Since the start of the year, world wheat prices have consistently trended lower, with Russian wheat maintaining its position as the world’s cheapest origin. With the Northern Hemisphere wheat harvest now complete, it brings about the question: have markets touched their seasonal lows, and in what direction will they go next? In this article, we will evaluate the underlying market factors driving recent price trends and highlight factors to watch moving forward.

A Downward Trend

Following the initial shock of Russia’s Ukraine invasion in 2022 with volatility on the way, world wheat prices have steadily decreased. From January 2023 to present, world wheat prices are down $77/MT, on average.

Russia’s influence in the world market is driving this trend in world price levels. According to the October World Agricultural Supply and Demand Estimates, Russian production was estimated at 85.0 MMT, 5.0 MMT above the five-year average. Likewise, 2023/24 Russian exports are forecast at 50.0 MMT, the highest on record. The ample supplies of Russian wheat and significant export flows have put downward pressure on the world wheat market. As a result, the October 23, 2023 AgriCensus price data puts Russian wheat with 12.5% protein (on a dry moisture basis) at $225/MT FOB, their lowest price since September 2020 and the cheapest on the world market.

Over the same time, world wheat demand has softened. For the first time since 2018/19, USDA projects a reduction in global use, with the October WASDE putting demand at 792 MMT, down from 796 MMT the year prior.

Since January 2023, world wheat prices have decreased by 17%, weighed by ample supplies exported from Russia. Source: AgirCensus Price Data, October 23, 2023.

More Than Meets the Eye

At first glance, the global supply and demand situation shows ample Black Sea grain exports and softening global demand, the perfect pairing for lower global wheat prices.

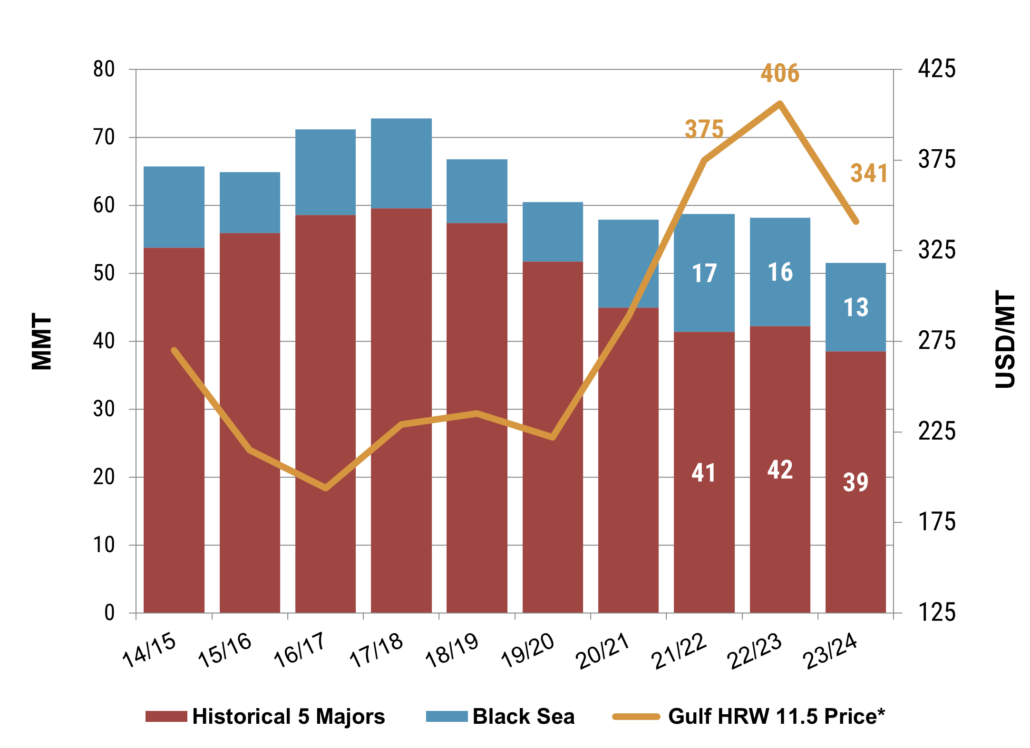

Looking more closely, ending stocks in major exporting countries are forecast to fall to the lowest level since 2012/13, demonstrating a tighter global balance sheet that is, apparently, not reflected in current price levels.

Ending stocks in major exporting countries are down 10% on the year and 29% from 2017/18. Despite the decreased stocks, wheat prices sit near 2021 levels, failing to reflect the tighter world balance sheet. Source: World Agricultural Supply and Demand Estimates and U.S. Wheat Associates Price Report.

Additionally, Southern Hemisphere wheat production, particularly Australian output, is a factor to watch. As the El Niño weather event develops in the equatorial Pacific, dry weather is expected to prevail in Australia. As a result, the October World Agricultural Supply and Demand Estimates put Australian production at 24.5 MMT, down 1.5 MMT from September and 15.2 MMT below the year prior. However, recent rains in Australia may help improve yields, bringing an additional bearish influence to the world market.

Beyond Traditional Fundamentals

In addition to supply and demand, macroeconomic factors have played an increasingly important role in world wheat prices. The U.S. dollar was strong a year ago, but softened over the first half of 2023. However, beginning in July, the dollar index shifted up again, driven by a sustained hawkish view held by the U.S. Federal Reserve and the resilience of the U.S. economy in the face of higher interest rates. As importers are keenly aware, a strong dollar adds cost to wheat purchases.

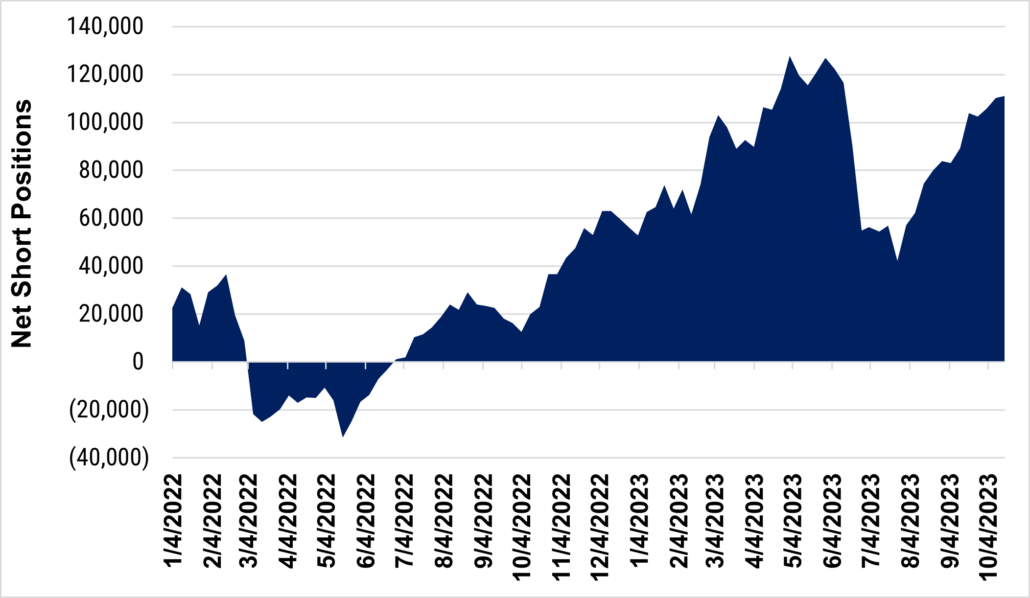

On the bullish side, commercial funds have become “net short” in the Chicago Board of Trade Wheat (CBOT) futures. The trend indicates that commercial investors believe prices will continue trending lower. If the sentiment shifts and prices rise, funds will be forced to cover the positions, potentially adding significant volatility and upward pressure on Chicago wheat futures and the market as a whole.

Speculative funds hold a net short position in CBOT Wheat futures. If sentiment shifts, forcing a massive covering of the short positions, prices will skyrocket; thus, contributing additional short-term volatility and bullish influence on the market. Source: Commodity Futures Trading Commission Data.

Finally, we cannot discuss global wheat prices without addressing the geopolitical risks associated with continued conflicts. Grain continues to flow from the Black Sea, and the market outlook has stabilized. Nevertheless, sentiment could shift quickly if a new development or escalation occurs in the conflict. Similarly, the unknowns of the war in the Middle East could have a detrimental impact on oil prices, directly impacting ocean freight rates and dampening the global economy.

Key Takeaways

In summary, many lurking influences may impact world wheat prices, both bullish and bearish, that are not yet priced into world markets. Buyers should closely monitor the Southern Hemisphere wheat harvest developments, pay attention to upcoming updates to the USDA World Agricultural Supply and Demand Estimates, and stay well informed regarding changes in the world macroeconomic situation.

With many unknowns, it is vital to maintain a dialogue with your local U.S. Wheat Associates (USW) office and suppliers to capitalize on opportunities to maximize the value of U.S. wheat.

By Tyllor Ledford, USW Market Analyst