The National Ag Communicators of Tomorrow (ACT) Professional Development Conference was developed to create an enriching and supportive environment where agricultural communications students can advance their skills, expand their professional networks and engage in meaningful community service. By organizing this conference, OSU ACT intended to facilitate valuable learning experiences, encourage connections between students and industry leaders, and contribute positively to the community.

Oklahoma Farm Report’s Farm Director KC Sheperd attended and spoke at the OSU ACT Professional Development Conference today, January 17, which was organized, in a large part, by our own Maci Carter.

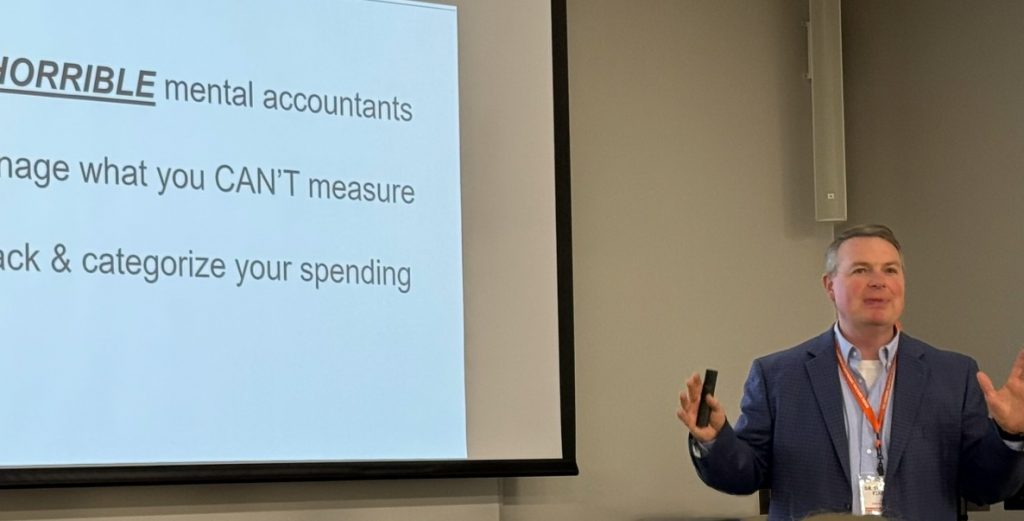

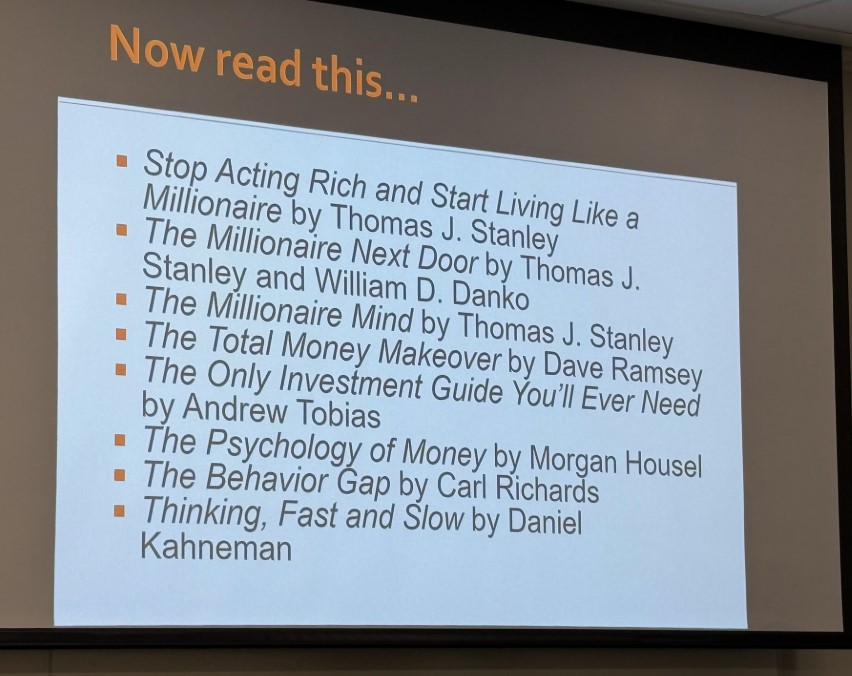

Students attended from many surrounding states for the opportunity to network with, and be inspired, educated, and empowered by industry professionals. Dr. Shannon Ferrell, with Lifestyles of the Poor but Entrepreneurial, gave a presentation on Business and Financial Management for Young Professionals, and Sheperd got to chat with him after the talk.

Other speakers included Alisen Anderson & Kinsey Westwood on Defending the Farm, Melissa Eisenhauer with Shavings, Stock Shows and Strategy about What it Takes to Plan the Oklahoma Youth Expo, Andrew Angulo with Beyond the Ballot, Jenna Schmidt with Speaking Simply on How to Communicate Complex Ideas in Agriculture, and Dr. Audrey King with Designing Your Digital Home presenting A Website Creation Workshop.

ht not be as actively engaged in the farm,” Dr. Ferrell said.He said, “There really is a lot of overlap between those two groups because, when we are talking to our ag communicators, a lot of them will go out and become self-employed, self-proprietors. Which means that no one else is taking care of their benefits, payroll, or tax withholdings, so they have to do all of that themselves. It is something that most of our farmers and ranchers have had to do for a long time.”

According to Dr. Ferrell, 88% of farmers and ranchers have no retirement plan. While they may be thinking that they will farm their entire lives, they may not realize that one day, they may not be able to farm at the intensity that they always have or might need to make room for the next generation farmer. He advised farmers to have a plan for alternate income in those scenarios so that they can continue to live comfortably as they age.

“Whenever we talk to our audiences about estate and transition planning, we talk about what things look like after you might not be as actively engaged in the farm,” Dr. Ferrell said. “Beyond concerns about where our health coverage might come from if there is a gap between our eligibility for Medicare or Medicaid and our regular health insurance, is long term care. Right now, the odds are about 50/50 that all of us, at some point in time, are going to need some long-term care. That stuff is pretty expensive, and it eats through a farm balance sheet pretty quick. If long-term care insurance is an affordable tool for us to get now, that is one way we can start hedging against that risk for ourselves.”

He added that there are more coverage options now than there used to be, so there are fewer reasons not to take advantage of them. “I don’t want to be a doom and gloom kind of guy, but you have to think about all of those contingencies so that you are prepared, and you and your operation can be resilient if something like that happens to you,” he said.

Dr. Ferrell claimed to have multiple stories about relatively young producers who have died in a farm accident, and they generally have a lot of debt tied up in their start-up costs. Their families are left covering not only the person’s medical expenses, but also the remaining farm debt.

“I really encourage young producers to at least take a look at what their needs for maybe a term life insurance plan could be, because if you are young and healthy, term insurance is going to be pretty effective in terms of bang for your buck on a policy limit,” he stated.

He urged producers to pay close attention to the developments in Washington, D.C., this year, especially on the Tax Cuts and Jobs Act’s scheduled expiration date on December 31, 2025.

“That will have implications for a lot of the tax provisions that we got under the Tax Cuts and Jobs Act back in 2017,” he said. “I do a lot of work with farm transitions and the big issue there is that, unless we do something with that act, our Estate Tax Exemption goes from what it is currently to what it would have been at 2017 levels and adjusted for inflation.”

About the roller coaster that Small Business Beneficial Ownership Interest Reporting (BOIR) and Corporate Transparency Act has become, Dr. Ferrell said, “At least as of right now, that requirement has been suspended pending the outcome of some federal litigation out there. So right now, you are okay, but if you have already done it, don’t feel bad. You have that covered for yourself. If you haven’t, be talking to your attorney and make sure that if you do have to do it, if that requirement pops back on, you will probably have to do it pretty quickly – just keep your eye on that – I’m sure that when it pops back up, there will be lots of outlets covering it.”

For more information about OSU Act, click here.