The fed cattle trade has undergone a tumultuous ride in the past two months. Weekly fed steer prices averaged $237/cwt. the second week in October, then rapidly declined $28/cwt. by the third week in November. Last week’s trade featured a sizeable recovery with the five-area steer average up $10/cwt., landing at $221/cwt. with prices as high as $226/cwt. in Kansas. Cash trade was limited to fewer than three packers in Texas, triggering confidentiality rules by USDA regulations. This rule is typically only triggered in the Colorado region where it’s the norm for trade to be reported for just two packers.

The total harvested head count was dramatically higher last week as the 600,000 head eclipsed the prior week’s holiday schedule by 102,000 head. Before last week’s strong upward move in the spot cash cattle price, packer margins were calculated somewhere north of $50/head. This helped to incentivize packers to ramp up harvest levels, coupled with the increased volume needed to fulfill pre-holiday grocery store beef obligations. The cattle price recovery quickly wiped out much of the packer margin, setting that closer to breakeven as this week got underway.

Carcass cutout values began December with a cheapening trend in continuation of the downward pattern established at the beginning of November. Many observers are decrying weakening beef demand due to the lower price trend. However, softer cutout values were recorded for the month of November in four out of five of the last four years, with the exception of 2024. December price trends are mixed in the last five years with 2022 and 2024 charting higher prices and the remaining three years trending lower.

Cutout price spreads are mixed with the CAB premium above Choice at a very reasonable $16.81/cwt., down $3/cwt. last week. The Choice/Select spread remains relatively wide at $20.06/cwt. in Urner Barry’s data last week. This level is much lower than a year ago, as the Select grade share of fed cattle has slipped to just 10.9% of the carcass supply. Customers for Select grade product are finding their orders shorted while distributors have told them to get on board with “at least” USDA Choice moving forward.

Big Shifts in Quality Grades

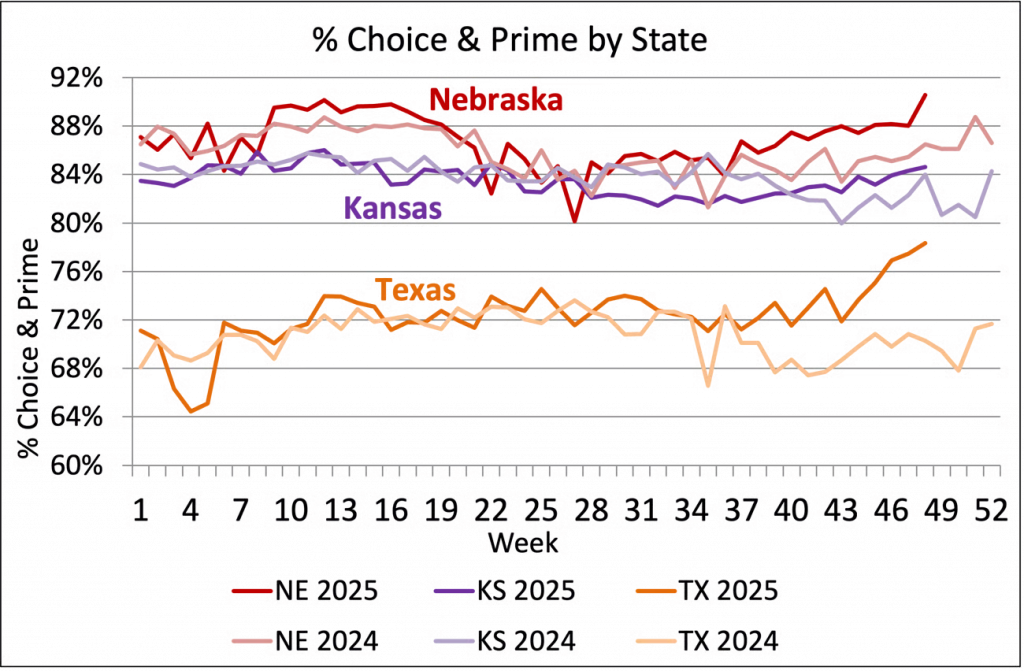

The 2025 quality grade trend tracked the USDA Prime grade a full percentage point higher than the prior year through August, averaging 11.5%. Since then, the Prime grade trend has defied seasonal expectations, normally setting a course toward a fall low in both Choice and Prime grade percentages. Instead, the Prime share steadily increased in a punctuated departure to the upside, averaging 12.1% since August.

While the unseasonal swing to the upside is impressive, the past four weeks of data add more emphasis to the chart. In November, Nebraska packers harvested three weeks of cattle above 14% Prime with the final week spiking to 17.2%. This stands to reason as the northern feeding region is currently carrying the most market-ready supply of cattle with the heaviest carcass weights, indicating that days on feed are pushing grade upward. Record-heavy industry carcass weights are a nationwide trend, but led by northern cattle.

On the other hand, Texas feedyards currently have the least occupancy with their cattle inventory hindered by the absence of Mexican cattle. Even so, the Texas grade trend is also charting much richer this season. While the state’s Prime grade is exceptional compared to history, averaging 7.8% since June, the uptrend in USDA Choice is notable. The Texas Choice grade average moved little on either side of 64% through October this year. Yet the last four weeks saw Choice carcasses jump to average almost 69% of the total, while the Prime share gave no ground, averaging 8.1% in the past month.

A combination of factors in Texas creates ample cause for the richer grade trend. First, the average Mexican feeder cattle supply has lower genetic potential for marbling. Absence of these cattle in the current Texas carcass mix easily pushes quality grade higher in the state. As well, the increase in beef x dairy cattle over the past several years has brought the grade higher with refined terminal genetics introduced through this substantial Texas cattle supply. Finally, it’s understood that some northern cattle are shipping to Texas to be harvested as the northern feedlot sector is heavy on market-ready head counts.

A larger share of Upper 2/3’s Choice and Prime carcasses in the Angus-type cattle supply is also helping to hold the CAB carcass certification rate a percentage point higher than a year ago, averaging 36% for the past six weeks. Record-heavy carcass weights featuring average steer carcasses at 988 lb. are keeping a lid on brand acceptance rates. While richer average marbling across the weekly fed harvest suggests we should see even higher brand acceptance rates, there has been an increase in carcasses disqualified because they exceed the brand’s maximum 1,100 lb. carcass weight.