Dr. Derrell Peel, Oklahoma State University Extension Livestock Marketing Specialist, offers his economic analysis of the beef cattle industry as part of the weekly series known as the “Cow Calf Corner,” published electronically by Dr. Peel, Mark Johnson, and Paul Beck. Today, Dr. Peel discusses Winter Stocker Grazing Prospects.

Why worry about winter grazing in early August? In just a few weeks, producers interested in grazing winter wheat (or other cool season cereals) for dual-purpose or forage-only grazing will be thinking about planting for fall/winter grazing. It’s not too early to begin evaluating the economic and agronomic conditions and considerations for possible winter stocker production.

Agronomic conditions will determine the feasibility and potential for early wheat planting. Factors such as soil moisture and soil temperature will determine just how early wheat can be planted. Additionally, producers must evaluate the early-planting trade-off between earlier grazing potential and the additional risk of limited forage production due to the likelihood of increased pest and weed challenges and uncertainty about fall moisture for continued growth of early-planted wheat.

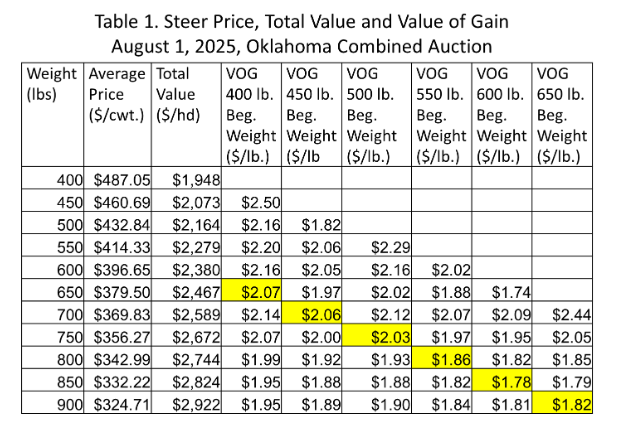

Economic considerations include preparing a budget, estimating the breakeven cost of production and evaluating returns potential and risk. General market conditions determine the overall potential for stocker production, expressed as the gross margin, i.e. value of gain for added weight of feeder cattle. Table 1 shows prices and value per head for steers in early August as well as current value of gain for a range of beginning weights and added weight gain. For example, the table shows that the value of 250 pounds of gain for a 500-pound steer at the current time is $2.03/lb. The value of gain varies depending on the beginning weight and the total amount of weight added. Of course, changes in feeder cattle price levels and relative prices between stocker purchase prices and feeder sales prices also change the value of gain.

The next step is to determine the cost of production and determine if the value of gain covers production costs and offers acceptable returns for the stocker enterprise. Beyond the first cost of the stocker animal (which is covered in the calculation of the value of gain), the value of gain must cover all other production costs plus economic returns to the enterprise. In the example above, $2.03/lb. times 250 pounds of gain is a per head margin of $508, which must cover costs for feed (grazing and supplements), vet/medicine, death loss, interest, and daily care costs plus returns for management and unpaid labor. Total cattle and production cost divided by ending weight provides a breakeven value which is compared to expected selling price to determine potential returns. Cattle breakevens will vary significantly across different operations and depend heavily on the grazing cost. The values of gain in Table 1 suggest the likelihood of positive returns at current market prices.

The market risk of stocker production is due to the fact that the animal is not bought and sold at the same time. The stocker purchase price is known from current market values, but the selling price depends on market changes during 4-5 months of stocker grazing. Feeder futures prices can provide an indication of feeder prices in the coming months. The current Feeder futures price for March 2026 is roughly $315-$320/cwt. (subject to lots of daily volatility). The March futures price is significantly lower than current cash and futures prices. Deferred futures are sharply discounted and have been rising to meet cash in recent months. For example, the August feeder contract was priced at about $296/cwt. on May 1 but is currently over $336/cwt. moving toward expiration of the contract this month.

It is likely that feeder prices will be higher than the March Feeder futures currently suggest, but the discounted futures prices means that some risk management alternatives are limited. Current feeder market prices suggest decent potential for stocker returns, subject to high levels of risk. Discounted futures prices means that it is likely not possible to lock in favorable margins for next spring and much of the return potential is “betting on the come”. Minimum pricing alternatives such as Puts or LRP contracts can provide some level of price coverage against market volatility and sharp price decreases.