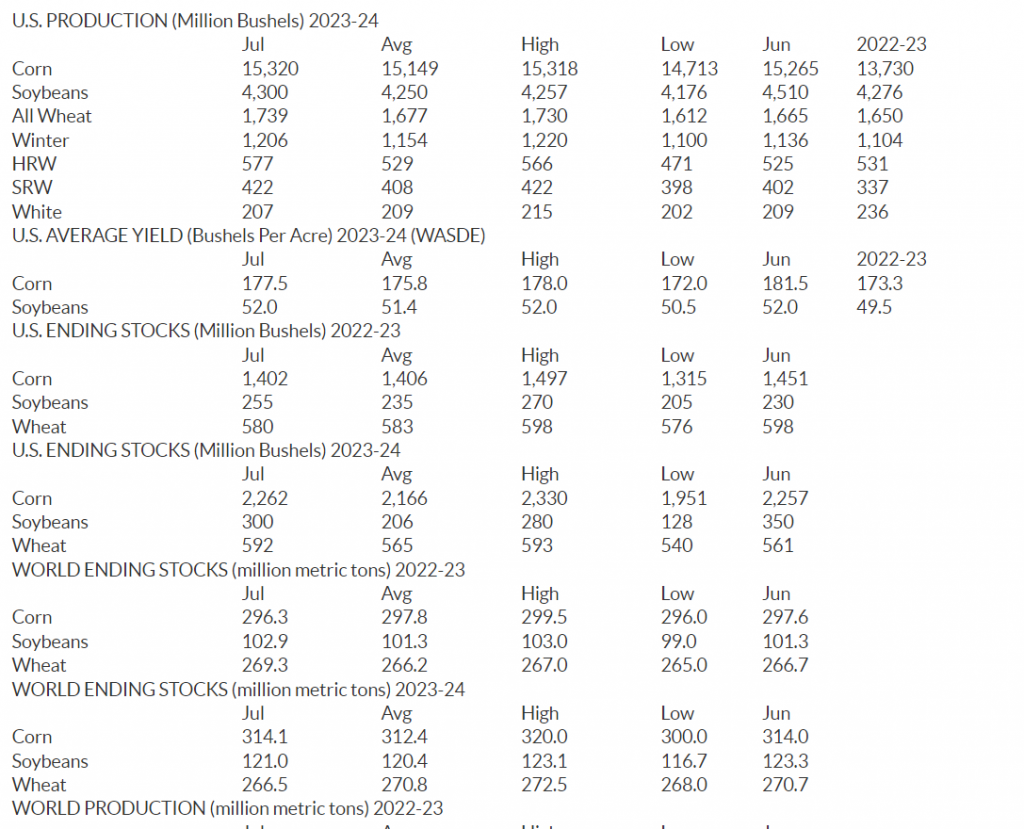

USDA on Wednesday, July 12, lowered the corn yield estimate to 177.5 bushels per acre (bpa) after bumping up its acreage estimate, but the July World Agricultural Supply and Demand Estimates (WASDE) still forecasts a record corn crop at 15.32 billion bushels (bb).

USDA lowered the soybean ending stocks forecast for the new-crop (2023-24) season to 300 million bushels (mb), above the range of pre-report expectations. The report accounted for the June 30 acreage estimate of 83.5 million planted acres but left yield unchanged at 52 bpa. USDA lowered export forecasts by 125 mb along with a small 10 mb reduction to crush.

Farm Director KC Sheperd caught up with Allendale’s Rich Nelson and talked about the latest WASDE report. The wheat side of things, Nelson said, was a bit of a surprise.

“As far as our new crop discussion, the trade only expected about an 18 million bushel increase for this production side, but it looks like the actual, though, 75 million bushels- higher than expected,” Nelson said.

As wheat harvest wraps up in some places, Nelson said some of those numbers were reflected in the report.

“There actually was an increase for the hard red side and lower numbers for the soft red side,” Nelson said.

Nelson said the trade was a bit surprised by the hard red winter wheat numbers overall.

“As far as this goes, this was a little bit of a disappointment,” Nelson said.

You can also access the full reports here:

— Crop Production: https://www.nass.usda.gov/…

— World Agricultural Supply and Demand Estimates (WASDE): http://www.usda.gov/…

WHEAT

USDA increased its estimate of all wheat production to 1.739 bb, up from 1.665 bb in its June report.

USDA estimates ending stocks for 2023-2024 wheat at mb, up from 562 mb in June. Ending stocks for old-crop wheat decreased to 580 mb from June’s estimate of 598 mb.

Wheat farm-gate prices dropped 20 cents to $7.50 per bushel.

Winter wheat production is forecast at 1.21 bb, up 6% from the June 1 forecast and up 9% from 2022. As of July 1, the United States yield is forecast at 46.9 bpa, up 2.0 bushels from last month but down 0.1 bushel from last year’s average yield of 47.0 bpa.

Area expected to be harvested for grain or seed totals 25.7 million acres, unchanged from the acreage report released on June 30, 2023, but up 10% from last year.

Hard red winter production, at 577 mb, is up 10% from last month. Soft red winter, at 422 mb, is up 5% from the June forecast. White winter, at 207 mb, is down 1% from last month. Of the white winter production, 11.4 mb are hard white and 196 mb are soft white.

Durum wheat production is forecast at 54.0 mb, down 16% from 2022. Based on July 1 conditions, yields are expected to average 37.9 bushels per harvested acre, down 2.6 bushels from 2022.

Area expected to be harvested for grain or seed totals 1.43 million acres, unchanged from the acreage report released on June 30, 2023, but down 10% from 2022.

Other spring wheat production for grain is forecast at 479 mb, down 1% from last year. Based on July 1 conditions, yields are expected to average 45.2 bushels per harvested acre, down 1.0 bushel from 2022. Area harvested for grain or seed is expected to total 10.6 million acres, unchanged from the acreage report released on June 30, 2023, but 1% above 2022. Of the total production, 441 mb are hard red spring wheat, down 1% from 2022.

On wheat world ending stocks, USDA estimated a decrease to 266.53 mmt in July from 270.7 mmt in June.

USDA estimates wheat ending stocks in China at 137.13 mmt, a decrease from 139.68 in June. USDA estimates European Union ending stocks at 14.66 mmt and 14.0 mmt in India.

USDA estimates wheat production in China at 140.0 mmt, unchanged from June. USDA estimates European Union Production at 138.00 mmt and production in India at 113.5 mmt, both unchanged from June.

CORN

As expected, USDA lowered its yield estimates 4 bpa — though still higher than the pre-report average — to 177.5 bpa. That follows the June planting report in which USDA raised corn planting 2 million acres to 94.1 million acres.

Even with the lower yield, USDA increased its production forecast to a record 15.32 bb, up 55 mb from June. If realized, that would top the 2016 record for corn production.

New crop ending stocks were pegged at 2.262 bb, up 5 mb from June’s forecast.

On the demand side, USDA largely held pat. USDA projects the 2023-24 Food, Seed and Industrial use at 6.735 bb. Ethanol use is forecast at 5.3 bb. Total domestic use is forecast at 12.385 bb. Exports for the new crop are pegged at 2.1 bb.

The farmgate price for the 2023-24 crop is projected at $4.80 a bushel, the same as last month.

USDA offset its increase in production by lowering old-crop carryover by 50 mb. Old-crop ending stocks from were lowered from 1.452 bb down to 1.402 bb.

USDA raised old-crop Feed and Residual use to 5.425 bb, up 150 mb from June. That offset lower export numbers for the old crop, which were dropped 75 mb to 1.65 bb.

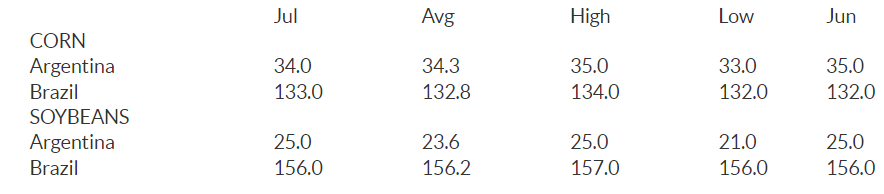

Globally, beginning stocks for the 2023-24 new crop were lowered slightly to 296.3 million metric tons (mmt). Production globally was increased 2.3 mmt to 1,224.47 mmt. Global exports were bumped up to 198.26 mmt. Global ending stocks for the new crop are forecast at 314.12 mmt, up slightly.

Ukraine’s production was increased.5 mmt to 25 mmt and Ukraine’s exports were pegged at 19.5 mmt.

Looking at global 2022-23 crop, Brazil’s production was bumped up 1 mmt to 133 mmt and exports were also raised 1 mmt to 56 mmt. Argentina’s production was lowered 1 mmt to 34 mmt because of drought concerns, and Argentina’s exports lowered to 22 mmt as well.

SOYBEANS

USDA lowered soybean ending stocks forecasts for the new-crop (2023-24) season to 300 mb, above the range of pre-report expectations. Using USDA’s 83.5 million planted acre estimate and an 83.5 mb yield estimate, total production was forecast at 4.3 mb. That led to a total supply estimate that was 185 mb lower than last month at 4.575 bb.

On the demand side, USDA lowered the crush forecast by 10 mb while slashing exports by 125 mb. The result is total use of 4.276 bb, and 300 mb of ending stocks. The national average farm gate price climbed 30 cents from last month to $12.40 per bushel.

USDA increased old-crop ending stocks by 25 mb to 255 mb, within the range of pre-report expectations. USDA cut export forecast by 20 mb and seed use by 5 mb. The national average farm gate price is pegged at $14.20 per bushel, unchanged from last month.

Globally, USDA raised 2022-23 (old-crop) stocks by 1.5 mmt to 102.9 mmt. Production estimates for Brazil and Argentina were left unchanged at 156 mmt and 25 mmt, respectively.

For the 2023-24 season, USDA cut ending stocks to 120.98 mmt globally, down from its 123.34 mmt estimate last month, largely due to smaller U.S. supplies.

LIVESTOCK

Wednesday’s WASDE report painted a mostly supportive outlook for the cattle and beef markets through 2023. Beef production for 2023 was increased by 75 million pounds as fed- and non-fed cattle slaughter is more aggressive than originally anticipated. For 2024, beef production declined by 25 million pounds as more fed cattle marketings are expected to hit the market in late 2023 than in the first two quarters of 2024.

Quarterly steer prices saw significant price increases from last month as the third quarter is now expected to average $178 (up $5.00 from last month) and the fourth quarter is estimated to average $183 (up $9.00 from last month. In 2024, first quarter steers prices are expected to average $186 (up $4.00 from last month), and the second quarter is expected to average $184. Beef imports for 2023 were increased by 20 million pounds, and exports fell by 10 million pounds. Meanwhile, in 2024, both beef imports and exports remained unchanged from a month ago.

Wednesday’s WASDE report shared a mixed outlook for the hog and pork markets. Pork production for 2023 fell by 5 million pounds from last month as slaughter in the second and third quarters of 2023 has been reduced. Pork production in 2024 saw a slight decrease as Prop 12 implications are expected to affect the marketplace.

The USDA WASDE report stated that, “Pork production is reduced as producers indicated intentions to reduce farrowings in the second half of 2023, and lower farrowings are expected to continue in the first half of 2024. However, a more rapid rate of growth in pigs per litter is expected to partly offset the lower farrowings. Nonetheless, smaller-than-previously-expected pig crops in late-2023 and early 2024 will result in a lower pork production forecast.”

Quarterly price projections for 2023 and 2024 were increased as supplies remain thin. For the third quarter of 2023, barrow and gilt prices are expected to average $63 (up $3.00 from last month, and fourth quarter prices are expected to average $57 (up $2.00 from last month). In 2024, barrows and gilts are expected to average $63.00 in the first quarter (up $3.00 from last month) and the second quarter is expected to average $68.00.

For 2023, pork imports were increased by 5 million pounds, and pork exports were increased by 110 million pounds as demand continues to remain strong from China and Mexico especially. For 2024, pork imports are unchanged from last month, but exports for 2024 were increased by 160 million pounds.