses through June 4. This performance is not unlike that of 2021, but the current six-week Nebraska average of 9.4% Prime pales in comparison to last year's record 15.7% Prime for the period.

Typically, the bulk of premium grade carcasses are generated in the north, with Nebraska being the largest volume producer of Prime and CAB brand carcasses. While that still holds true, the two other largest packing states in the country are holding a steadier grade pattern this season. In the same recent six weeks, Kansas packers saw their share of Prime carcasses slip by only 8.4%, while Texas packers Prime count increased 7.7%.

Looking at national Prime carcass production tonnage shows an 11.9% smaller year-to-date total. In the past six weeks, the year-on-year decline is even greater at 18% less tonnage. Bear in mind that we're describing total hot carcass weight, a very basic measure, instead of actual boxed Prime labeled sales.

Consumer concerns with inflation are quite real and retail beef values closed out the first quarter 15% higher than last year. The pattern will be in line with this again when the second quarter data is complete. Even so, the end user beef market has gained a widening appreciation for Prime beef (not to mention the much larger, more economical Premium Choice branded market, primarily CAB).

This is reflected in the current Prime cutout value. Data from the first week in June showed a $35.89/cwt. Prime premium over the Choice cutout, 64% higher than a year ago. Packers have recently shared roughly half of the wholesale premium with cattle feeders on their grids, $17/cwt. in the past two months.

While Prime grid premiums have backed off of their lofty January highs near $28/cwt., the current Prime value is exceptional on a historical basis. The last time Prime grid values surpassed the current level during this time of the year was in 2014. That market presented an entirely different Prime production environment compared to today. The supply chain was starved for cattle as the nation restocked the beef cow herd while Prime carcasses were just 3.5% of fed cattle production.

Prime carcass tonnage in May 2014 was roughly one-third of the total for May 2022. As rare as per capita pounds of Prime beef were at that time, the grid premium was only $1.78/cwt. higher (10%) than it is today. Even as price sensitivity is ubiquitous among consumers during an extremely inflationary economic environment, an opportunity to build beef loyalty remains strong with high quality specifications. The premium grade and brand premiums are impossible to ignore at this time.

WebReadyTM Powered by WireReady® NSI

Top Agricultural News

More Headlines...