Exports of U.S. pork eclipsed previous highs in both volume and value in 2024, according to year-end data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Beef export value climbed 5% from 2023 despite a slight decrease in volume, as unit export values were record high. Lamb exports trended higher than a year ago in both volume and value.

Senior Farm and Ranch Broadcaster Ron Hays caught up with Joe Schuele, USMEF Vice President of Communications, at CattleCon 2025 and got his thoughts on the market implications of the latest report. Be sure to click the listen bar at the top of the page to hear their complete conversation.

Record pork exports to FTA partners underscore the importance of duty-free access

“It was a record for volume and value on pork,” Shuele noted. “What is significant about that volume record is our last volume record was in 2020 when we were sending a tidal wave of pork to China. We knew that demand was fairly temporary, that China would rebuild after the African Swine Fever, and that its domestic production would recover. Here we are just a few years late with exports to China much lower than they were back then, and yet we are setting volume and value records.”

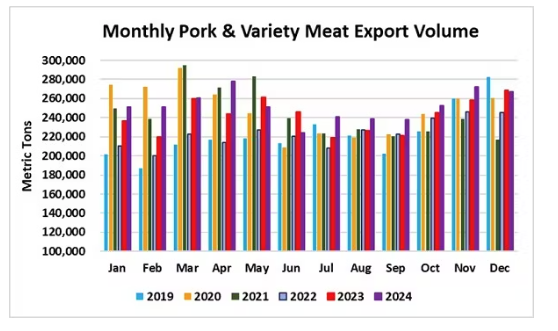

December pork exports totaled 267,132 metric tons (mt), slightly below last year’s large volume, while value increased 1% to $771.8 million. These results pushed the full-year volume to 3.03 million mt, up 4% from a year ago and topping the previous high (2.98 million mt) reached in 2020. Export value totaled $8.63 billion, up 6% from the previous record set in 2023.

“Market diversification has been a key goal of the U.S. pork industry for many years, and the resulting broad-based growth has never been more evident than in 2024,” said USMEF President and CEO Dan Halstrom. “While exports to Mexico were record-large for the fourth consecutive year, U.S. pork’s footprint expanded greatly in the Western Hemisphere and made gains in the Asia-Pacific, which bolstered global export totals and pushed export value per head slaughtered to a new high of more than $66.”

In addition to Mexico, pork exports achieved annual volume and value records in Central America, Colombia, New Zealand, Malaysia and several Caribbean markets. Value records were reached in South Korea, Australia and the Dominican Republic.

“It has been a challenging few years for the pork industry,” Schuele admitted. “Things have taken an upturn lately in terms of profitability, and we like to think that exports are a big driver of that.”

Beef exports post strong finish, with annual records in Caribbean and Central America

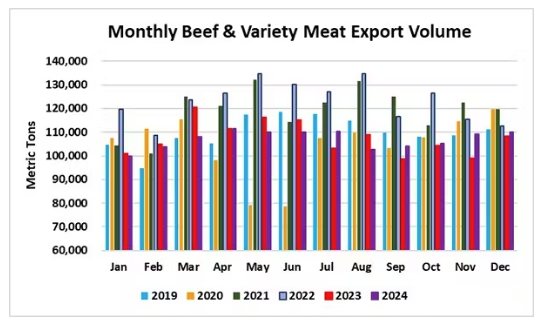

“I think we entered 2024 with a lot of concerns about the production challenges,” Schuele said. “Beef production actually held up pretty well, and exports exceeded expectations. It wasn’t record-large; that was in 2022, but the percentage exported stayed pretty steady and at very high values.”

December beef exports totaled 110,171 mt, up 1.5% from a year ago, while value climbed 4% to $897.6 million – the highest since July. For the full year, beef exports were 1.29 million mt, down 0.5% year-over-year, while value increased 5% to $10.45 billion.

Halstom agreed with Schuele’s comment. “Considering the formidable headwinds in the large Asian markets – especially in the first half of the year – and the challenges on the supply side, beef exports exceeded expectations in 2024,” He said. “The economic climate in Asia has shown modest improvement and in the meantime, demand for U.S. beef strengthened in other regions, including double-digit growth in Mexico. The U.S. beef industry continues to export a steady percentage of production at higher prices, as evidenced by export value per head of fed slaughter reaching $415. U.S. beef always sells at a premium internationally, and the strong U.S. dollar contributed to further increases in pricing in local currencies. So the 2024 results confirm that global demand is extremely resilient.”

Schuele added, “One metric that we always keep an eye on is the export value per fed head slaughtered because that takes into account where we are on the production side. That $415 per head isn’t a record, but it is a very strong number. That is up a lot from just a few years ago.”

Market diversification also paid dividends for beef exports, which achieved annual volume and value records in a number of emerging markets, including the Dominican Republic, Guatemala, Honduras, Panama, the Leeward-Windward Islands, Netherlands Antilles, Turks and Caicos, Cuba, Guyana, Singapore and Morocco. Value records were reached in the Bahamas, Bermuda, Qatar, Jordan and Bahrain.

Led by Caribbean and Mexico, U.S. lamb exports trend higher

Exports of U.S. lamb totaled 2,723 mt in 2024, up 16% year-over-year, while export value climbed 14% to $14.3 million. For lamb muscle cuts, exports totaled 2,003 mt valued at $11.8 million, each down slightly from 2023. The Caribbean and Mexico are the two largest destinations for U.S. lamb muscle cuts, and exports to the Caribbean were up 14% to 976 mt, valued at $7.1 million (up 13%), fueled in part by a doubling of shipments to the Bahamas. Exports to Mexico were the highest since 2019 at 759 mt, up 21% year-over-year as a wider range of cuts – including shoulder and flap meat – gained traction in Mexico’s foodservice sector. Export value to Mexico jumped 20% to $2.4 million.

A detailed summary of the 2024 export results for U.S. pork, beef and lamb, including market-specific highlights, is available from the USMEF website.

For questions, please email Joe Schuele or call 303-547-0030.

Audio provided by Oklahoma Farm Report, along with quoted comments from Joe Schuele in the text. Article predominantly provided by USMEF.