Dr. Derrell Peel, Oklahoma State University Extension Livestock Marketing Specialist, offers his economic analysis of the beef cattle industry as part of the weekly series known as the “Cow Calf Corner,” published electronically by Dr. Peel and Mark Johnson. Today, Dr. Peel talks about beef demand and prices.

With ever-tightening cattle and beef supplies pushing prices higher, all eyes are on beef demand going forward. Beef demand has been remarkably robust through many shocks in recent years and continues to surprise and impress despite the nervousness of the industry to the challenges facing consumers. Post-pandemic beef demand has been exceptional since 2021. Per capita beef consumption in 2022 was 58.9 pounds, equal to 2021. Real (inflation-adjusted) retail all-fresh beef prices were record high in 2021 and just slightly lower in 2022. This compares to 2015, when real retail all-fresh prices reached the same level but with per capita beef consumption at 54.0 pounds, 8.3 percent less than the 2021-2022 level.

So far in 2023, retail all-fresh beef prices have continued to increase, especially since July, with September at $7.82/lb., a new record high monthly retail price. Retail all-fresh prices have averaged 6.6 percent higher year over year (4.0 percent higher in real dollars) in the July-September period. Since July 4, weekly Choice boxed beef prices have averaged $307.16/cwt., ranging from a low of $299.94/cwt to a high of $321.97/cwt. Choice boxed beef prices have averaged 18.4 percent higher year over year through the third quarter of the year. With beef production projected to be down more than 5.5 percent year over year, per capita beef consumption is expected to decease to 57.0 pounds this year,

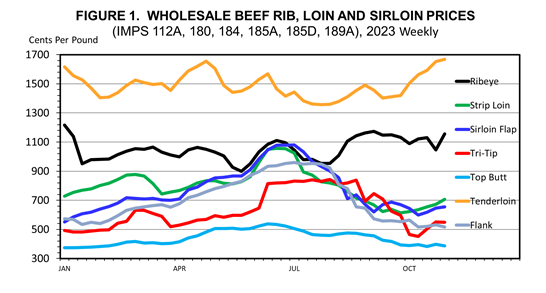

Figure 1 shows weekly prices for several Choice wholesale middle cuts in 2023. Tenderloin and Ribeye, the two highest value cuts have held steady through the year and are beginning increase seasonally into the fall. Other steak items that are seasonally highest for summer grilling, including strip loins, sirloin and tri-tip have decreased from summer highs, but are generally following normal seasonal patterns.

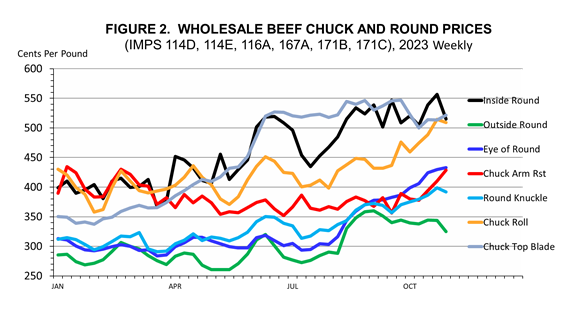

Figure 2 shows weekly Choice wholesale chuck and round products. These items all generally held steady through the first half of the year and are increasing in the second half of the year. This likely reflects both seasonal tendencies and tightening beef supplies. It is common for roast items to increase seasonally when cooler weather brings out the crock pots.

There are certainly plenty of macroeconomic and geopolitical uncertainties to keep the industry nervous about beef demand. However, the increasingly high quality and consumer preferences for beef continue to be reflected in strong beef demand. These factors, combined with tightening beef supplies, will keep wholesale and retail beef prices strongly supported in the coming months.