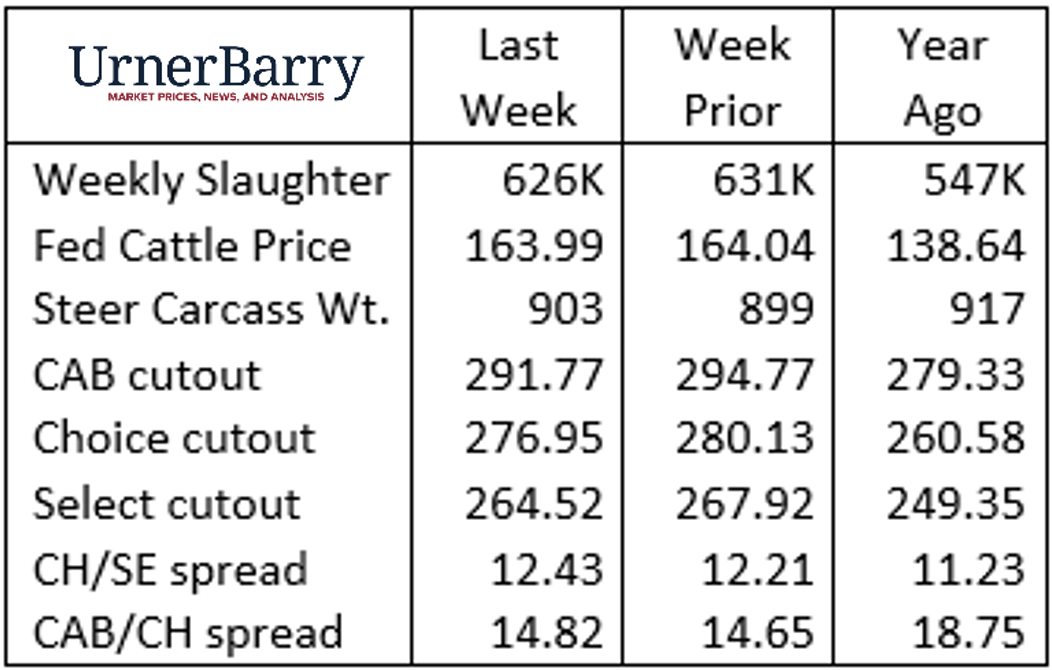

| In early March, the fed cattle market topped out at just over $165/cwt. before pulling back to an average around $164/cwt., where prices have become stagnant for a few weeks. Live cattle contract prices on the CME have been unsettled, to put it mildly. It is likely that the unrest surrounding financial institutions, coupled with resulting equity market volatility, generated concerns about consumer beef demand. The April Live Cattle contract topped at $166/cwt. on March 7 then rapidly fell to $161.50/cwt. on March 15. Another week’s worth of trading saw the contract bounce up and down in a range around $162/cwt., a discount to the spot cash cattle market. A strong recovery beginning last Friday has brought the April contract up to $165/cwt., now over $1/cwt. premium to last week’s cash trade and certainly more reflective of the cattle supply tightening moving into the spring. |

|

| The direction of the fed cattle market is also reflective of carcass cutout values this March. The CAB cutout touched the year-to-date high of $295/cwt. at the first of the month and has lost only a few dollars through last week’s average quote of $292/cwt. The Choice cutout also saw a short term high of $282/cwt. at the beginning of March but has dropped a bit more than the CAB value, giving up $6/cwt. to average almost $277/cwt. last week. The cutout price direction in March has been softer during the past two weeks than the same period in 2021 and 2022. However, the general March trend this year, as well as the past two, can be described as a pullback prior to when spring beef buying demand kicks in. April demand is yet to be unveiled but protein buyers should be taking advantage of the recent dip in price on certain beef cuts, especially those popular for grilling. |

| Seasonal Quality Grade Highs Likely Already Posted |

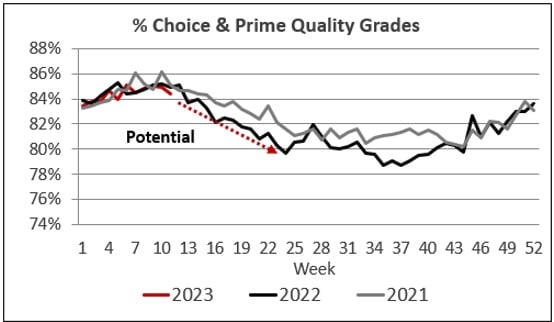

| The official beginning of spring is already a week old and the calendar will turn to April soon. This means the beef market should be heating up right along with outdoor temperatures. Middle meats and some chuck primal steak items should start to see boost in demand. As we review this annual spring phenomenon it’s important to keep in mind that current prices for such grilling items are easily record-high relative to history. CAB tenderloins, for example, are currently 15% higher than a year ago at a wholesale price of $15.17/lb. on average. With the stepped-up inflation, this is not entirely surprising but still a price that may slow demand a bit. On the other hand, the spring tenderloin price rally in the past two years has been so sharp that betting against a repeat this spring may not be a safe bet. On the supply side, spring demand opens up discussion about carcass quality trends. March typically marks the highs in national fed cattle percentages of Choice, Prime and CAB carcasses. The pattern in this year’s data looks normal in that the industry did build up to a higher quality mix of carcasses into early March. USDA Choice reached 75% and USDA Prime reached 10% of the total fed carcasses. The share of eligible Angus-type carcasses to meet CAB brand specifications extended above 40%, highly reliant on the modest or higher marbling specification. |

|

| The factor to watch moving forward is the carcass quality peak, which arrived approximately two weeks earlier this year versus a more typical pattern of previous years. For the week of March 13, the latest data shows a slight dip in the Prime grade from 10% to 9.5% while percent Choice fell back a very small one tenth of a percentage point. These are small changes, no doubt, but it is potential that the quality highs have already been tallied for the season. With current fed cattle carcass weights 16 lb. lighter than a year ago marbling achievement, on average, is likely to underperform in contrast to the past two years. Early in March, packer boxed beef supplies featured an abundance of CAB and other premium beef product but this condition is set to change given lighter carcass weights, a very current fed cattle supply, and the seasonal trend for a rapidly diminishing mix of quality carcasses. |

|

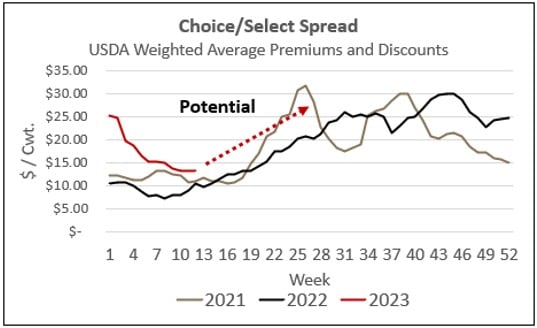

| The USDA’s grid premiums and discounts report for this week showed the Choice/Select spread to be $13.10/cwt., 25% or $2.76/cwt. higher than the same week a year ago. While much lower than the record-wide $25.20/cwt. spread seen January 1, the current value is nothing to scoff at. Looking at the seasonal trend again, the market is poised to push the quality price spreads much wider into the spring driven from both supply and demand factors. The CAB grid premium is currently quoted in a range from $3 to $6/cwt. above Choice with Prime at $18.49/cwt. above Choice, nearly even with a year ago. The grid pricing incentive for feedyards to hit 50% CAB and 20% or more Prime carcasses remains good today and better in weeks to come. |

Mar 29