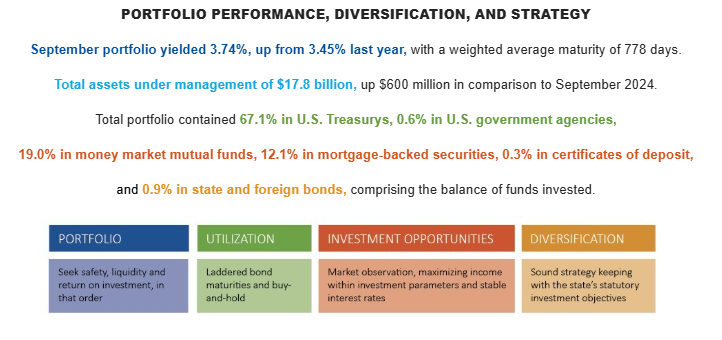

TOTAL FUNDS INVESTED

Funds available for investment at market value include the State Treasurer’s investments at $12,498,569,494 and State Agency balances in OK Invest at $3,517,599,833, American Rescue Plan investments at $934,179,839, and the Oklahoma Capitol Improvement Authority Legacy Fund at $899,473,119 for a total of $17,849,822,285.

MARKET CONDITIONS

The treasury yield curve tenor, which is a visual representation of treasury bond yields relative to the years remaining to maturity, dropped across-the-board at the end of September. The 2-year treasury was 3.09% and the 10-year benchmark was at 4.15%, which reflected a decline of 0.09% and 0.08% respectively.

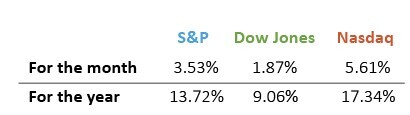

The year-to-date returns for the major stock indices were higher for September compared to August with the S&P 500, Dow Jones Industrial Average and Nasdaq coming in at 13.72%, 9.06% and 17.34% respectively. Tech companies were major movers for the stock markets on the backdrop of artificial intelligence deals. On a monthly basis the S&P gained 3.53%, the Dow was at 1.87% and the Nasdaq earned 5.61%.

The September 17 Federal Open Market Committee (FOMC) minutes released on October 8 revealed that most members supported further reductions of the key interest rates. Many Fed officials felt that the risk of unemployment outweighed that of inflation since their last meeting in July. The Committee continues to seek maximum employment and inflation at the rate of 2% over the longer run and “Participants stressed the importance of taking a balanced approach in promoting the committee’s employment and inflation goals”. The current federal funds target rate range is now 4.00% to 4.25%.

ECONOMIC DEVELOPMENTS

The September employment report was not released due to the ongoing government shutdown following Congress’s failure to pass a funding bill by the September 30 fiscal year-end deadline. As a result, the Bureau of Labor Statistics (BLS) has been unable to publish new data for September, leaving August figures as the most recent indicator of labor market conditions.

In August, job growth in the U.S. slowed sharply, with nonfarm payrolls rising by only 22,000, marking one of the weakest monthly gains since the pandemic recovery. The unemployment rate climbed to 4.3%, the highest level since late 2021. The BLS noted that employment gains in health care were partially offset by losses in the federal government and in mining, quarrying, and oil and gas extraction. According to Reuters, sweeping import tariffs and an immigration crackdown have constrained the labor supply, intensifying challenges on the hiring side.

The Consumer Price Index (CPI) for September rose 0.3% month over month, slightly below the expected 0.4% increase. On an annual basis, CPI climbed to 3.0%, up from August’s 2.9% rise but below economists’ forecast of 3.1%. The increase was driven primarily by higher energy prices, which advanced 1.5% from August due to rising gasoline costs, as well as a 0.7% gain in apparel prices and a 0.2% uptick in household furnishings. Core CPI, which excludes food and energy, rose 0.2% on the month and 3.0% year over year, also under the 3.1% projection. The report showed some easing in housing-related pressures, even as food and gasoline costs moved higher.

The Producer Price Index (PPI) data was delayed due to the government shutdown, but economists noted that tariff-sensitive goods such as furniture and apparel continued to show upward price momentum. Inflation remains above the Federal Reserve’s 2% target, keeping policymakers focused on balancing rate cuts with price stability.

The release of September retail sales data has been delayed due to the ongoing government shutdown, which has paused economic reporting from several federal agencies. As a result, August figures remain the latest available measure of consumer spending activity. Retail sales in August came in better than expected, up 0.6% and July was upwardly revised to 0.6% from 0.5%. The Census Bureau reported that non-store retailers were up 10% from last year, while food service and drinking places were up 6.5% from August 2024. There are concerns that “momentum could ease amid labor market weakness and rising goods prices because of tariffs on imports” as reported by Reuters.

The housing market showed signs of improvement in September as easing mortgage rates and better affordability supporting buyer activity. The National Association of Realtors (NAR) reported that existing home sales rose 1.5% to a seasonally adjusted annual rate of 4.06 million, marking a rebound from August’s 4.0 million. The median existing home price stood at $415,200, reflecting a 2.1% year-over-year increase and the 27th consecutive month of price gains. Total housing inventory reached 1.55 million units, equivalent to a 4.6-month supply, matching August’s level. According to NAR Chief Economist Lawrence Yun, “improving affordability and declining mortgage rates are lifting home sales, while limited distressed activity and continued price growth highlight ongoing market stability”.

The Bureau of Economic Analysis (BEA) reported that in the second quarter real gross domestic product (GDP) increased to 3.8% on an annual basis. The first quarter GDP reflected a contraction of 0.6%. The BEA said the 0.5% increase from the last estimate was primarily due to a decrease in imports and an increase in consumer spending. These movements were partly offset by decreases in investment and exports.

COLLATERALIZATION

All funds under the control of this office requiring collateralization were secured at rates ranging from 100% to 110%, depending on the type of investment.

Best regards,

TODD RUSS

STATE TREASURER