Heard at the coffee shop: “Calf prices are so high right now that I don’t see why I would bother vaccinating or weaning before I take them to town. It’s extra work and buyers aren’t going to pay premiums with prices this high anyway.”

Will preconditioning pay in the face of historic cattle prices that continue to rise? Econ 101 says that a profitable decision requires that the revenue added by preconditioning must outweigh the cost added by preconditioning. (That equation also holds true for any subset of management practices.) Looking at recent history provides insight into the revenue side of that equation.

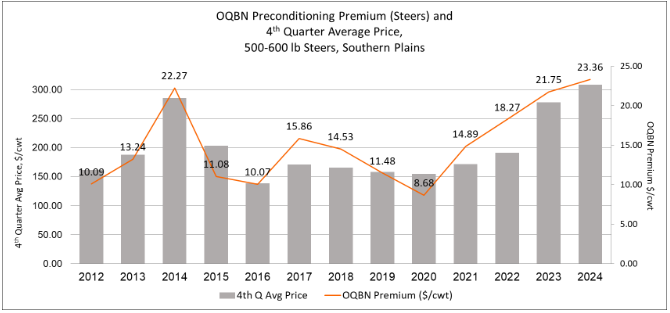

Figure 1 overlays the average preconditioning premiums ($/cwt) for steers received by Oklahoma Quality Beef Network (OQBN) cattle from 2012 through 2024 with the average 4th Quarter price (Oct-Dec) for 500-600 pounds steers in those same years. Average price is represented by the bars with the price scale on the left. The corresponding premiums are represented by the orange line and the price scale on the right. The pattern is clear – premium levels tend to move with price levels.

Recall that the Southern Plains suffered through a severe drought from 2012-2015, forcing herd liquidation by many cattlemen. As price levels rose drastically in 2014, many asked then whether the market would still reward preconditioned calves with premiums. Figure 1 indicates that the answer was a resounding “yes”.

Figure 1. OQBN Preconditioning Premiums Relative to 4th Quarter Average Price for 500-600 lb. Steers, Southern Plains. Source: Livestock Marketing Information Center and Oklahoma Quality Beef Network Historical Data (Raper and Peel).

Why would cattle buyers not only pay premiums, but pay relatively HIGHER premiums for those already very expensive cattle? The answer is RISK. The whole point of preconditioning calf health programs is to prepare calves for better performance as they move through the system. That improved performance is measured in lower death loss, fewer health issues, and better gain – that is, lower risk. For example, a survey of Texas Cattle Feeders Association feedlot managers indicated death loss rates of 4.3% for nonpreconditioned cattle and death loss of only 1.5% for preconditioned cattle. As prices move upward, the cost of death loss as well as the opportunity cost of lost performance also increases. Buyers who pay premiums for preconditioned cattle are paying to lessen that risk. And as prices move higher, the premiums that they are willing to pay for that decrease in risk will generally rise in response to the rising economic risk.

So, what’s the answer to our question “Will preconditioning pay in the face of historic cattle prices that continue to rise?” History says “Yes”. While marketing calves off the cow may yield positive returns, particularly in the current environment of rapidly rising prices, the case for preconditioning prior to marketing is still strong.