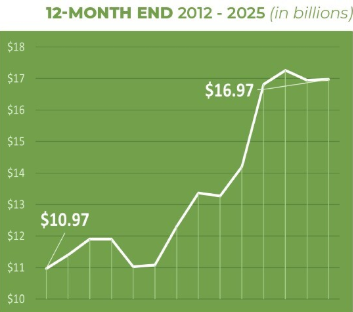

– Revenue total of $16.97B for the last 12 months, an increase of $16.96M, or 0.1%, over the last year.

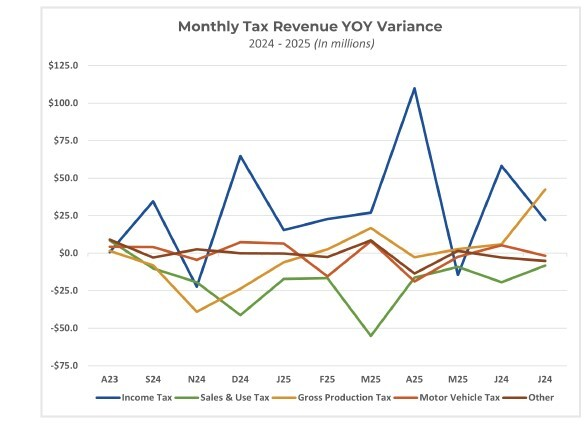

– Year over year monthly comparisons show an overall decrease of $2.7M or 0.2%.

– Decrease in revenue of 9.8% over last month.

– One tax source increased over the last month:

– Total Sales and Use Tax of $594.9M up 0.3%,

– Total Income Tax of $3861.1M down 17.5%,

– Gross Production Tax of $85.8M down 31.9%,

– Motor Vehicle Tax of $71.4M down 9.3% and

– Other Tax Sources of $133.8M down 7.3%.

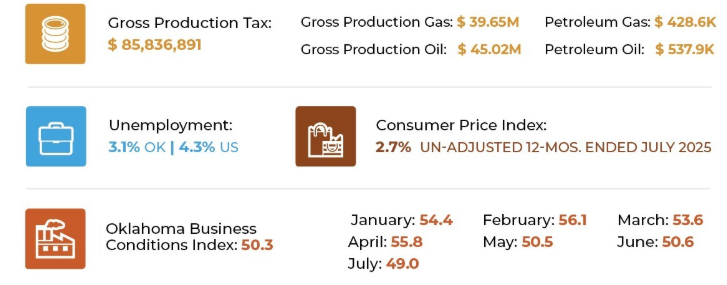

The state’s Business Conditions Index for August rose to 50.3 from 49.0 in July. Components of the overall July index were: new orders at 49.4; production or sales at 52.9; delivery lead time at 55.6; inventories at 49.5; and employment at 44.1. According to ITA data, the Oklahoma manufacturing sector exported $3.5 billion in goods for the first five months of 2025, compared to $3.3 billion for the same period in 2024, for a 4.5% gain.

Formally known as the Gross Receipts Report, this report is a timely, broad view of the state’s economy and releases in conjunction with the General Revenue Fund report. Providing information to state agencies for budgetary planning purposes, the General Revenue Fund acts as the state’s main operating account and receives a portion of the state’s gross receipts as well as state, city and county funds.

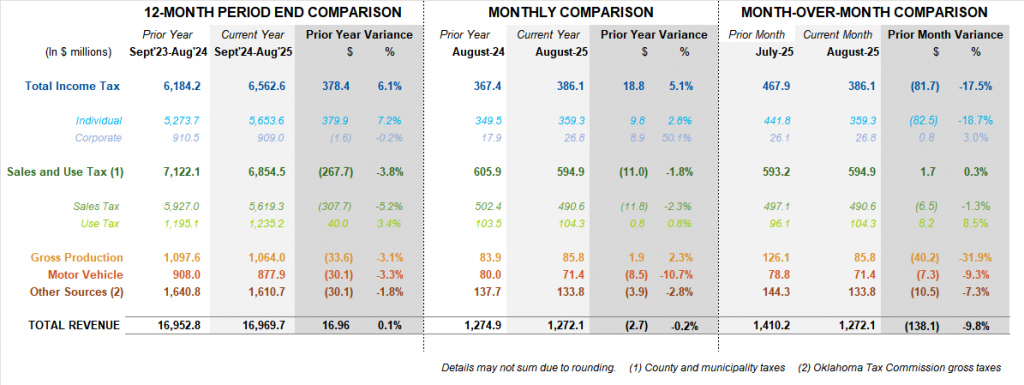

12-Month Period End Comparison

Tax Revenue total of $16.97 billion, up $16.96 million or 0.1 percent.

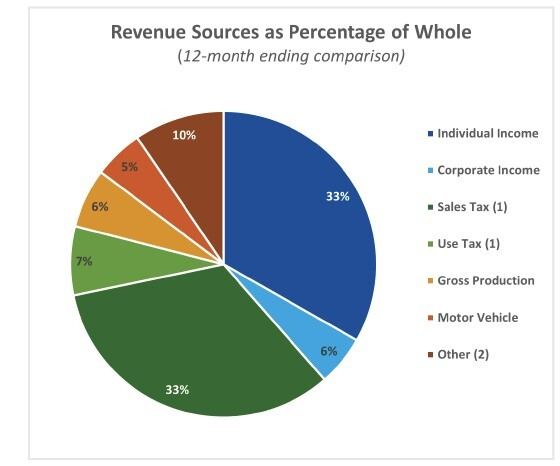

· Combined individual income tax and corporate income tax $6.5 billion, up $378.4 million or 6.1 percent.

o Individual tax of $5.6 billion, up $379.9 million or 7.2 percent.

o Corporate tax of $909.0 million, down $1.6 million or 0.2 percent.

· Combined sales tax and use tax–including city and county remittances–of $6.9 billion, down $267.7 million or 3.8 percent.

o Sales tax of $5.6 billion, down $307.7 million or 5.2 percent.

o Use tax, received on out-of-state and Internet purchases, of $1.2 billion, up $40.0 million or 3.4 percent.

· Oil and gas gross production tax of $1.06 million, down $33.6 million or 3.1 percent.

· Motor vehicle tax of $877.9 million, down $30.1 million or 3.3 percent.

· Other sources, including 70 different revenues, of $1.61 billion, down $30.1 million or 1.8 percent.

Monthly Comparison

Tax Revenue total of $1.27 billion, down $2.7 million or 0.2 percent for August 2025 vs. 2024.

· Income tax of $386.1 billion, up $18.8 million or 5.1 percent.

o Individual tax of $359.3 million, up $9.8 million or 2.8 percent.

o Corporate tax of $26.8 million, up $8.9 million or 50.1 percent.

· Sales and use tax of $594.9 million, down $11.0 million or 1.8 percent.

o Sales tax of $490.6 million, down $11.8 million or 2.3 percent.

o Use tax of $104.3 million, up $0.8 million or 0.8 percent.

· Gross production taxes of $85.8 million, up $1.9 million or 2.3 percent.

· Motor vehicle taxes of $71.4 million, down $8.5 million or 10.7 percent.

· Other sources of $133.8 million, down $3.9 million or 2.8 percent.

Month-Over-Month Comparison

Tax revenue total of $1.27 billion, down $138.1 million or 9.8 percent from last month.

· Decrease in income tax of $81.7 million or 17.5 percent.

· Increase in sales and use tax of $1.7 million or 0.3 percent.

· Decrease in gross production taxes of $40.2 million or 31.9 percent.

· Decrease in motor vehicle taxes of $7.3 million or 9.3 percent.

· Decrease in other sources of $10.5 million or 7.3 percent.