Dr. Derrell Peel, Oklahoma State University Extension Livestock Marketing Specialist, offers his economic analysis of the beef cattle industry as part of the weekly series known as the “Cow Calf Corner,” published electronically by Dr. Peel, Mark Johnson, and Paul Beck. Today, Dr. Peel compares four years of March feeder cattle market conditions.

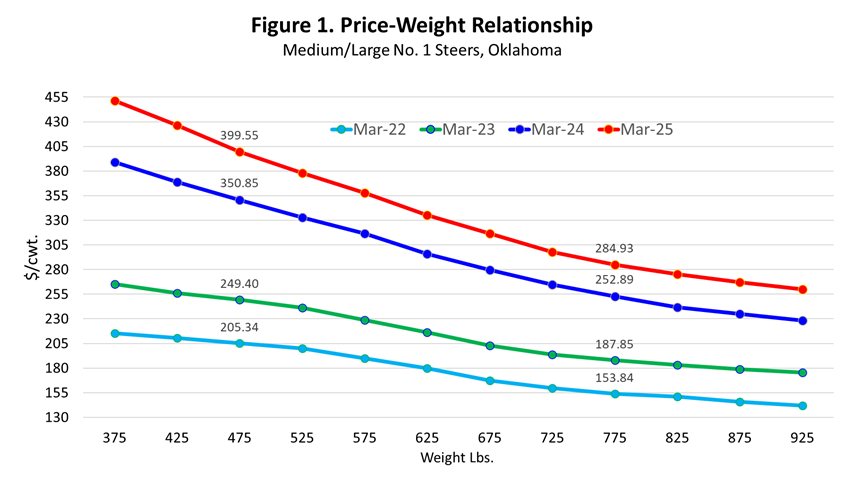

As March wraps up, it is interesting to look back at feeder cattle markets over the past four years. Figure 1 shows Oklahoma combined auction prices by weight for M/L, No 1 steers in March since 2022. Not only have feeder cattle prices risen dramatically, but the relationship between light and heavy weight feeder cattle has changed significantly. The change in relative prices across weight groups reflects market signals about how resources should be used for cattle production.

As an example, Table 1 summarizes the prices and relationships between calf prices and feeder cattle for 475- and 775-pound steers. These prices are highlighted in Figure 1. In total, prices for calves increased by 94.6 percent from 2022 to 2025 while prices for 775-pound steers increased by 85.2 percent. Prices for the feeder steers increased faster initially in 2023 before the calf prices increased sharply in 2024 and 2025. In 2023, the March feeder prices were 75.3 percent of the calf price level but by 2025, the feeder price was 71.3 percent of calf price.

The price relationships between calves and feeder cattle determine the value of adding additional to calves as stockers. Table 1 includes the value of 300 pounds of gain between the 475-pound calves and 775-pound feeders. In 2022, the value of gain was $0.72/pound and increased to $1.03/pound by 2025. Over the four years, the value of gain increased by 43.1 percent.

Table 1. March Prices and Value of Gain, M/L, No. 1 Steers, Oklahoma Combined Auctions

| Weight | 2022 | 2023 | 2024 | 2025 | % Chg.2022-2025 | |

| Lbs. | $/Cwt. | |||||

| 475 | $205.34 | $249.40 | $350.85 | $399.55 | +94.6 | |

| % Chg. YOY | +21.5 | +40.7 | +13.9 | |||

| 775 | $153.84 | $187.85 | $252.89 | $284.93 | +85.2 | |

| % Chg. YOY | +22.1 | +34.6 | +12.7 | |||

| 775 as % of 475 | 74.9 | 75.3 | 72.1 | 71.3 | ||

| VOG | ($/lb.) | $0.72 | $0.90 | $0.98 | $1.03 | +43.1 |

| % Chg. YOY | +25.0 | +8.2 | +5.8 | |||

YOY = Year over Year; VOG = Value of Gain

The increase in calf prices means that cow-calf revenue has increased dramatically in the past four years. Based on the March prices in Table 1, calf revenue has increased from $975.37/head in 2022 to $1,897.86/head, an increase of $922.49/head. In contrast, gross revenue for 300 pounds of stocker gain have increased from $216/head in 2022 to $309/head in 2025. If we assume that it would be possible to stock two head of stockers per cow, the total stocker revenue increase would be $186 on a per cow equivalent. In other words, cow-calf revenue has increased 424 percent more than stocker revenue from 2022 to 2025.

Current market conditions clearly favor calf production over stocker production. That is to say, grass has more value marketed as weaned calves compared to stocker-based gain. Cow-calf producers have increased incentives to maximize calf production compared to retaining calves for increased stocker gain. Stocker producers face challenging margins and limited opportunities in the current market. The combination of increased calf production incentives and relatively cheap feedlot cost of gain means that stockers are squeezed into a limited role generally favoring lighter beginning weights and faster turnover of stockers.