|

We invite you to listen to us on great radio stations across the region on the Radio Oklahoma Network weekdays-

if you missed this morning's Farm News - or you are in an area where you can't hear it-

click here for this morning's Farm news from Ron Hays on RON.

Let's Check the Markets!

OKC West is our Market Links Sponsor- they sell cattle three days a week- Cows on Mondays, Stockers on Tuesday

and Feeders on Wednesday- Call 405-262-8800 to learn more.

Today's First Look:

mornings with cash and futures reviewed- includes where the Cash Cattle market stands, the latest Feeder Cattle Markets Etc.

Click on the name of the auction to check out our report from them as compiled by USDA Market News:

Okla Cash Grain:

Futures Wrap:

Feeder Cattle Recap:

Slaughter Cattle Recap:

TCFA Feedlot Recap:

Our Oklahoma Farm Report Team!!!!

Ron Hays, Senior Farm Director and Editor

KC Sheperd, Associate Farm Director and Editor

Sam Knipp, Farm Editor

Pam Arterburn, Calendar and Template Manager

Dave Lanning, Markets and Production

|

|

Oklahoma's Latest Farm and Ranch News

Your Update from Ron Hays of RON

Friday, April 17, 2020

|

Howdy Neighbors!

Here is your daily Oklahoma farm and ranch news update.

|

|

As the coronavirus continues to take an economic toll on agriculture producers, U.S. senators from both parties have come together to encourage the U.S. Department of Agriculture (USDA) to work with the cotton industry so that needed aid can be delivered in

a timely manner.

Senator James Inhofe joined a letter from 21 senators to USDA Secretary Sonny Perdue-led by Sens. John Boozman (R-Ark.) and Mark Warner (D-Va.)-that noted while all sectors of the agricultural economy have been impacted by this public

health crisis, the U.S. cotton industry has been particularly hard hit during this time, making the need for assistance all the more urgent.

"Since the beginning of 2020, cotton futures prices have declined 30 percent. As retail stores around the globe have shuttered, orders from U.S. textile mills have dropped as much as 90 percent in the last month. Cotton merchandisers and distributors

are also facing additional costs for storage, interest, and other carrying costs as worldwide demand is significantly depressed," the senators wrote.

The senators encouraged USDA to work with the industry to craft policies that will aid each segment of the cotton industry.

"We understand the cotton industry has reached consensus on a package of recommendations to assist all segments of the industry. We encourage you to work with the industry, so that needed aid can be delivered in a timely manner. In responding to the current

crisis, Congress and the Administration have acted swiftly to assist the people of our country during this time. We ask that you use that same approach to ensure that this critical industry represented throughout our states receives the necessary assistance,"

they wrote.

|

|

Sponsor Spotlight

We are part of the rural communities we serve and understand that vibrant rural communities need strong, modern infrastructure. Farm Credit loans finance the rural infrastructure providers that provide reliable power, modern telecommunications,

clean water, and other vital community services.

For more information,

click here to go to our Oklahoma AgCredit website.

|

The Live Cattle Futures market is drawing a lot of negative attention from cattle producers, but it remains a relevant factor in price discovery according to

Don Close, senior analyst-animal protein for Rabo AgriFinance. I spoke with Close about how that market is currently operating.

Close said the futures market is predicting a ton of risk hanging over the market right now.

The need for risk management has never been greater, Close said.

"It (the futures market) is predicting the market to be lower than I think they need to go," Close said.

He said the results are basically twofold: unprecedented record level basis has created a windfall for those who were already hedged; but, it put a deep discount on deferred contracts, making it almost impossible to buy replacement cattle at a price they

can hedge at time of purchase.

Close said the pricing mechanism appears to be transitioning to pricing fed cattle off the wholesale boxed beef trade.

With the level of attention on this, the packers must look at ways to support the cash cattle market, Close said. They need to put more reference on cut out values and less on the futures market.

Close was a member of the blue-ribbon panel of economists selected to analyze the economic impact of the COVID-19 pandemic. It is hoped the panel's analysis will help USDA determine how to dole out the $9.5 billion of relief in the CARES Act.

"This will not make producers whole," Close said, "but it is a step in the right direction."

|

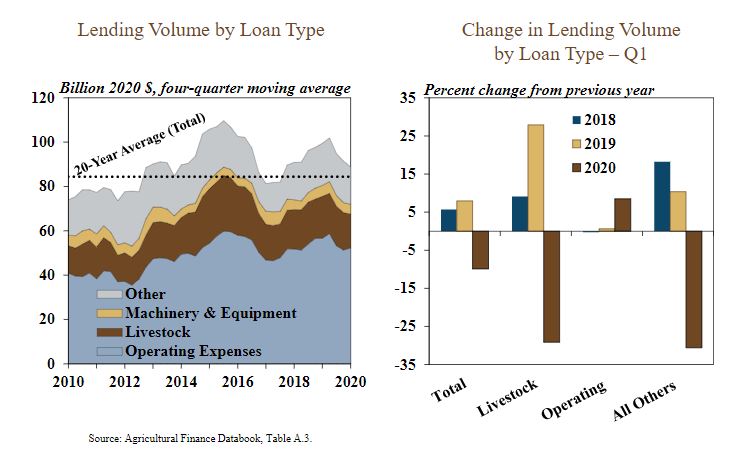

Looking at The latest issue of the KcFED Ag Finance Databook with Cortney Cowley, Economist and

Ty Kreitman, Assistant Economist shows Farm Lending Activity Slowed in the First Quarter

Prior to the emergence of global economic developments related to COVID-19, growth in farm lending continued to show signs of slowing. While the volume of operating loans in the first quarter of 2020 increased slightly from a year ago, overall demand

for non-real estate loans declined. At the end of 2019, delinquency rates on farm loans continued to increase slightly, but agricultural credit conditions and farmland values were holding steady. Capital cushions at agricultural banks, which have increased

steadily in recent years, remained at historically high levels through 2019. As the effects of recent economic disruptions materialize in coming months, the current stability of farm real estate values and financial soundness of farm banks may be key sources

of support for the sector.

Section A - First Quarter National Farm Loan Data

According to data collected in early February, agricultural lending activity showed further signs of slowing in the first quarter, despite an increase in the volume of operating loans. The total volume of non-real estate loans remained above the historical

average, but were about 10 percent lower than a year ago. Despite a decline in most types of lending, loans for operating expenses increased nearly 10 percent (Chart 1). The overall decline was driven by a drop of about 30 percent in both livestock loans and

loans for miscellaneous purposes.

The upward trend in loan size appeared to wane, despite a larger average for operating loans. Since 2010, the average size of farm loans has trended steadily higher, but the pace of the increase has slowed following a sharp rise in late 2018 and early

2019 (Chart 2). Similar to loan volumes, operating loans were about 10 percent larger than a year ago while loans for all other purposes were smaller. However, the average size of all loan types over the past four quarters was below the trend level of growth

through the first quarter.

|

At its first-ever virtual monthly meeting, the Farm Credit Administration board today received a report from staff about the participation of the Farm Credit System (System) in the Small Business Administration's Paycheck Protection Program.

According to the report, so far 56 System institutions are participating, or plan to participate, in the Paycheck Protection Program.

The program authorizes up to $349 billion in forgivable loans to small businesses to support payroll and certain other needs during the COVID-19 pandemic.

The report discussed the guidance that the agency has issued to System institutions over the past 10 days to facilitate their participation in the program and to answer their questions. To read this guidance, see the Paycheck Protection Program webpage

on the agency's website. FCA will continue to add to the guidance provided on this page.

Quarterly report on the farm economy and the condition and performance of the Farm Credit System

In other business, the board received a quarterly report from agency staff on economic issues affecting agriculture, together with an update on the financial condition and performance of the Farm Credit System as of Dec. 31, 2019.

Current and future fiscal stimulus is designed to help temper the evolving economic crisis.

Recent events have intensified the volatility and risk to agriculture. Industries that produce goods are important to local economies and are likely to be hit hard during the remainder of 2020. This would have serious implications for off-farm income,

which is an important part of farm household income and key to loan repayment in rural America.

|

|

Sponsor Spotlight

The vision of the Oklahoma Beef Council is to be a positive difference for Oklahoma's farming and ranching families and the greater beef community and its mission is to enhance beef demand by strengthening consumer trust and exceeding

consumer expectations. To learn more, visit www.oklabeef.org.

Also, don't forget to like its Facebook page at www.facebook.com/oklabeef

for stories on Oklahoma's ranching families and great beef recipes.

|

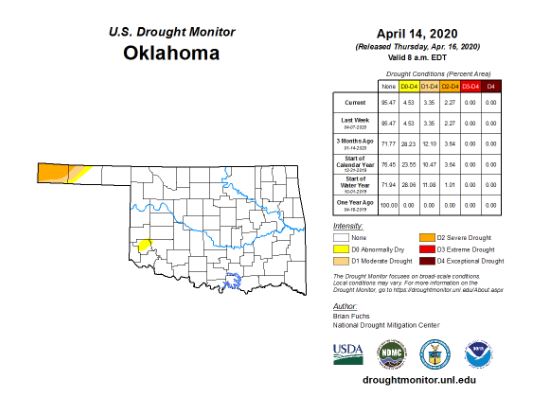

Striking a balance between good news and bad news is a challenge for the western Oklahoma Panhandle in the latest U.S. Drought Monitor map. This is especially true when you look at the seasonal drought outlook April-July. The drought is expected to persist

for the Panhandle and neighboring regions.

The good news is no drought is expected to form anywhere else in the state.

For this week, there is no change in drought conditions from last week for

Oklahoma. Severe drought covers 2.27 percent of the state, all of it in the western Oklahoma Panhandle and the same amount as last week.

Boise City, in Cimarron County, recorded .47 of an inch right after Christmas. Only one inch has fallen since and for Kenton the stats are even worse. A total of 110 days has elapsed since any significant moisture has fallen so it is not difficult to

understand why that area is in severe drought. The drought actually started last fall for the 4-corner region of the Oklahoma Panhandle, Colorado, New Mexico and Kansas.

There is no extreme or exceptional drought anywhere in Oklahoma today.

|

Oklahoma State University Extension Grains Market Analyst Dr. Kim Anderson talks about what is going on in the Wheat Markets weekly on SUNUP.

This week Dr. Anderson says there's a lot going on in the grain markets right now. Oil prices are low, and low oil prices impact corn prices, and corn prices effect wheat prices. Anderson says as far as future prices are concerned if

you take the three main things: Oil, COVID-19, and the dollar index they all create risk and volatility in the market, but he says you can still buy and sell wheat at the current prices. Click below to hear the complete analysis with Kim Anderson on SUNUP.

This week on SUNUP, Josh Lofton has an update on canola and the planting windows for summer crops.

- Then, in the Mesonet weather report, Wes Lee shows us how far temperatures dropped during the recent cold snap and for how long. Gary McManus says parts of the state have not had a measurable amount of rain in over 110 days.

- Derrell Peel says cattle producers are feeling the pain of a clogged beef processing sysytem.

- Paul Beck has options for cattle producers who have livestock ready for marketing.

- In Cow-Calf Corner, Glenn Selk explains why it is important to finish breeding season before the heat of the summer.

- Dave Lalman show us how to determine how much moisture is in forage.

- Kim Anderson says wheat markets are indirectly impacted by the low prices of oil and corn.

- Finally, Alex Rocateli has advice for producers growing bermudagrass for forage.

|

Today, Growth Energy CEO Emily Skor rejected the requests in a letter from five oil-state governors to the U.S. Environmental Protection Agency, which asked the agency waive the refiners' obligations to

blend ethanol into their fuel as required by the Renewable Fuel Standard:

"This is an offensive attempt by refiners to steal markets from struggling biofuel producers and farmers. Any move to unravel the RFS now would dim any hopes of economic recovery in rural America, where so many in the U.S. biofuel industry have been impacted

by furloughs and plant closures, and millions of farmers are struggling to stay afloat.

"We've seen the courts reject this kind of abuse before. Even oil companies admit that biofuel credits don't impose a real cost on refiners. We see this as a non-starter and call on this

administration to focus on restoring - not destroying - rural jobs."

|

US Wheat Associates Analyst Looks at Major Wheat Growing Regions and Their Price Outlook US Wheat Associates Analyst Looks at Major Wheat Growing Regions and Their Price Outlook

Claire Hutchins, USW Market Analyst, has written the following article for USwheat.org about how COVID-19 Changes Global Wheat Trade Dynamics.

It is no secret that these are uncertain times. As countries across the world work to contain and combat the novel coronavirus (COVID-19) outbreak, U.S. Wheat Associates (USW) is closely monitoring the effects of the outbreak on global wheat trade dynamics.

Over the past several weeks, several major wheat exporters have implemented measures to curb 2019/20 wheat exports to stabilize domestic prices amidst greater demand uncertainty-spurring upward price movement across the world. In its April World Agricultural

Supply and Demand report, USDA updated its global wheat trade estimates to reflect new policy and price dynamics.

The major regions of the world are scrutinized- including the United States:

"The U.S. grain export industry and the government agencies that protect and promote U.S. agriculture are working to ensure continuous trade flows despite market uncertainty during COVID-19. As of April 2, U.S. wheat export sales to date total 25.0 MMT,

up 2 percent from last year. On April 9, USDA reduced its 2019/20 U.S. wheat export estimate from 27.2 MMT to 26.8 MMT, still 5% greater than last year and 9% above the 5-year average, if realized. Seasonally slower export sales and higher U.S. wheat export

prices through the last half of March pressured USDA's total U.S. wheat export forecast month-over-month. Heightened domestic demand and large hard red winter (HRW) sales to China supported U.S. export prices between mid-March and early April."

Read More by

clicking or tapping here.

|

|

Our thanks to Midwest

Farms Shows, P

& K Equipment, AFR

Insurance, Oklahoma

Farm Bureau, Great

Plains Kubota, Stillwater

Milling Company, National

Livestock Credit Corporation, Oklahoma

Beef Council, Oklahoma

AgCredit, the

Oklahoma Cattlemens Association and KIS

Futures for their support of our daily Farm News Update. For your convenience, we have our sponsors' websites linked here- just click on their name to jump

to their website- check their sites out and let these folks know you appreciate the support of this daily email, as their sponsorship helps us keep this arriving in your inbox on a regular basis- at NO Charge!

We invite you to check out our website at the link below too that includes an archive of these daily emails, audio reports and top farm news story links from around the globe.

God Bless! You can reach us at the following:

phone: 405-473-6144

|

|

|