Paperwork is often an unwelcome chore for farmers and ranchers. To participate in payment programs through USDA, farmers must meet several eligibility thresholds, which vary slightly from program to program. In this Market Intel, we’ll dive into the criteria for two of the more complicated eligibility requirements: adjusted gross income (AGI) and actively engaged in farming (AEF).

Adjusted Gross Income

To participate in payment programs through the Farm Service Agency (FSA) and the Natural Resources Conservation Service (NRCS), participants must complete USDA’s CCC-941 Average Adjusted Gross Income (AGI) Certification and Consent to Disclosure of Tax Information. The form attests that farmers have a three-year average AGI of under $900,000. But, what exactly is adjusted gross income?

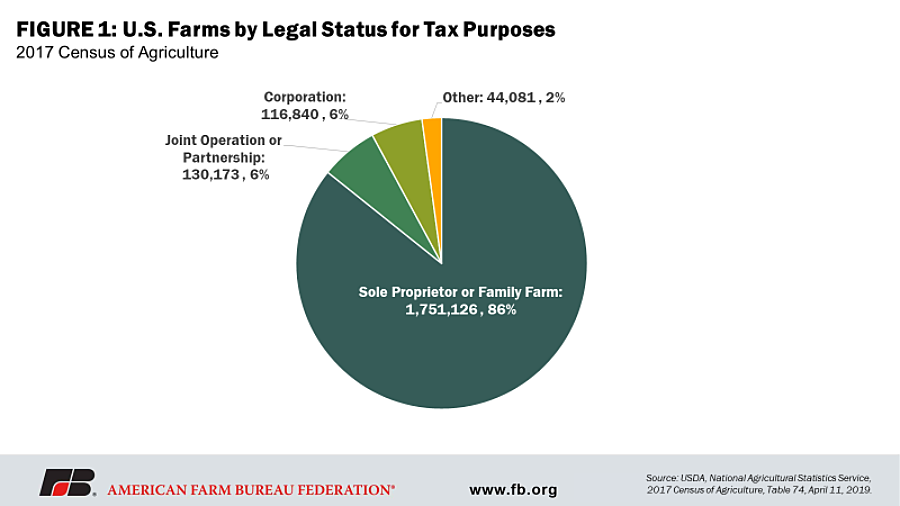

For most tax-paying citizens, an AGI is simple to calculate. However, as with all taxes, it can be a bit more complex for farmers. Most U.S. farms are operated as sole proprietorships or partnerships and are thus taxed under individual income tax rules rather than corporate tax rules. USDA estimates that 98% of farm households are “pass-through” entities, where profit or loss is passed through to the owner/partner/shareholder and is taxed on an individual level via a personal income tax return. According to the 2017 Census of Agriculture, for tax purposes 86% of U.S. farms are sole proprietors, 6% are a joint operation or partnership, 6% are structured as corporations, and an additional 2% are filed in other classifications such as cooperatives or trusts.

Farm households paying taxes as a pass-through entity file taxes with a U.S. Individual Income Tax Return (Form 1040) using an additional form, Schedule F, to report farm income and expenses.

Most notably, while the “gross” in adjusted gross income indicates all money earned before taxes or deductions, it incorporates net farm profit or loss as calculated on Schedule F, line 34.

Thus, adjusted gross income incorporates on-farm income (defined as farm profit or loss) and off-farm income, minus various adjustments to income as covered in Part II of Schedule 1 (Form 1040). Adjustments to income that are widely applicable include health savings account deductions, alimony payments, student loan interest deductions, individual retirement account (IRA) deductions, and self-employed health insurance deductions. If you file taxes as an individual, and want to find your AGI, it is listed under line 11 of Form 1040.

As a reminder, for program eligibility a three-year average AGI is used. For crop year 2023, the relevant AGI base years are 2019, 2020 and 2021. In more technical terms, the three relevant base years are the three taxable years preceding the most immediately preceding complete taxable year for which benefits are requested. In simpler terms, it’s the three years preceding last year.

How Many Farms are Impacted by the AGI Limit?

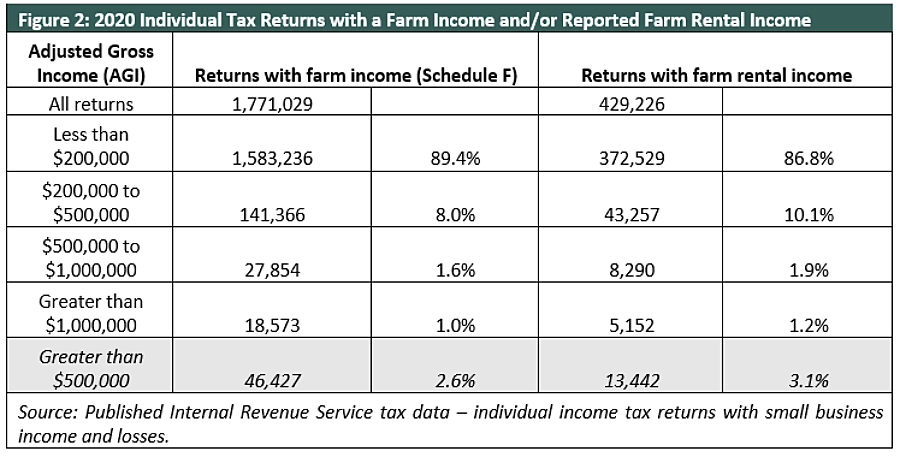

We can use IRS federal income tax data to approximate how many farm sole proprietors and farm rental landlords are impacted by the AGI cap. Unfortunately, for this purpose, income taxes are reported in brackets that do not have a cut-off at $900,000. In the latest year available, 2020, 1% of individuals filing a Schedule F farm income return had an AGI of over $1,000,000 and thus would not qualify for most farm programs due to the AGI limit. A further 1.6% had an income of between $500,000 and $1,000,000, so probably less than 2% of individuals reporting a Schedule F farm income return have an AGI beyond the $900,000 limit. By the same figuring, about 2% of individuals reporting income from farm rentals would meet the disqualifying AGI threshold. (See Figure 2.)

While this method provides a one-year snapshot of AGI, it is important to note again that for USDA purposes a three-year average AGI is required. Thus, if a farmer were to win the lottery and earn $2,500,000 in one year, but only $70,000 and $60,000 in the other two years, they would still be eligible for payment programs as their three-year average would be below $900,000.

Notably, farm incomes have risen dramatically in recent years, with 2022 net farm income ($183 billion) nearly doubling 2020 net farm income ($95 billion). With the spike in farm income, the AGI limit may be impacting more farmers.

Actively Engaged in Farming

Another term that must be defined for eligibility for several programs, most notably the Agriculture Risk Coverage (ARC), Price Loss Coverage (PLC) and Marketing Assistance Loan (MAL), and other benefits is actively engaged in farming (AEF). Notably, AEF requirements are not applicable for crop insurance and conservation programs. For an individual to be considered actively engaged in farming, they must make a significant contribution in two different categories and meet the farm bill definition of a producer. A producer is defined as an “owner, operator, landlord, tenant, or sharecropper that shares in the risk of producing a crop and is entitled to a share of the crop that is produced on the farm.” The first additional category for AEF is a significant contribution of land, capital, and/or equipment. The second category is a significant contribution of active personal labor and/or active personal management. But, what qualifies as a “significant contribution”?

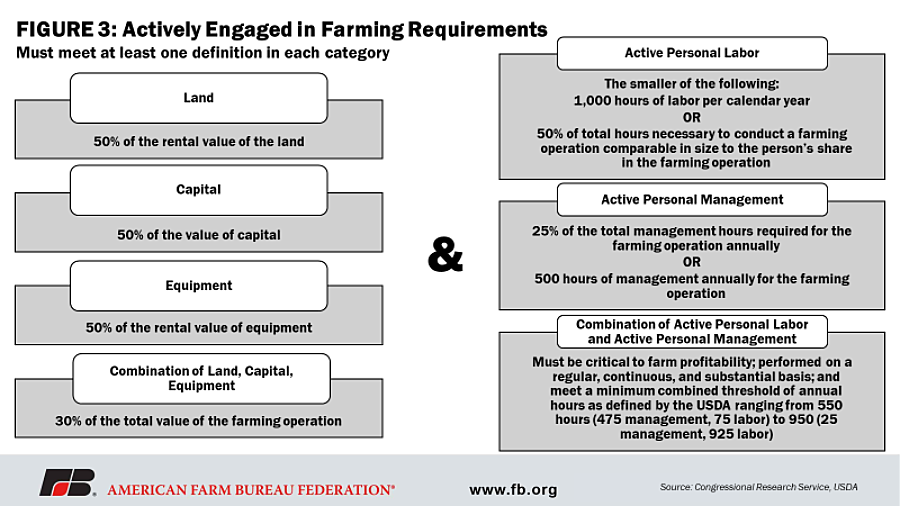

For the first category, a “significant contribution” is defined as at least 50% of the rental value of the land or 50% of the value of the capital or equipment necessary to conduct the farming operation. If a combination of the three is the qualifying factor, an AEF individual must contribute at least 30% of the total value of the farming operation.

For the second category, different thresholds are laid out for active personal labor and management. The active personal labor threshold is met if either the individual puts in 1,000 hours per calendar year of labor or 50% of the total hours needed to conduct a farming operation comparable in size to the person’s share in the farming operation. To reach the threshold for active personal management an individual must either perform 25% of the total management hours required for farming operations on an annual basis, or 500 hours of management annually. A combination of active personal labor and active personal management is allowed as well. To qualify under the combination, the individual must be critical to farm profitability; perform on a regular, continuous, and substantial basis; and meet a minimum combined threshold of annual hours as defined by the USDA. The combined hours schedule defined by the USDA ranges from 550 hours, with a minimum of 75 hours of labor and 475 hours of management, to 950 hours, with a minimum of 925 hours of labor and 25 hours of management. Below, Figure 3 describes these requirements graphically.

Exceptions to AEF

There are several categories of people who qualify without meeting the specific criteria of AEF. For married people, if one spouse is determined to be actively engaged in farming, the other spouse will also be determined to have met the requirements. Thus, married farmers can double their individual payment regardless of whether their spouse meets AEF definitions as an individual.

Adult family members, 18 years or older, who receive an income based on a farm’s operating results also meet AEF requirements. Eligible family members include siblings, spouses, lineal ancestors (e.g., great-grandparent, grandparent, or parent), lineal descendants (e.g., son, daughter, grandchild, or great-grandchild), nieces, nephews, or first-cousins of the principal operator.

Landowners may forego requirements for AEF labor and management if they receive income based on the farm’s operating results (sharing in the risk of profits and losses). If the landowner engages with a fixed rental payment or fixed share, they do not qualify as a producer and thus do not qualify as an actively engaged producer.

Conclusion

We hope this Market Intel has helped bring clarity to a few “clear as mud” terms. For a more detailed examination of the actively engaged in farming requirements, including requirements for corporations and joint ventures, check out the Congressional Research Service’s USDA’s Actively Engaged in Farming (AEF) Requirement. For further information on eligibility requirements generally, check out the Congressional Research Service’s U.S. Farm Programs: Eligibility and Payment Limits report and FSA’s payment eligibility webpage.

Story credit: Betty Resnick, American Farm Bureau Federation