Today, the USDA released the Prospective Plantings and Quarterly Grain Stocks Reports. Farm Director KC Sheperd spoke with Rich Nelson from Allendale, who provided insights into the reports’ implications, highlighting both surprises and ongoing concerns.

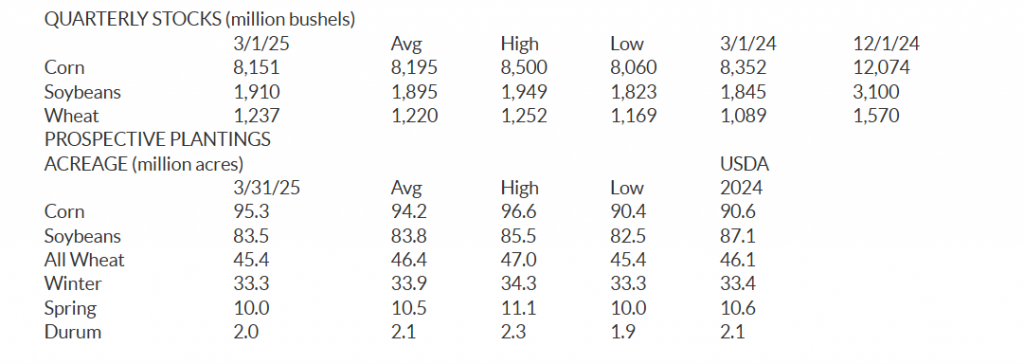

“We had our update as far as what’s left over for these crops as of March 1st,” Nelson began, discussing the grain stocks report. “Quite a surprise for these reports. Normally, these are hard to guess, and the trade is quite wrong on a few of these numbers. In this case, 8.2 billion bushels of corn are leftover on the trade estimate, 1.9 billion bushels of soybeans are leftover on the trade estimate, and certainly, for our discussion as far as wheat, there are 1.2 billion bushels left over on the trade estimate, for the most part. So very surprising, the trade got these numbers correct for old crop stocks mid-year.”

Turning to acres, Nelson highlighted a significant corn acreage projection. “USDA gave us a 95.3 million acre estimate for corn. This is the largest of all time,” he stated. “But the market has not really taken this as a big bearish surprise. A lot of the trade had moved up its prior views in recent days. So for corn, they’re really calling today’s report quite neutral.”

Soybean acreage was closer to trade expectations. “For soybeans, as far as acres, they came in relatively close to the average trade guess, 83.5, so a more or less than neutral acres and neutral stock number. So neutral for soybeans,” Nelson explained.

However, the wheat report presented some surprises. Nelson noted. “USDA already gave us a January estimate for winter wheat planted acres. That, of course, is revised on this report and will be revised again in June. USDA took off a full 600,000 off those winter wheat acres. That’s a bit hefty for what they normally would do on this revision.

“Also another surprise for us, other spring wheat; the trade had mistakenly looked at only a minimal decline for those plantings up in North Dakota, Minnesota, and Montana. In this case, USDA said, ‘No, we’re going to go from 10.6 to 10.0.’ So as far as spring wheat, I believe these are record lows or near-record lows for other spring here. So a little concerned about this tighter supply on wheat than we expected to see.”

If realized, this represents the second-lowest all-wheat planted area since 1919, which Nelson agrees is pretty significant: “It certainly is. It is bullish, but given the fact that much of our world competitors, over the past 15 years, have kind of filled that gap. They’ve been picking up wheat acres while we’ve been dropping them. It has likely supported the price, but probably not as exciting of a price as it would sound normally here.”

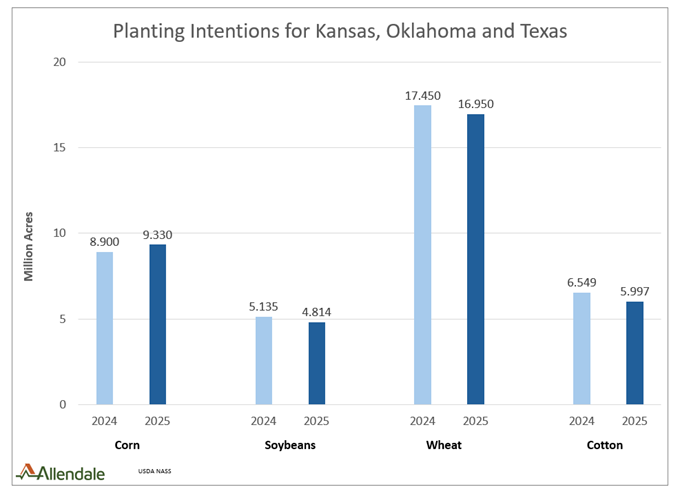

Planting conditions and weather remain a major concern. “That’s going to be one thing directly ahead of us here. So we’ve got the planting estimates in front of us now; the question is, what actually goes in these into the ground here, especially given our forecast, which is still suggesting some problems here for Texas, up through Kansas,” Nelson stated.

Cotton acreage also saw a notable adjustment. “On this report, USDA suggested 9.9 million acres of plantings. That’s down 1.3. It doesn’t sound exciting, but keep in mind, we only have 9 to 11 total. This is about a 12% drop in cotton plantings from last year, so an aggressive drop, and certainly something that will get the trade’s attention here,” Nelson explained.

Looking ahead, Nelson identified key factors to watch. “We have three main issues directly in front of us. We have this week’s discussion about tariff structures. We’ll see if the trade gets any shocks out of that. Once we get past this week’s news, then, of course, our discussion really turns towards plantings, moisture concerns here in these next few weeks, and whether we will have any excess rains on the eastern Corn Belt or lasting dryness in the West. A big issue for us, which is still quite a bit of concern, is this mid-summer forecast, which is agreed upon by both public and private forecasters. It is going to be something which does give this market a little bit of yield risk and maybe higher prices in the coming months.”

To see the complete report, go to Prospective Plantings and Grains Stocks.

For more Information from Allendale, click here.