On March 31, the United States Department of Agriculture (USDA) released its yearly Prospective Plantings Report, and Quarterly Grains Stocks reports. The reports provide valuable insights for U.S. wheat importing customers as we enter the final two months of the 2022/23 marketing year and look ahead to the 2023 harvest. In this article, we will analyze USDA’s recent reports and their implications while also looking at the broader market conditions not encapsulated in USDA’s data.

Prospective Plantings Reaction

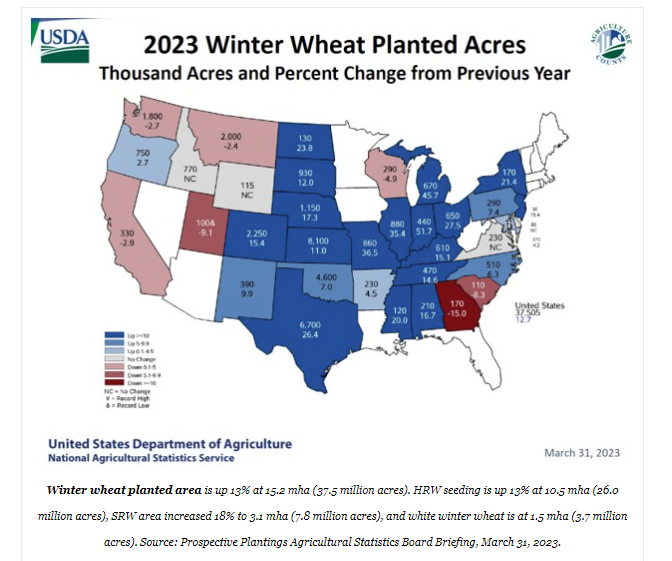

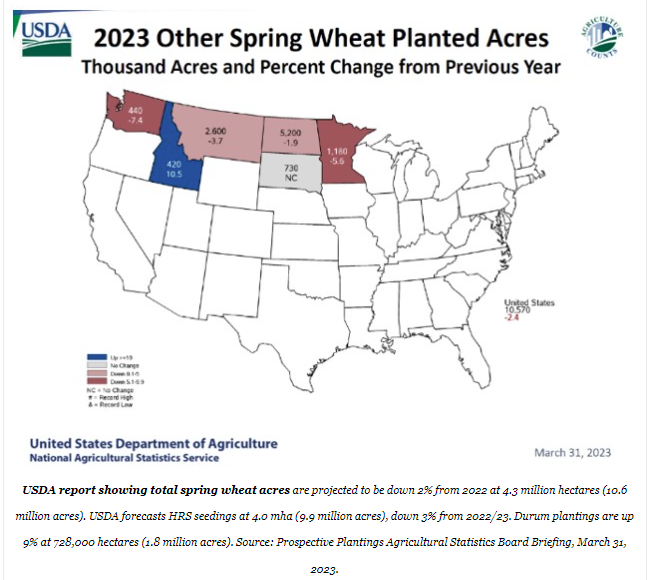

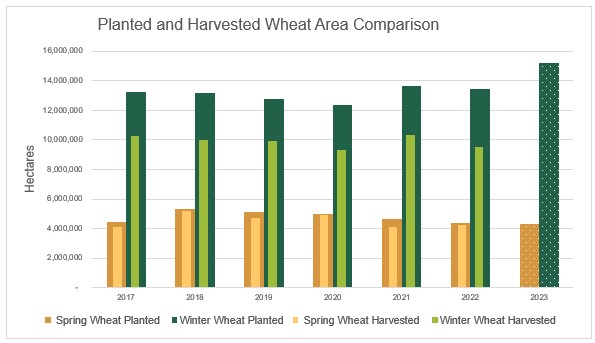

USDA estimates the total wheat area for the marketing year 2023/24 at 20.1 million hectares (mha) (49.9 million acres), up 9% from 2022 and 8% above the five-year average.

With a 9% increase in the total area year over year and the highest planted area since 2016, the numbers appear bearish at first glance. However, on Friday, March 31, Kansas City Board of Trade HRW futures closed up 6 cents, Minneapolis Grains Exchange HRS futures closed up 16 cents, and Chicago Merchants Exchange SRW futures remained unchanged. The market reaction points to more bullish influences outside the USDA report scope.

Despite the increase in overall wheat area, spring wheat area dropped 2% to its lowest level since 2017, 4.3 million hectares (10.6 million acres). Likewise, even as the winter wheat seeding outlook appears positive, the assumption that increased planted area equates to increased production does not always hold, especially as drought persists in the U.S. Southern Plains.

Weather Risk Creates Uncertainty

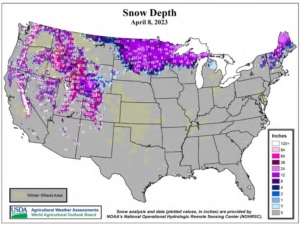

Since the spring of 2022, conditions in the U.S. Southern Plains have steadily deteriorated. A continued lack of precipitation and above-normal temperatures has left 48% of the winter wheat-growing region in drought. The severe dryness increases the likelihood of abandonment (particularly in Hard Red Winter wheat) and has a detrimental impact on the yield of the fields that make it to harvest.

Winter wheat abandonment has averaged 33% the last five years, , though in 2022/23, it increased to 42%. As drought persists, the share of area abandoned may increase. Source: USDA National Agricultural Statistics Service.

Meanwhile, late-season snow and cold temperatures in the HRS planting region have delayed spring fieldwork. A late spring may affect spring wheat plans, increasing the likelihood of prevent plant as farmers run up against crop insurance deadlines. A rapid warm-up is not yet out of the question.

Winter weather persists in much of the Northern Plains. As of April 1, farmers in the Dakotas, Montana, and Minnesota have had less than 1 day suitable for fieldwork. Late planting has a negative impact on yield and area. Source: USDA Weekly Weather and Crop Bulletin.

A Tight U.S. Balance Sheet

As drought persists in the U.S. Southern Plains and cold lingers in the North, the weather fuels supply concerns; thus, supporting wheat prices. In addition to weather fears, the USDA Quarterly Grains Stocks report put all wheat stocks at 25.7 MMT, down 8% from last year and hovering at their lowest level since 2008. Meanwhile, the April World Agricultural Supply and Demand Estimates forecast 2022/23 U.S. ending stocks at 16.3 MMT, up 5% from the March estimates, but still down 14% from 2021/22.

Though ending stocks rest precariously above historic lows, April’s increase may help alleviate some price pressure, especially as weather remains an unpredictable bullish factor. Nevertheless, as the end of the marketing year approaches, a tighter balance sheet and weather uncertainty will continue to influence U.S. prices until well into the 2023 harvest.

By USW Market Analyst Tyllor Ledford