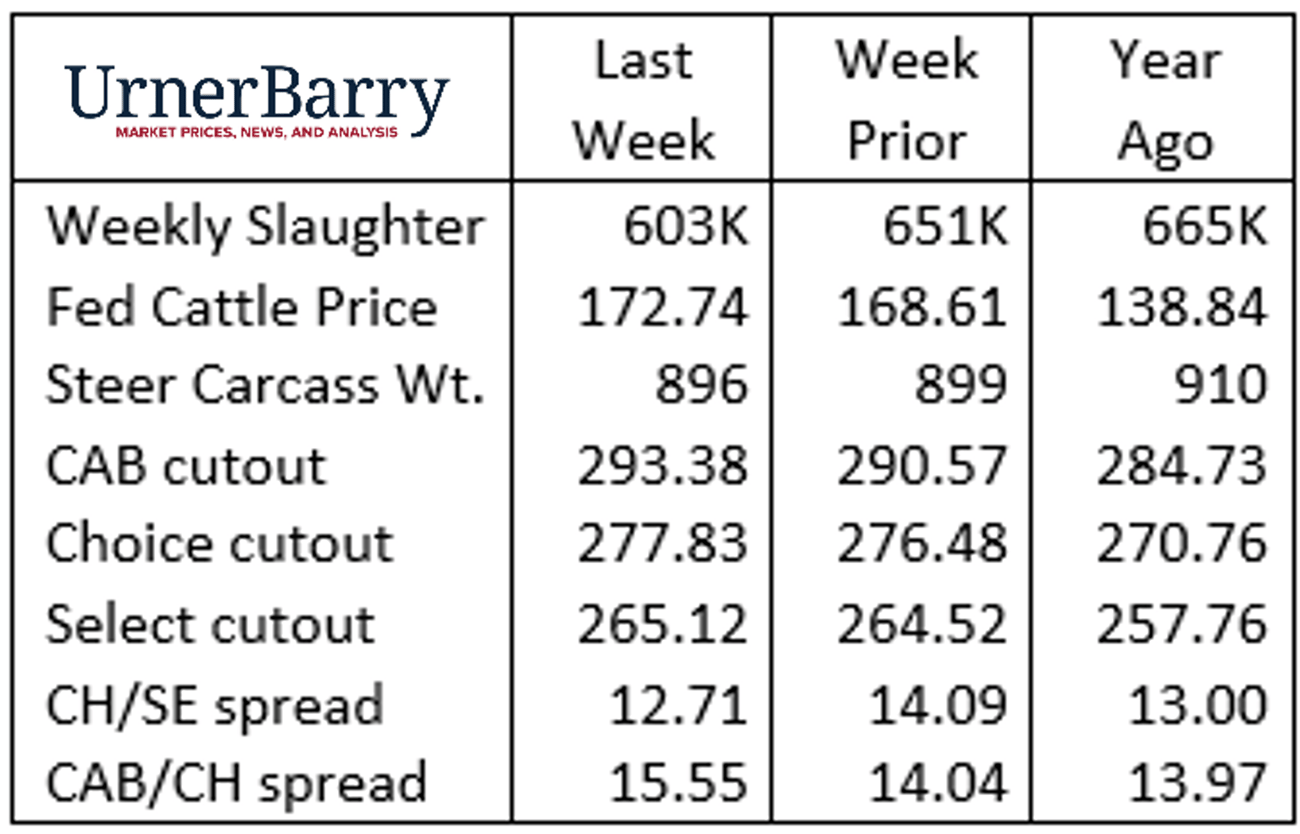

| The fed cattle market is exceptionally bullish as last week’s six-state fed steer average marked an $8/cwt. two-week run to average nearly $172/cwt. Prior to this period, the market was rangebound in the $164/cwt. area, seemingly held back by conditions outside the fundamentals of the cattle complex. One indication of outside market influence is the fact that the April Live Cattle futures contract opened Friday, March 27, at a $5/cwt. discount to that week’s cash market average. Futures prices have since raced to higher values to keep up with the spot market. The latest fed cattle weekly average price is a new record-high, just edging out the prior record in late 2014. Tight supplies of market-ready cattle are the overriding factor setting the market up for such fireworks in both the 2014 and present timelines. |

|

| Many factors are not the same when comparing today’s market value with that of 2014. The most glaringly obvious is the cost of gain difference in the feedyard. Using Kansas State University’s “Focus on Feedlots” data to compare the two timeframes indicates current feedlot costs are roughly 160% of those seen in 2014. As well, U.S. inflation since 2014 has been about 27%, suggesting that today’s record-high fed cattle price, when adjusted for inflation, is effectively much lower than the 2014 high. Carcass cutout values also moved higher in the past two weeks with the Choice cutout up $4.81/cwt. and the CAB cutout netting a $1.61/cwt. gain for the period after a slight decline a week ago. Ribeye prices have softened a little in the past two weeks but loin items and end meats have held total carcass value higher. Strip loin and short loin prices on forward contract pricing have been at a premium to current spot market prices with anticipation for building spring demand. The higher price trend is emphasized by the expected tighter cattle supply. Briskets are also moving to a higher price level as late spring demand is typically very good for this item. Tri-tips, ball-tips and flanks are also on a seasonal upward move with the latter two of these likely to see true price spikes as Cinco de Mayo draws nearer. Strong demand for thin meats across the carcass and inside skirts results in higher pricing while outside skirts are at a 52-week price high, well above April prices from the prior three years. Tenderloins have marked big spring price spikes in the past two years, currently $15.52/lb. wholesale. This is above any prior year after dropping only $2.37/lb. in January from a December high. |

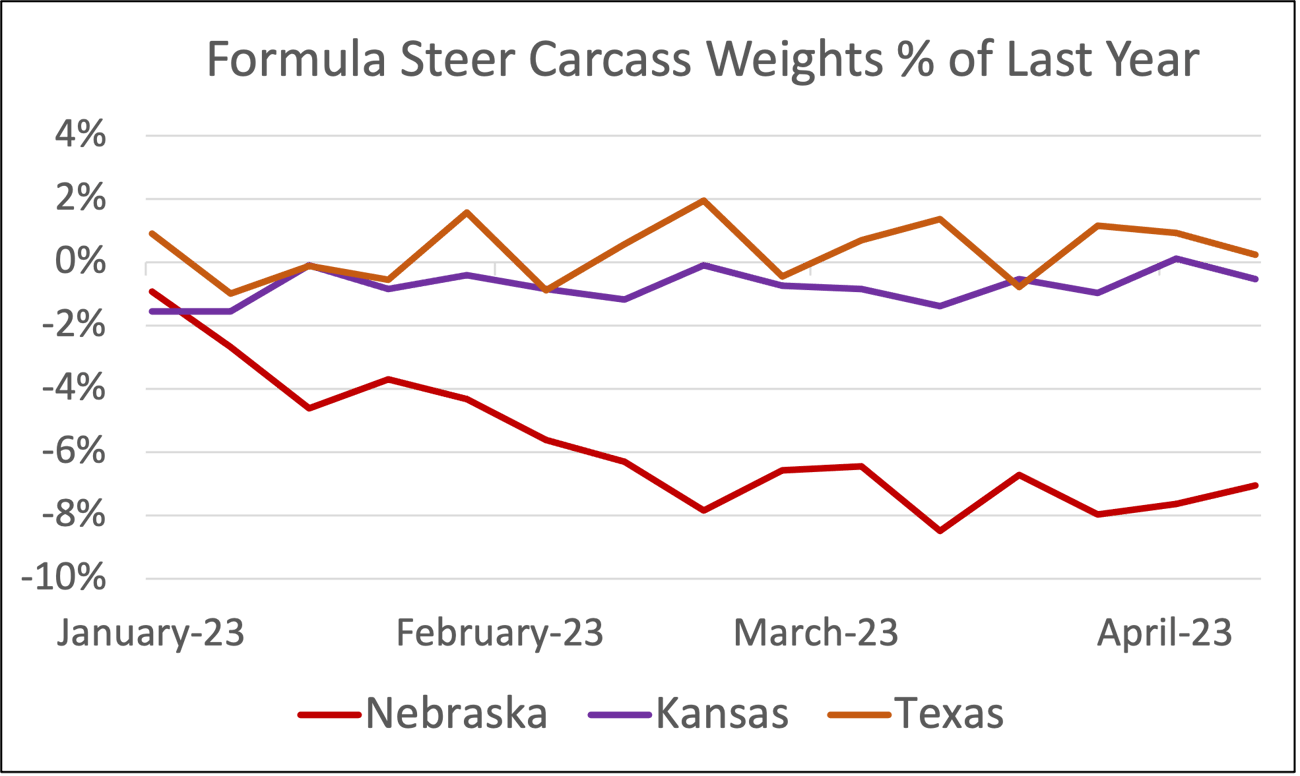

| Regional Winter Performance in Carcass Weights |

| We’ve focused a lot on the extended cold and precipitation levels in the northern feeding regions since January. This has been understandably impactful to cattle performance in all sectors, but measurably detrimental in feedlots. Plowing headlong into spring we’re now observing the impacts of not only smaller weekly slaughter but lighter carcass weights in the north. The chart shows a year-on-year comparison of formula dressed steer carcass weights in the major three packing states. The lines in the chart indicate the difference in 2023 year-to-date carcass weights versus those recorded in 2022. Viewing the data in this format drives home the point that feedlot performance has been dramatically different from north to south. |

|

| Intuitively, Texas cattle performance outshined the north yards as winter conditions have been generally dry and favorable in the southern feeding region. Dressed formula steer carcasses have been par to a year ago with a 0.4% increase. The southwest Kansas feeding region has been in a drought all winter and that’s reflected in the year-to-date decline in steer weights of just 0.8%. Nebraska packing plant steer weights reflect the major departure in weights of an astounding 5.8% decline through early April. The market dynamics in play currently are a lagging effect of northern winter conditions and the sparse availability of market-ready cattle in the north. The long-yearling fed cattle are seasonally depleted in the north and the calf feds that will soon become the primary supply focus in the region remain weeks away from a carcass fat content suitable to harvest to achieve high rates of marbling required to make CAB and Prime quality. As we discussed in the last Insider, the cards are stacked in favor of high carcass quality cattle this spring. The early March highs for quality grade are certainly already recorded and the seasonal grade decline is already underway. With last week’s Choice/Select spread quoted by Urner Barry at $12.71/cwt. and the CAB/Choice cutout spread at $15.55/cwt. some may question if the demand signal through grid premiums is presently reflecting the supply change. The answer is “no” – the premium is yet to build into the market structure in a large way. However, all indications are that carcass quality price spreads will drive much greater grid premiums in the weeks ahead. |

Apr 12