Dr. Derrell Peel, Oklahoma State University Extension Livestock Marketing Specialist, offers his economic analysis of the beef cattle industry as part of the weekly series known as the “Cow Calf Corner,” published electronically by Dr. Peel, Mark Johnson, and Paul Beck. Today, Dr. Peel discusses beef demand in 2025.

The all-fresh retail beef price for January was $8.15/lb., up 4.3 percent year over year. All-fresh beef retail prices have averaged 5.2 percent higher month over month for the last year leading to retail all-fresh beef prices for the past twelve months at a record average level of $8.27/lb. Per capita beef consumption in 2024 was unexpectedly higher at 59.7 pounds as a result of constant domestic beef production and larger net imports of beef. The combination of increased beef consumption and higher prices indicates stronger beef demand.

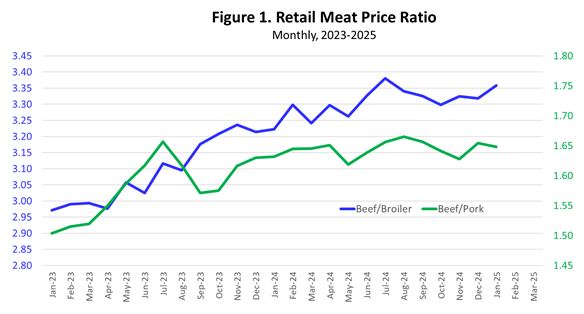

All-fresh retail beef prices continue to increase relative to pork and broiler prices as shown in Figure 1. For the past twelve months, the average ratio of all-fresh beef to broiler retail prices has been 3.31 and for beef to pork prices has been 1.65. Retail broiler prices were unchanged year over year in January while retail pork prices were up 3.3 percent from one year ago.

Wholesale Choice beef cutout prices have averaged 11.8 percent higher year over year for the first six weeks of 2025. Prices are higher for all primals with stronger prices for end meats relative to middle meats. Prices for rib primals are up 9.2 percent year over year with loins prices up 4.6 percent compared to the first six weeks on year ago. Chuck prices are 14.8 percent higher and round primal prices are up 22.3 percent year over year.

Prices for most wholesale beef cuts are higher thus far in 2025 compared to one year ago (Table 1). Most steak prices are higher, including Strip Loins and Ribeye. The most notable exception is weaker prices for Tenderloin in recent weeks. Strong prices numerous lean carcass cuts, primarily from the round, are supported by increased grinding demand for ground beef production.

Table 1. Wholesale Beef Prices, Selected Products, Six Week Average

| Primal | Product | IMPS | Price | % Change from one year ago |

| Chuck | Top Blade | 114D | $503.65 | 14.0 |

| Arm Roast | 114E | $519.43 | 31.5 | |

| Petite Tender | 114F | $556.54 | -23.4 | |

| Mock Tender | 116B | $400.14 | 26.8 | |

| Chuck Flap | 116G | $792.23 | -4.0 | |

| Brisket | Brisket | 120A | $644.40 | 2.5 |

| Round | Knuckle | 167A | $413.40 | 25.1 |

| Top Inside Round | 168 | $381.33 | 27.6 | |

| Bottom Round | 170 | $380.81 | 19.3 | |

| Outside Round | 171B | $389.65 | 13.7 | |

| Eye of Round | 171C | $393.33 | 16.4 | |

| Loin | Strip Loin | 180 | $890.80 | 14.1 |

| Top Butt Sirloin | 184 | $425.05 | 7.1 | |

| Tri-Tip | 185D | $656.92 | 16.2 | |

| Tenderloin | 189A | $1262.33 | -9.1 | |

| Flank | Flank | 193 | $581.55 | 8.9 |

| Rib | Ribeye | 112A | $1020.09 | 3.2 |

| Trim | 90 % Lean Trim | $358.09 | 25.3 | |

| 50 % Lean Trim | $110.50 | 26.7 |

Derrell Peel, OSU Extension livestock marketing specialist, looks at how cattle markets are performing one month into the new year on SunUpTV from February 8, 2025 at https://www.youtube.com/watch?v=llgALnrsyB4&list=PLglOSpV-TcadvUT94k2ZDaOvQF9BRvTGs&index=1