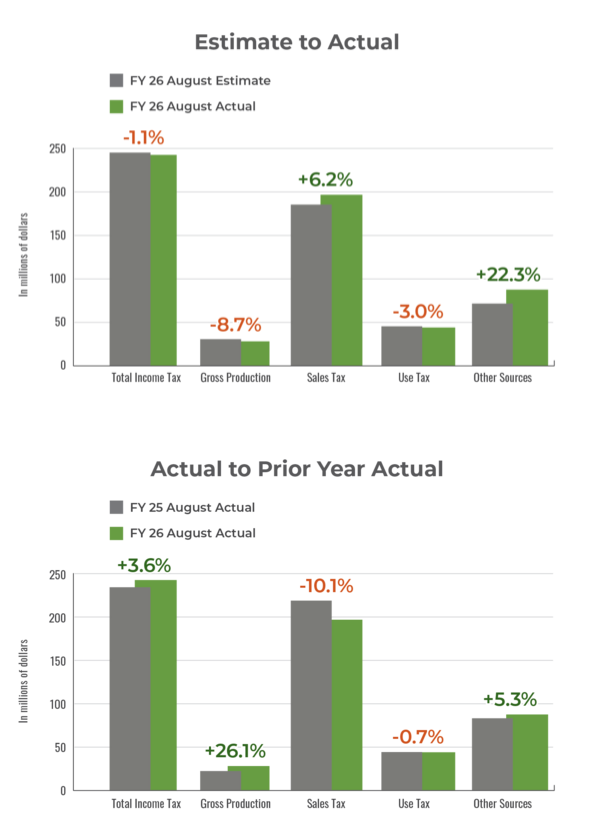

General Revenue Fund (GRF) collections in August totaled $599.1 million, which is $20.7 million, or 3.6%, above the monthly estimate. This total is also $3.9 million, or 0.6%, below collections from August 2024.

GRF collections for the first two months of fiscal year 2026 stand at $1.2 billion. This is $47 million, or 4.1%, above the year-to-date estimate and $15.4 million, or 1.3%, below collections from the same period in FY 2025.

“Two months into the new fiscal year, revenue collections are generally tracking with estimates certified by the Board of Equalization,” said State Chief Operating Officer and OMES Director Rick Rose. “Compared to this time last year, income tax and gross production tax collections are up, while the drop in sales tax reflects the grocery sales tax cut. Overall, it’s a stable start to FY 2026.”

August 2025 revenue tables are available on the OMES website.

As state government’s main operating fund, the GRF is the key indicator of state government’s fiscal status and the predominant funding source for the annual appropriated state budget. GRF collections are revenues that remain for the appropriated state budget after rebates, refunds and other mandatory apportionments, and after sales and use taxes are remitted back to municipalities. In contrast, gross collections, reported by the state treasurer, are all revenues remitted to the Oklahoma Tax Commission.