Fri, 04 Nov 2022 08:24:44 CDT

Gross Receipts to the Treasury for the past 12 months surpassed last month’s record high of $17 billion by more than $200 million, State Treasurer Randy McDaniel announced today.

Twelve-month gross receipts through October are $17.24 billion, up by $2.5 billion, or 17.3 percent, from the prior 12 months. Furthermore, this aggregate is more than $4 billion higher than the slowdown in June 2020 of $13 billion.

“Gross Receipts to the Treasury continue to rise,” said Treasurer McDaniel. “While inflationary pressures are offsetting the purchasing power of much of the growth, the trend lines from key revenue sources remain favorable.”

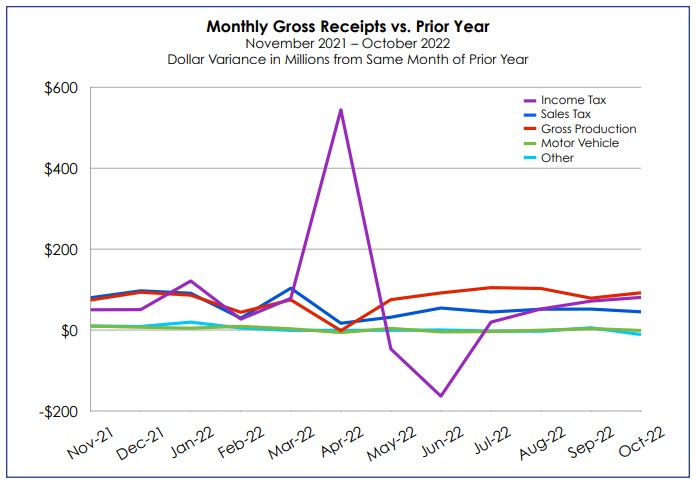

Major revenue streams for the past 12 months have increased by rates ranging from 92 percent for oil and gas gross production collections to 2.6 percent for motor vehicle receipts. The largest components are taxes on income and sales. They show double-digit growth with income tax collections up 17.2 percent and the combined sales and use taxes up 11.4 percent.

Compared to last October, the economic results for the month are also robust. Total October collections of $1.48 billion are up by $204.6 million, or 16.1 percent, from October 2021. The highest percentage of growth is seen in oil and gas gross production receipts, up by 87 percent from the prior year. Sales and use tax collections continue to keep up with inflation, growing 8.5 percent compared to the same month of last year.

Other indicators

As measured by the Consumer Price Index, the U.S. Bureau of Labor Statistics (BLS) reports the annual inflation rate at 8.2 percent in September. The energy component of the index is up 19.7 percent over the year. The food index rose by 11.2 percent.

The Oklahoma unemployment rate in September was reported as 3.2 percent by the BLS. That is up from 3.1 percent in August. The U.S. jobless rate was listed as 3.5 percent in September, down by two-tenths of a percentage point from August.

The monthly Oklahoma Business Conditions Index contracted in October. The index for the month was set at 51.3, down from 55.6 in September. The outlook indicates slow growth during the next three to six months.

October collections

October 2022 collections compared to gross receipts from October 2021 show:

· Total monthly gross collections are $1.48 billion, up by $204.6 million, or 16.1 percent.

· Gross income tax collections, a combination of individual and corporate income taxes, generated $494.5 million, up by $80.4 million, or 19.4 percent.

o Individual income tax collections are $450.5 million, an increase of $70.1 million, or 18.4 percent.

o Corporate collections are $44 million, up by $10.3 million, or 30.7 percent.

· Combined sales and use tax collections, including remittances on behalf of cities and counties, total $573.9 million – up by $44.8 million – or 8.5 percent.

o Sales tax collections total $489.1 million, an increase of $36.9 million, or 8.2 percent.

o Use tax receipts, collected on out-of-state purchases including internet sales, generated $84.9 million, an increase of $7.9 million, or 10.3 percent.

· Gross production taxes on oil and natural gas total $197.7 million, an increase of $91.9 million, or 86.9 percent.

· Motor vehicle taxes produced $66.8 million, down by $1.3 million, or 1.9 percent.

· Other collections composed of some 60 different sources including taxes on fuel, tobacco, medical marijuana, and alcoholic beverages, produced $144.6 million – down by $11.3 million, or 7.3 percent.

o The medical marijuana tax produced $4.3 million, down by $672,321, or 13.4 percent from October 2021.

Twelve-month collections

Combined gross receipts for the past 12 months compared to the prior period show:

· Gross revenue totals $17.24 billion. That is $2.54 billion, or 17.3 percent, above collections from the previous 12 months.

· Gross income taxes generated $6 billion, an increase of $882.1 million, or 17.2 percent.

o Individual income tax collections total $4.97 billion, up by $657.5 million, or 15.3 percent.

o Corporate collections are $1.04 billion, an increase of $224.6 million, or 27.7 percent.

· Combined sales and use taxes generated $6.79 billion, an increase of $693.7 million, or 11.4 percent.

o Gross sales tax receipts total $5.75 billion, up by $566.2 million, or 10.9 percent.

o Use tax collections generated $1.03 billion, an increase of $127.5 million, or 14.1 percent.

· Oil and gas gross production tax collections generated $1.91 billion, up by $913.7 million, or 91.9 percent.

· Motor vehicle collections total $874.6 million, an increase of $22.4 million, or 2.6 percent.

· Other sources generated $1.67 billion, up by $27.5 million, or 1.7 percent.

o Medical marijuana taxes generated $55.9 million, down by $10.4 million, or 15.7 percent.

About Gross Receipts to the Treasury

The monthly Gross Receipts to the Treasury report, developed by the state treasurer’s office, provides a timely and broad view of the state’s economy.

It is released in conjunction with the General Revenue Fund report from the Office of Management and Enterprise Services, which provides information to state agencies for budgetary planning purposes.

The General Revenue Fund, the state’s main operating account, receives less than half of the state’s gross receipts with the remainder apportioned to other state funds, remitted to cities and counties, and paid in rebates and refunds.

To access charts and graphs, click here.