Market News:

Agricultural futures markets experienced limited volatility over the past week, with mixed patterns across different commodities heading into the Thanksgiving holiday. The grain complex continues to face challenges from large supplies, trade policy uncertainties, and general market risk. The week saw reduced trading activity around the Thanksgiving holiday, with markets closed Thursday and CME issues on Friday. Looking ahead, market observers should monitor export demand, particularly from China, currency movements, and upcoming USDA reports that could influence price direction.

Wheat Market Outlook:

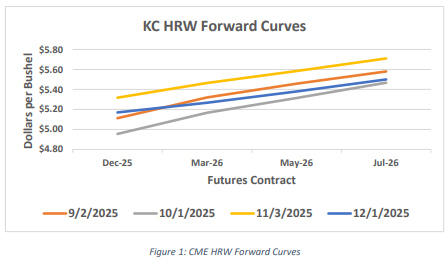

KC hard red winter wheat prices rose slightly over the last week to close at $5.17 on the December contract on Monday. December HRW futures prices sit near the center of the $5.00 – $5.40 range that they have been in since late October. July harvest contract prices closed at $5.50 near the low end of the $5.45 – $5.75 range they have experienced over the same period. Expectations are a continuation of prices in this band with limited upside potential without production disruptions elsewhere globally. Basis in Oklahoma has remained stable in the lower range of the five-year average. A

carry is still in place between nearby and deferred KC HRW contracts.

As Figure 1 shows, the forward futures curve sits in a carry position. The chart shows the futures prices across the HRW forward curve through the July harvest contract for the first day of the last four months. The rally seen in late October into early November shows up on the November 3 curve as the high point. The slopes and carry amounts changed little over the time selected. Despite decent export demand, the market is in no way indicating any market changing demand pressure.

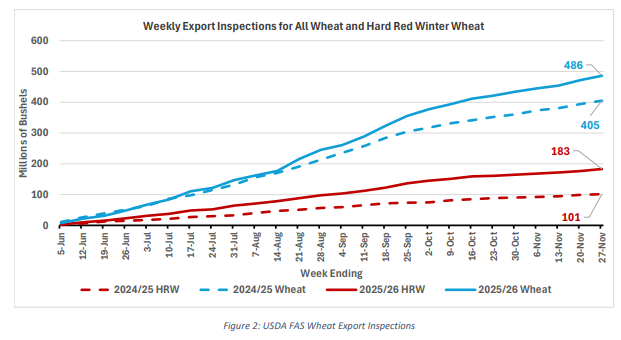

Export inspections picked up a bit to close out November. Figure 2 shows wheat inspections for the current and last marketing years. Wheat inspections for week ending November 27 came in at 14.1 million bushels. While slightly down from the 17.6 million bushels recorded on November 20, the last two weeks are above the ten million bushel a week pace produced over the previous month. Inspections need to average a little over fifteen million bushels a week for the remainder of the marketing year to hit USDA’s 900-million-bushel forecast. At present, there is not an expectation of

USDA changing the overall wheat export forecast in next Tuesday’s WASDE report, but foreign competition remains robust.

Hard red winter wheat exports picked up over the last two weeks with 4.5 million and 6.7 million bushels respectively in the inspections report. HRW needs to average approximately five million bushels per week to make USDA’s 325-million-bushel forecast.

Hard red wheat prices look to remain range bound until new supply issues or a geopolitical shock hit the market. Large stocks in Oklahoma along with continued foreign pressure will limit basis movements. The upcoming USDA reports bear monitoring.

Corn Market Outlook:

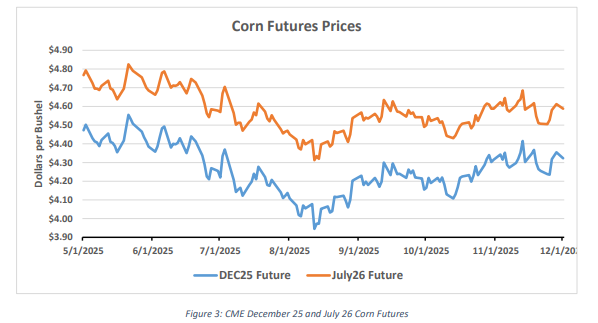

Corn prices appear stuck in a range bound pattern with basis remaining stable in Oklahoma. December corn futures have been oscillating between $4.10 and $4.40 since early September as shown in Figure 3. Expect demand to remain excellent at these low prices with plenty of supply to maintain the pace of use. USDA releases the December WASDE next Tuesday, but expectations of any major changes before the January Crop Production and Stocks reports should be low.

USDA continues to release the Export Sales reports missed during the government shutdown. The reports are gradually catching up and showing strong sales as expected in October. Recent sales continue this trend in the export program USDA has forecast. Reports of a private export sale totaling 273,988 MT of corn for unknown destinations came in from USDA on Friday morning.

As of Monday morning, export sales are provided through the week ending on October 23 and indicated 972 million bushels of outstanding sales for 2025/26, exceeding the 750 million bushels last year. Total commitments (outstanding sales plus accumulated exports) through October 23 were 1.39 billion bushels. Export inspections through November 27 were reported at 747 million bushels, approximately 310 million bushels above last year.

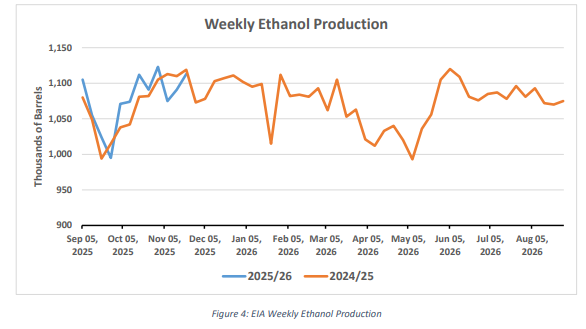

Weekly ethanol production remains strong and is running slightly above last year’s production pace as reported by the EIA through November 21 as shown in Figure 4. While gasoline demand picked up slightly moving into the end of November, it still trails last year. Ethanol exports remain crucial to reaching USDA’s 5.6-billion-bushel projection. 2024/25 marketing year ethanol exports came in at 2.134 billion gallons which was a record for a marketing year by a good distance. EIA reports weekly ethanol exports that tend to undershoot Census trade data. At present, EIA data puts exports on par with last year’s pace. Nonetheless, corn usage is going to be large during the first quarter of this marketing year. Despite this fact, there remains room for downward adjustment in USDA’s demand side of the balance sheet. Hence, corn prices continue to find it difficult to breakout.

Sorghum prices still languish at low levels due to heavy supply and muted export demand. Cash prices on December 1 in major production areas ranged from $3.35 – $3.45. Export inspections through November 27 indicate 18.5 million bushels exported thus far in the marketing year. Thus far, this year’s marketing year inspections are down twenty-four million bushels from last year’s pace which was not considered a strong year for exports. On a positive note, sorghum registered a 784 metric ton sale to China in the November 27 export inspection report which holds the promise of more

buying to come.

EIA released ethanol usage numbers for September which saw sorghum usage tick down to 10.26 million bushels from the 11.28 consumed in August. However, sorghum use for ethanol is up over eight million bushels from the previous September and indicates a continuation of strong usage in the current marketing year for the ethanol sector. Sorghum price is tied to corn and the same range bound pattern looks hard to escape without a large influx of buying from China.