The agricultural sector is undergoing significant transformations, and the American Bankers Association (ABA) is at the forefront of advocating for policies that ensure farmers and ranchers have access to crucial financial resources. Farm Director KC Sheperd recently visited with Ed Elfman from the ABA, who shed light on the organization’s priorities and the challenges facing agricultural lenders and producers.

Elfman emphasized ABA’s commitment to supporting agricultural lending across the United States, given that 82% of the banks in the United States have agriculture in their portfolios.

Elfman articulated the ABA’s central mission to ensure that “We’re getting money out to those farmers and ranchers to make sure that they’re able to do what they need to do. Then we’re always keeping track of things in Washington, DC, to make sure that credit can continue to flow out to rural America.” This underscores the organization’s dual role as both a credit facilitator and a policy advocate.

Several key issues are currently at the forefront of the ABA’s agenda. First, the agricultural economy itself remains a critical concern. “I will tell you whether it’s good or bad. We’re always watching the ag economy,” Elfman stated. He also highlighted regional economic disparities, noting, “There’s definitely some nervousness in the south and southeast as far as the ag economy goes.”

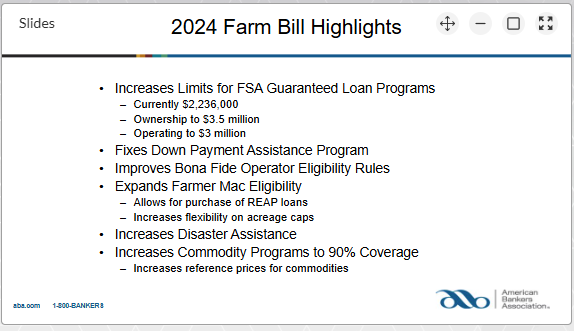

The Farm Bill is another significant focus. “We really want to get a long-term farm bill done because it creates stability for bankers and farm customers and everybody else across the board,” Elfman explained. He also advocated for the modernization of reference prices, asserting, “They’re woefully behind.”

Additionally, tax reform is a prominent issue. “The third big thing I think everybody in DC is really talking about is tax reform through the reconciliation process,” he noted.

The changing structure of farm operations also presents unique challenges. “When you look at the last Ag Census, compared to the most recent Ag Census, you’ll see some more consolidation in agriculture,” Elfman observed. This trend, he explained, creates obstacles for smaller banks, as “if you have these larger and larger operations, it’s going to be harder and harder for smaller banks to finance those large operations.” However, he also noted the positive trend of “an emergence of more and more smaller, beginning farmers, again.”

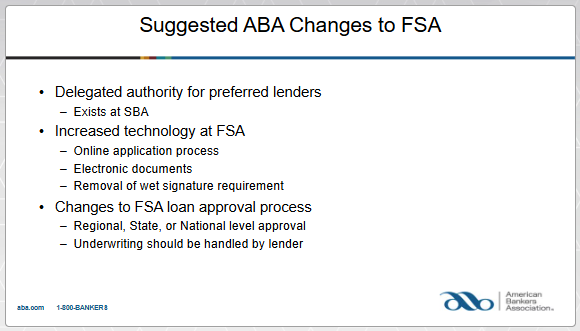

To address these challenges, ABA is advocating for improvements in the Farm Service Agency (FSA). Elfman offered a specific example of inefficiencies: “If you fill out loan documentation through FSA and you forget to put your middle name, what currently happens is all the paperwork you’ve sent to a farm service agency gets turned around.” He proposed that “you can’t go to the next page unless all fields have been filled out” in an online application to improve efficiency.

Furthermore, ABA emphasizes the importance of economic assistance programs like ECAP. “So for us, it’s trying to make sure that we’re using that program to help people get through this next year here, because some folks are going to be pretty short,” Elfman stated.

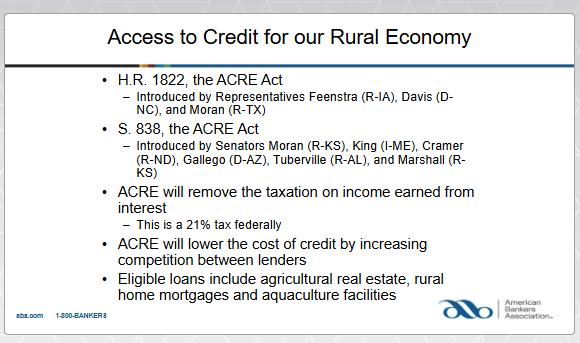

ABA is also promoting the ACRE Act, which aims to lower interest rates for farmers and ranchers. “ACRE will create more competition in the lending space and help lower interest rates for farmers and ranchers,” he explained.

Staying Informed

For those seeking more information, the ABA provides resources on its website:

- aba.com: The ABA’s main website.

- aba.com/acretoolkit: Information on the ACRE Act.

- aba.com/agbanking: Resources on farm bill and other agricultural banking matters.

The ABA’s efforts are crucial in ensuring that the agricultural sector has the financial support it needs to thrive in a constantly evolving environment.