Last week’s 591,000 head federally inspected cattle harvest was 18,000 head smaller than the week prior and 23,000 head smaller than a year ago. With that said, the production volume trend is positive, with a two-week average of 600,000 head per week compared to the prior two weeks, averaging just 571,000 head.

Broad economic turbulence on the heels of tariff announcements set equities in a tailspin beginning last Wednesday. Concerns for domestic beef demand and global implications to beef trade spilled over into Live Cattle futures with a four-day slide devaluing these contracts multiple dollars. Tuesday’s April ‘25 Live Cattle contract was valued $10/cwt. cheaper than last week’s spot fed cattle average price.

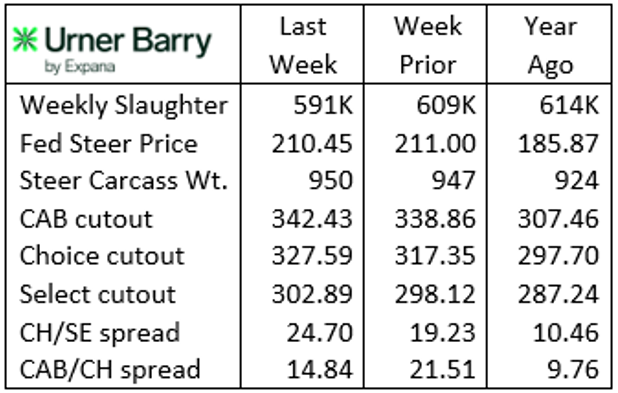

Wholesale boxed beef values were sharply higher last week with the Choice cutout leading the way, posting an increase of $10.24/cwt. in Urner Barry’s weekly average. The Certified Angus Beef ® (CAB®) brand cutout increased by $3.57/cwt., cutting the brand’s premium over Choice to $14.84/cwt. Select carcasses, at just 12.6% of the fed cattle mix, increased by $4.77/cwt., widening the Choice-Select spread to a massive $24.70/cwt. in Urner Barry’s average weekly comparison. Early this week the USDA reported the Choice-Select spread at $15/cwt in the weighted average pricing.

Recent trends have tracked middle meats and grinds driving most cutout gains. Buyers are preparing for spring holiday and grilling demand as ribeye prices have posted sharply higher since early March. Short loin, strip loin and sirloin values are increasing with similar seasonal demand, with sirloins the most inflated versus a year ago.

Chuck and round items are certainly not seeing price weakness but compared to the middle meats are in a more subdued pattern. This applies to most items except for the leaner round knuckles, eye of rounds and insides, each of which are seeing strong pricing. Thin meats and briskets are trading at values within expectation for this season and compared to recent annual patterns.

Robust Quality Supply and Demand

A wild week in economic news and equity markets rapidly transitioning to lower values has logically created a degree of uncertainty surrounding beef. However, a look at fed cattle beef production and recent price activity show promise.

The 2025 fed cattle harvest has run very close to a year ago with the full production weeks averaging 473,000 head, a 1,600 head increase over the same period last year. This may surprise some due to the fact that the cull cow and bull harvest has been dramatically lower again this year, down 14.7%, pulling total federally inspected harvest counts lower by 2.4%.

Fed steer and heifer carcass weights have averaged 32 lb. heavier than a year ago and 43 lb. heavier than 2023. Just comparing this year to last, the carcass weight increase is equivalent to adding 16,470 fed cattle to the weekly harvest, a 3.5% increase.

That fed cattle tonnage advance stands in contrast to the more readily understood theme of tighter fed cattle supplies. While we know that feedlot inventories and placement patterns indicate smaller head counts near term, the net carcass tonnage is shockingly large.

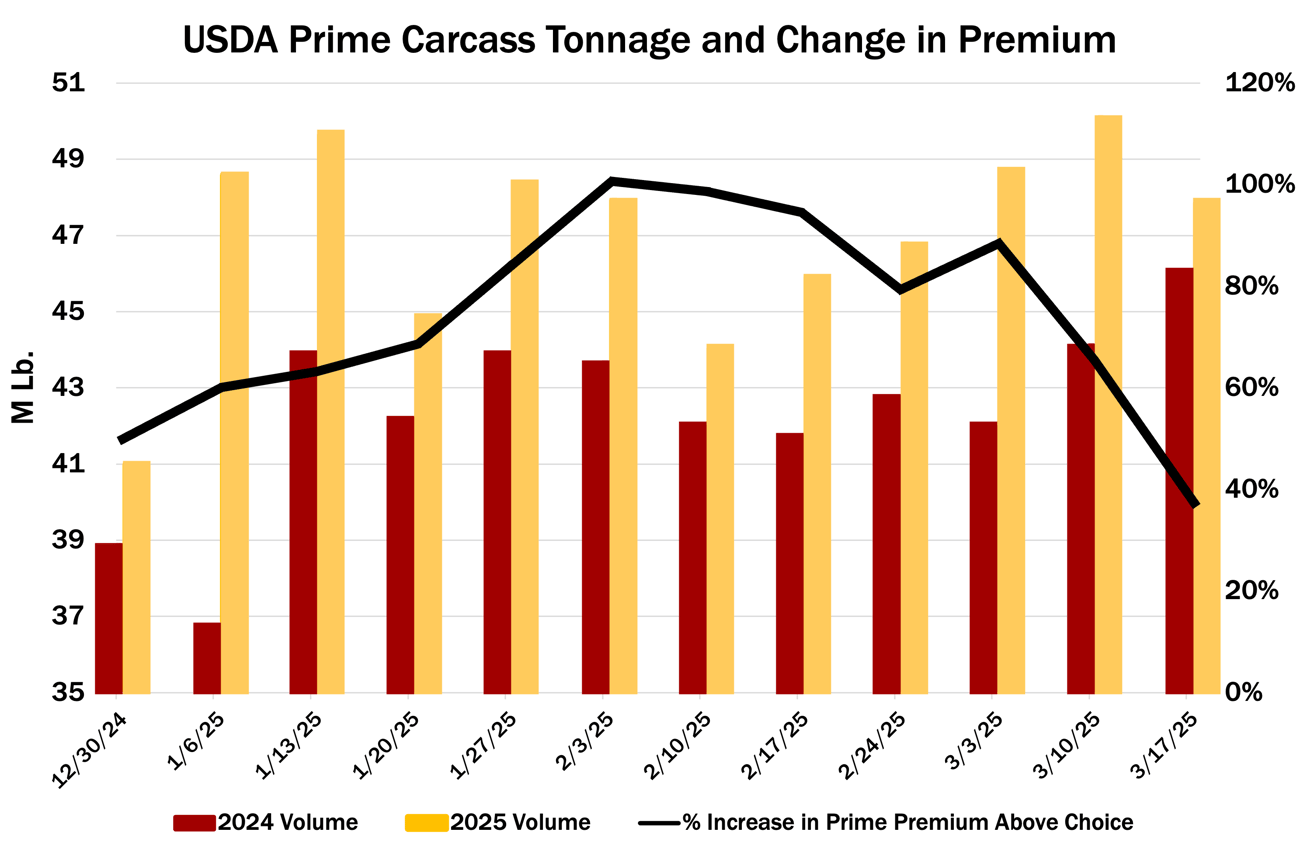

Combined Choice and Prime quality grade percentages recently touched a record-high 86.5% of fed cattle carcasses. USDA Prime has been the driver with the year-to-date number at 11% of fed cattle compared to 10% a year ago. Heavier carcass weights and the one percentage point increase in the Prime carcass share have netted a 10.8% increase in total Prime carcass tonnage. Even so, the Prime cutout premium over Choice has run 65% wider than a year ago in the last 14 weeks.

In contrast, CAB carcass tonnage has totaled 1% smaller than a year ago in the latest 10-week period. The brand’s cutout premium over Choice has averaged 16% greater on roughly the same weekly production volume for the period verus a year ago.

These supply and price metrics paint a picture of robust demand for premium-quality beef in an economic setting that has been quite inflationary over a handful of years. Consumer dollars are undoubtedly stretched and concerns over domestic and international demand are rightfully befalling cattle futures prices. Yet this snapshot suggests that recent demand patterns cast a vote in favor of the beef sector continuing a path of quality in relatively large volume rather than relying on scarcity alone as a profit driver.