USDA on Thursday slightly bumped up crop production for corn and soybeans and brought down projected ending stocks for both crops as well.

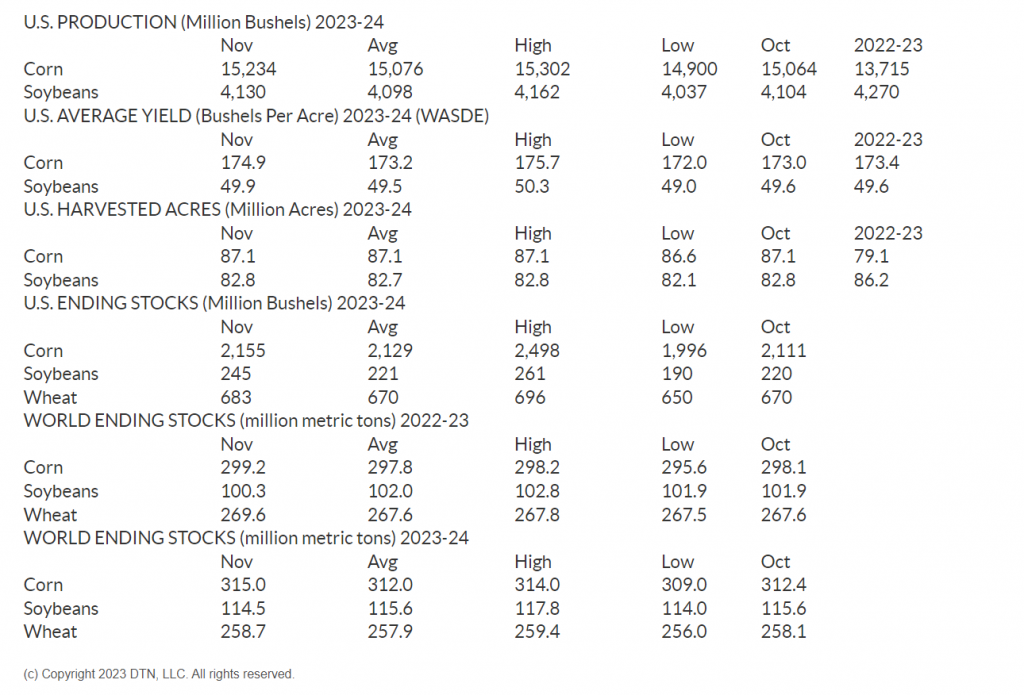

USDA increased the 2023-24 corn production by 170 million bushels (mb) to 15.234 billion bushels (bb) — a surprise that was beyond the pre-report estimates. If that holds, that breaks the 2016 production record. USDA also increased soybean production by 25 mb to 4.129 bb.

Farm Director, KC Sheperd, had the chance to talk with Allendale’s Rich Nelson about this month’s report. The November report, Nelson said, is usually a more mild report.

“Usually, by this point, we are only seeing mild changes to the established production numbers on corn and soybeans,” Nelson said. “Wheat production is already decided at the end of September in a special report, so relatively quiet numbers are usually seen on this report here.”

On the wheat side, Nelson said there was a moderate increase in stocks, and the export numbers didn’t see much change.

“The trade focus for wheat is still on this foreign competition issue,” Nelson said. “Argentina’s crop was dropped 1.5 million tons. They do have that continuing drought, we are finding out, going through some harvest yield numbers now.”

Five million tons of wheat were added to Russia’s production, Nelson said, putting them at 90 million tons.

Regarding livestock, Nelson said the USDA has made a seemingly dramatic change to the 2024 beef production story.

“They added 535 million pounds to their previous number,” Nelson said.

You can also access the full reports here:

— Crop Production: https://www.nass.usda.gov/…

–– World Agricultural Supply and Demand Estimates (WASDE): http://www.usda.gov/…

WHEAT

USDA pegged U.S. wheat production at 1.812 bb in November, unchanged from October’s estimate.

USDA estimates ending stocks at 684 mb in November, an increase from October’s estimate of 670 mb. U.S. wheat use is estimated at 1.86 bb, unchanged from October.

Wheat exports were set at 700 mb, unchanged from October. USDA set the farmgate price of wheat at $7.20, down from $7.30 last month.

Wheat world ending stocks were estimated at 258.69 mmt, an increase from 258.13 mmt in October.

USDA estimates global wheat production at 781.98 mmt, down from 783.43 mmt in October.

USDA estimates wheat production in Argentina at 15.0 mmt, down from the October estimate of 16.5. Brazil’s production is estimated at 9.4 mmt. Wheat production in Australia was unchanged from last month’s 24.5 mmt.

Wheat production in Russia was pegged at 90 mmt and Ukraine production was estimated at 22.5 mmt. Wheat exports from Russia were pegged at 50 mmt and 12 mmt in Ukraine.

USDA increased wheat imports 10 mb to 145 MB.

CORN

USDA raised the 2023-24 crop by bumping up the yield estimate 1.9 bushels per acre (bpa) to 174.9 bpa.

That drove up production 170 mb to 15.234 bb as a result. That breaks the production record of the 2016 crop, which came in at 15.148 bb.

USDA held pat on harvested acres at 87.1 million acres.

Ending stocks for the 2023-24 crop were increased 45 mb to 2.156 bb.

On the demand side, USDA increased Feed and Residual use 50 mb to 5.65 bb. Total 2023-24 Food, Seed and Industrial use at 6.740 bb, up 25 mb. Ethanol use was also increased 25 mb to 5.325 bb. Total domestic use is forecast at 12.390 bb up 75 mb.

Exports for the new crop also were increased 50 mb to 2.075 bb.

The farmgate price for the 2023-24 crop was lowered 10 cents a bushel to $4.85 a bushel.

Globally, beginning stocks for the 2023-24 new crop were raised 1.12 million metric tons (mmt) to 299.22 mmt. Production globally was increased 6.32 mmt to 1,220.79 mmt. Global exports were bumped up 3.37 mmt to 199.62 mmt. Global ending stocks for the new crop are forecast at 314.99 mmt, up 2.59 mmt.

Ukraine’s production was increased 1.5 mmt to 29.5 and Ukraine’s exports were increased .5 mmt to 20 mmt.

Looking at global 2022-23 crop, Brazil’s production was held at 137 mmt and exports were held pat at 57 mmt. Argentina’s production was held at 34 mmt and Argentina’s exports were held pat at 23 mmt.

SOYBEANS

USDA raised its national soybean yield forecast 49.9 bpa, up 0.3 bpa from last month’s estimate. Harvest acres were left unchanged at 82.8 million acres, unchanged from the previous forecast. Total production climbed to 4.13 bb. All estimates are within the range of pre-report estimates.

Domestic ending stocks for 2023-24 are now forecast at 245 mb, 25 mb higher than last month. The change reflects increased production forecasts, as USDA made only a minor change to the residual on the demand side of the balance sheet. The national average farm gate price was left unchanged at $12.90 per bushel.

Globally, ending stocks for the 2023-24 marketing year were 114.51 million metric tons, down 1.11 mmt from last month. The change is mostly due to smaller beginning stocks. USDA forecasts Brazilian farmers will harvest 163 mmt of soybeans, while Argentine growers will harvest 48 mmt.

Old-crop, 2022-23 world ending stocks, dropped to 100.31 mmt from last month’s 101.9 mmt. USDA said the changes were due to back-year balance sheet revisions for China and Brazil. “China’s beginning stocks are reduced on lower soybean imports for 2021-22 and 2022-23 and higher crush for 2022-23. Conversely, Brazil’s beginning stocks are increased on a larger 2022-23 crop of 158 million tons due to higher-than-expected use to date,” the report stated.

LIVESTOCK

Thursday’s November WASDE report posted reduced overall beef and pork production levels for 2023, while 2024 projection were mixed from the previous month with a strong increase production projected in beef, while moderate to firm pork production losses were seen. This will continue to likely cause concern for beef producers and overall cattle prices in the near future.

Fourth-quarter beef production fell 55 million pounds, creating the expectation of annual production levels falling 44 million pounds from the last month estimate. The focus on increased production of 535 million pounds in 2024 was strongly attributed to gains in first quarter projections accounting for 235 million pounds. The confirmation of these numbers is adding additional bearish influence to overall market prices as traders are focusing on larger-than-expected beef production through most of 2024.

Beef price levels for the fourth quarter of 2023 were unchanged, which also left overall annual price projections unchanged at $177.30 per cwt. Price levels for 2024 were unchanged when it came to annual overall price projections, but first quarter 2024 prices were reduced by $2 per cwt from the previous month while second quarter prices fell $1 per cwt.

Beef Imports for 2023 increased by 36 million pounds from the previous month while total beef supplies fell 8 million pounds. Expected imports in 2024 increased 40 million pounds from last month’s estimate, increasing overall 2024 supply issues by 590 million pounds.

Pork Production posted moderate to strong production losses from the previous month for both 2023 and 2024. Annual pork production is expected to fall 72 million pounds in 2023 from October’s estimate, while annual pork production in 2024 is estimated to be reduced 165 million pounds from previous month’s levels. This is expected to create some additional support through the lean hog complex long term, but there remains the need to sustain current values based on short term demand.

Hog prices were actually reduced on an annual level in both 2023 and 2024, with fourth quarter prices falling $3 per cwt in the latest report. First quarter 2024 hog prices were also reduced by $3 per cwt, and currently based on current hog numbers in the pipeline and the potential for this to put pressure on short term market levels.

Pork imports for 2023 increased 9 million pounds from the previous month estimate but were unchanged for 2024 from October levels. The small adjustments in imports are not expected to be a major focus following the moderate to firm overall reduction in pork production for both 2023 and 2024 from October levels.