Last Thursday, the Women In Agriculture and Small Business Conference was hosted in Edmond, Oklahoma. At this conference, Dr. Shannon Ferrell presented two talks on farm and family transition planning. Radio Oklahoma Ag Network Intern, Maci Carter, got the opportunity to talk to Dr. Ferrell about family farm and ranch transition planning, how to make the transition easier, where to start, and much more.

“What we’re really talking about is not only how do we move a person’s property after they’ve passed away, but how do we successfully move an intact business from one generation to the next,” Ferrell said.

Most people think of this topic as just estate planning, and while that’s true, it is certainly not the only piece to the puzzle. Ferrel explains that farm transition planning is more of a transfer of livelihood.

“We want to make sure that we’ve got a nice smooth pathway for every part of the farm that is vital to its economic well-being,” Ferrell said.

Ferrell explained that gradual and smooth transitions are vital to ensuring the best outcome possible. Slow transitions over time and in advance allow for adjustments as needed and proper preparation as people take on this new role in their life.

“The more that people have that information, the better decisions they make and the less nasty surprises I think we have opportunities for in the process as well,” Ferrell said.

Oftentimes, farm and ranch operations happen in a “black box”, according to Ferrell, and that doesn’t usually set up the next generation for success. He says one of the most important things families can do when facing this challenge is to communicate, communicate, communicate! The more that that can be shared, the better that recipients can be prepared and manage their own expectations.

“If you have that information, you can make so many better decisions than if you were just walking around almost intentionally ignorant of what those answers might be,” Ferrell said. “So, it’s the answer for making this process easy is to do the hard things, but you find out that if you do the hard things, you can make the whole process actually a lot easier.”

No one is arguing that these conversations are not hard; however, if we have these difficult conversations and have the bravery to ask uncomfortable questions, the process becomes a lot easier, according to Ferrell.

“I think one of the biggest problems I run into is that people think if I have two kids or three kids or four kids, I’ve got to treat them exactly equally,” Ferrel said. “And if I treat them equally, that’ll avoid all the fights, and just nothing in my personal or professional experience bears that out.”

Equity and equality are two different things, Ferrell said, as oftentimes folks think the only way to make things fair to their beneficiaries is to split up their own assets equally when in reality, that’s not always equitable to everyone, and it doesn’t stop family feuds. Finding out what equity means to your family is a good step in proceeding and handling breaking up estates and assets.

“People think that transition planning or estate planning is only for people that have ‘a lot of assets’, or whatever that means, but it’s every bit as important for somebody who doesn’t have a lot or maybe is just starting out and has a lot of debt, and they’re really trying to turn that debt into equity over time,” Ferrell said. “It’s every bit, if not more important, for them to have a plan as it is for that well-established operator that’s in a great equity position.”

A big misconception with farm transition planning, Ferrell said, is that it’s not important unless you have “a lot of assets.” Ferrel said that is far from the truth, and transition planning is just as, if not even more important, for folks who don’t have as much to give their beneficiaries. Everyone can benefit from transition planning, he added.

“The first thing is really maybe the simplest thing you can do, and that’s just getting a really good handle on where you’re at right now,” Ferrel said.

Ferrell described it as a GPS being able to tell where you’re at in order to be able to tell you how to get somewhere. This means taking a deep dive inventory and rounding up all of your assets, no matter how small so that you can determine what the role of that asset is and where it’s going to go.

“Then last but not least, everybody needs to have a will,” Ferrell said. “So, if nothing else, if you can just get those pieces in place. You’ve done a tremendous service for your family.”

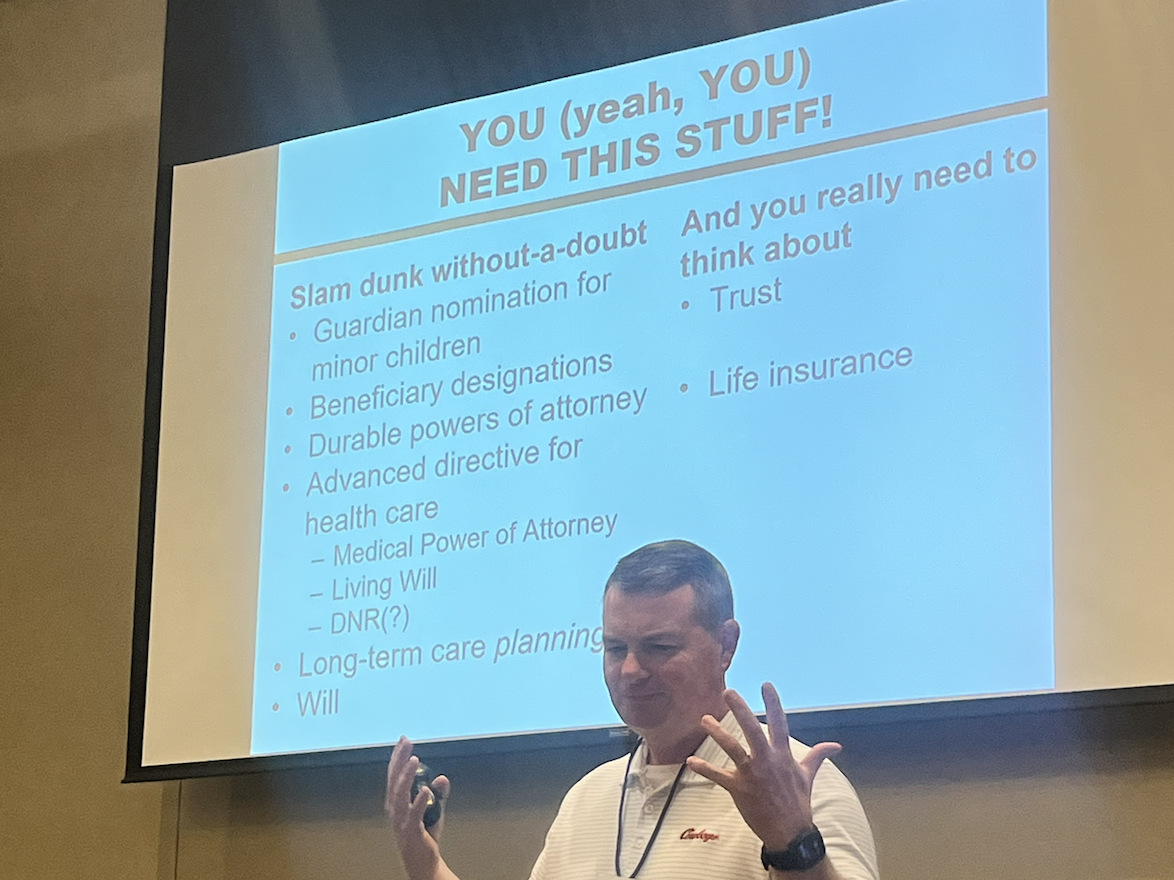

During his presentation, Dr. Ferrell shared a list of a few things that EVERYONE needs to have. These included a guardian nomination, durable power of attorney, advanced directive, long-term care plan, a contractual tool for any savings or investments, and most importantly, a will. If nothing else, these few things will save your family some heartache.