Record-high cattle prices offer a significant financial opportunity for producers who leverage smart marketing and risk management strategies, according to Dr. James Mitchell, a livestock economist at the University of Arkansas and former Oklahoma State University professor.

In an interview with Farm Director KC Sheperd, Dr. Mitchell discussed the volatility of the current market and how producers can capture even greater premiums by focusing on quality and mitigating price swings.

The Marketing Fundamentals That Still Pay

Dr. Mitchell stressed that even in a strong market, profits can be lost due to poor preparation. He emphasized that the “I can make money selling anything right now” attitude ignores “a lot of money on the table that can be captured by marketing cattle and doing the types of things that we know pay.”

He outlined the essential practices that offer proven premiums:

- Uniformity: Selling uniform lots of cattle and putting together truckloads.

- Health: Weaning and vaccinating calves.

- Quality: Castrating bull calves and dehorning, if necessary.

Dr. Mitchell noted that producers should weigh the costs of keeping calves back for 45 days for a precondition program against the market premium. He concluded that in most operations, “the answer is yes, it does,” confirming that the premium for preconditioned calves is positively correlated with high cash prices.

Overcoming the Small-Producer Hurdle

For Oklahoma producers, more than half of whom have less than 50 cows, lot size poses a major challenge because small lots can quickly absorb any potential preconditioning premium.

“If you’re a producer who’s got some really, really good calves… precondition sales is a great way for you to overcome the limitation of lot size,” Dr. Mitchell told Sheperd.

He highlighted programs like the Oklahoma Beef Quality Network and precondition sales, which allow small producers to sell their cattle in large, uniform lots, preventing the premium from being “completely eaten up by small lots” that require commingling.

Risk Management: Buy Insurance on Your House

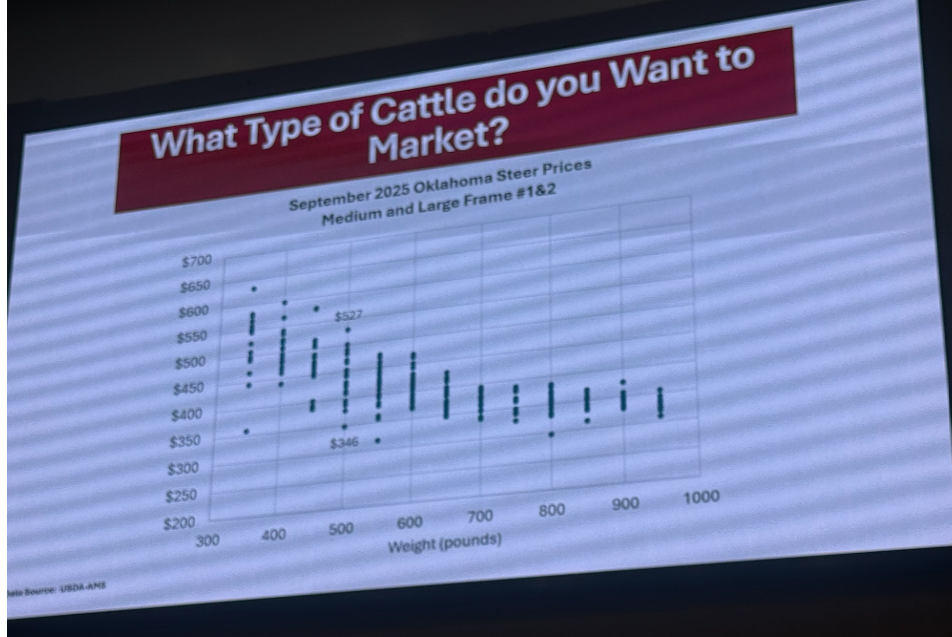

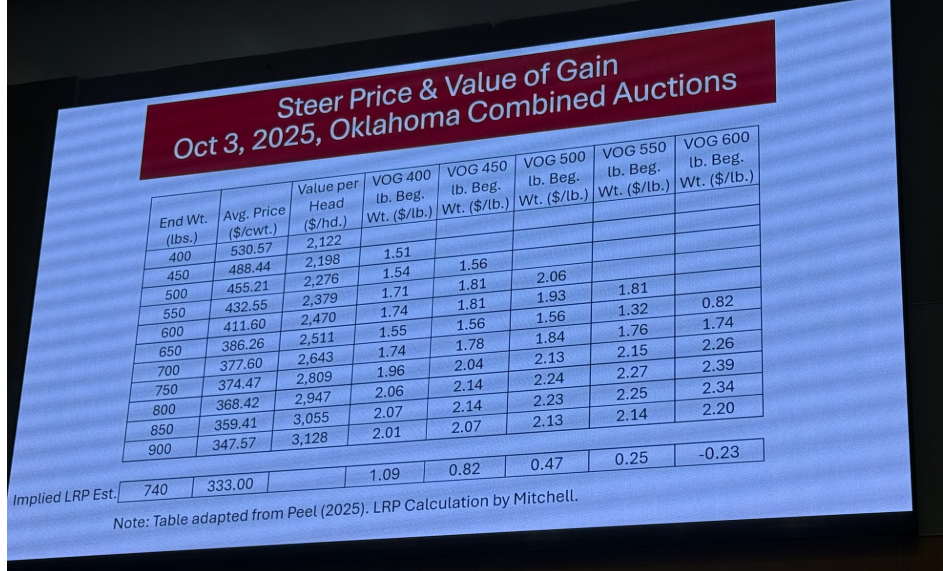

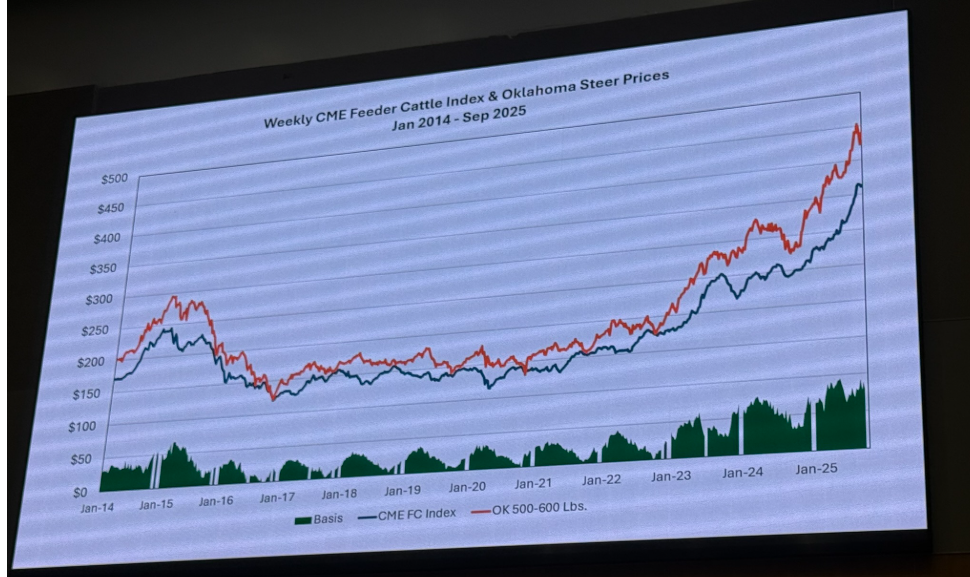

With cattle prices exceptionally high, Dr. Mitchell advised producers to consider risk management options, noting that even strong markets see big swings of “plus $15 a hundredweight, minus $15 a hundredweight” depending on the week.

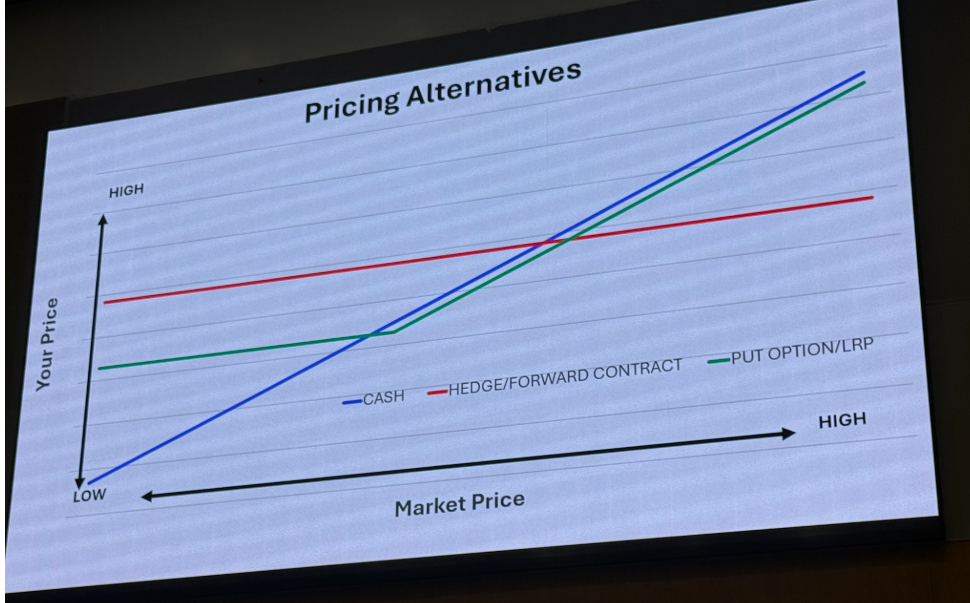

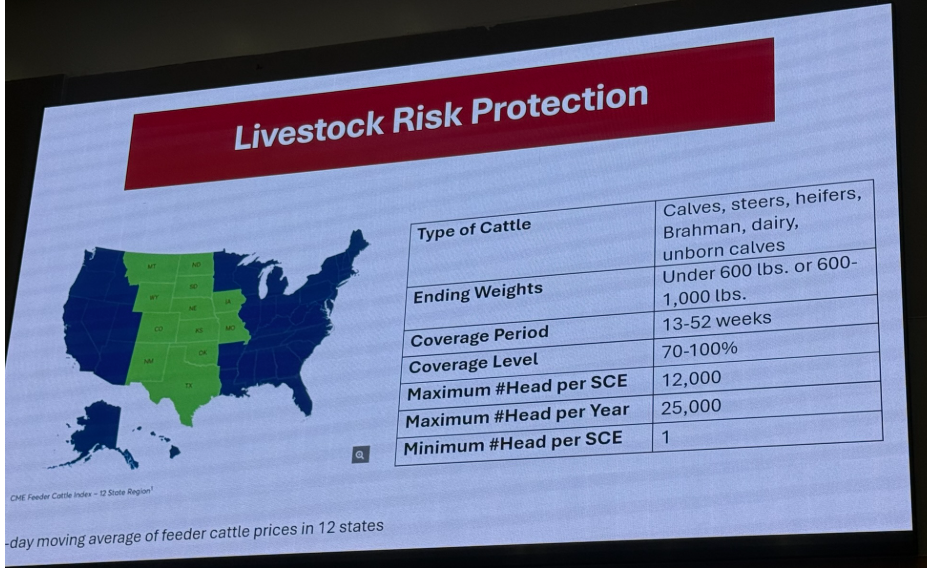

He compared using risk management products like Livestock Risk Protection (LRP) to buying homeowner’s insurance:

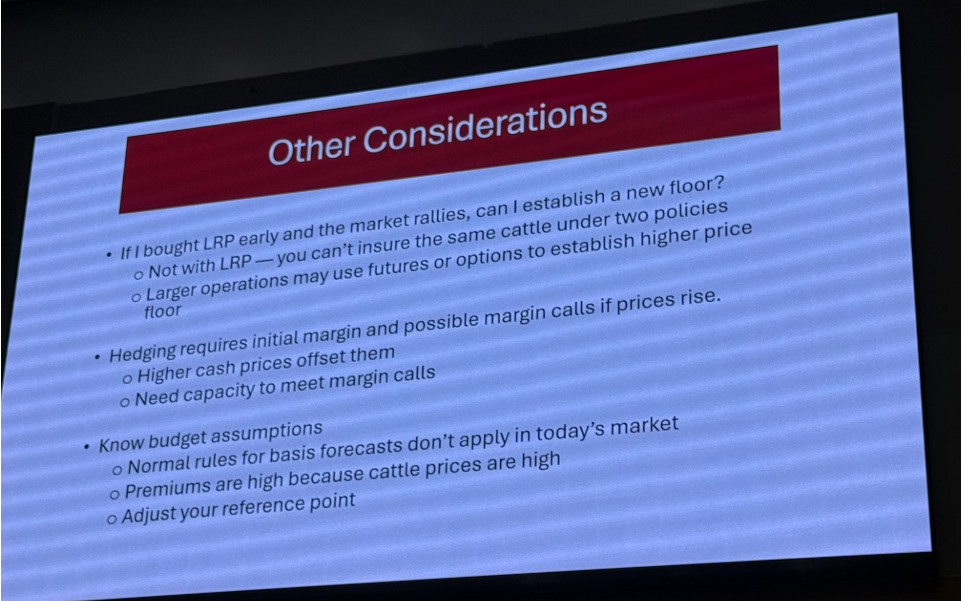

“The best scenario is still for the market to improve, but you have that product in place in case something adverse does happen. My advice is always just to take it slow and make sure that you’re aware of how the product works and set reasonable expectations.”

While LRP subsidies have increased, Dr. Mitchell cautioned that high cattle prices mean premiums for risk management products are also more expensive, requiring careful consideration.

Beef Demand and the Screw Worm Concern

Addressing questions about beef demand sustainability, Dr. Mitchell noted that consumer decision-making comes down to the price of beef relative to competing proteins like pork and chicken. As these relative price relationships have remained stable, aggregate demand has held up. He added that while some consumers may “trade down” to cheaper cuts like ground beef instead of steak, they are generally “still consuming beef.”

Finally, concerning the recent screw worm concern, Dr. Mitchell stated that market impacts have largely been observed because the U.S.-Mexico border has been closed to feeder cattle imports. This halt in supply only exacerbates the existing tight domestic cattle supplies, serving as “just another factor pushing prices up.”

Dr. Mitchell concluded his visit with a forward-looking message for producers: to use the current financial strength to invest money back into their operations to make improvements in “productivity and efficiency” for sustained success in the future.