September exports of U.S. pork were down slightly from a year ago but maintained a robust pace, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Beef exports continued to struggle compared to last year’s record totals but showed increasing strength in Western Hemisphere markets.

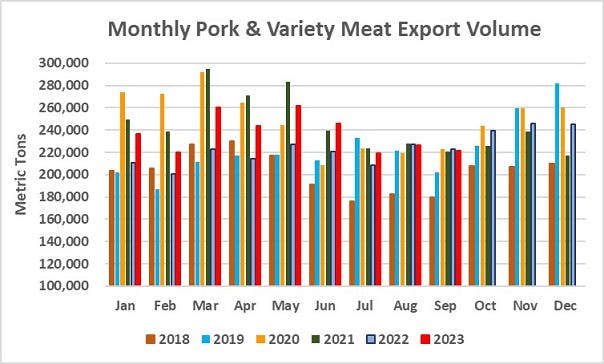

Pork exports totaled 221,140 metric tons (mt) in September, down less than 1% from a year ago, while export value fell 4% to $643.7 million. For the first three quarters of 2023, pork exports increased 9% year-over-year to 2.13 million mt and climbed 7% in value to just under $6 billion.

“Pork exports achieving another $200 million month in Mexico is fantastic,” said USMEF President and CEO Dan Halstrom, “But the good news doesn’t end there, as growth in regions such as Central America, the Caribbean and Oceania helped offset lower shipments to China and Japan.”

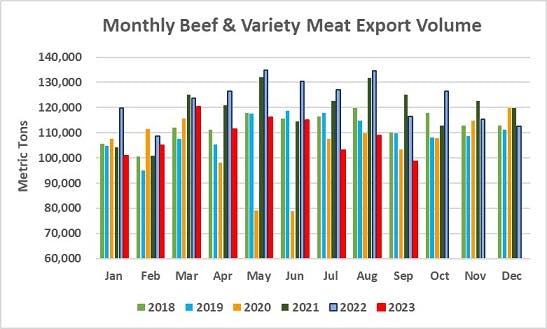

September beef exports totaled 98,757 mt, down 15% from a year ago and the lowest of 2023, while value fell 12% to $795.5 million. For January through September, exports were 13% lower in volume (980,100 mt) and down 18% in value ($7.49 billion).

“U.S. beef continues to face tough sledding in our Asian markets, where weakness in major currencies persist and consumer confidence remains guarded,” Halstrom said. “In the past few weeks we have seen several Asian trading partners step up efforts to stimulate their economies and ease pressure on consumers. In the meantime, bright spots for U.S. beef continue to emerge in the Western Hemisphere, led by strong demand in Mexico.”

Another outstanding month for Mexico bolsters September pork exports

September pork shipments to Mexico remained well ahead of last year’s record pace, increasing 17% to 89,042 mt. Export value increased 18% to $207.6 million, the third highest month on record. Through the first three quarters of 2023, exports to Mexico climbed 13% from a year ago to 794,354 mt, valued at $1.68 billion. This included excellent growth in pork variety exports, which surged 31% in volume (117,945 mt) and 40% in value ($220.4 million).

Led by robust growth in leading markets Honduras and Guatemala, September pork exports to Central America increased 34% year-over-year in both volume (9,507 mt) and value ($29.6 million). Through September, exports to the region increased 9% to 89,061 mt, while value jumped 15% to $258.8 million. In addition to Honduras and Guatemala, shipments trended higher to El Salvador, Nicaragua and Costa Rica.

Pork exports to the Dominican Republic are on a record pace in 2023, with September shipments increasing 3% from a year ago to 5,785 mt and value up slightly to $17.4 million. Through the first three quarters of the year, exports to the DR climbed 23% in volume (72,518 mt) and 29% in value ($198.7 million). In addition to the DR’s strong demand for muscle cuts, pork variety meat shipments surged 95% to 3,143 mt, valued at $5.9 million (up 148%).

Other January-September results for U.S. pork exports include:

- Demand for U.S. pork has rebounded impressively in Oceania, where exports through September increased 80% from a year ago to 57,615 mt, as U.S. pork continues to retake market share from the European Union. Export value climbed 64% to $202 million. Due to market access restrictions, most U.S. exports to the region are raw material for further processing, but value-added processed products from the U.S. have also gained popularity in both Australia and New Zealand.

- While September exports to the ASEAN region were below last year, shipments through the first three quarters of the year were still 30% above last year at 52,471 mt, with value up 7% to $124.4 million. The Philippines was the top destination (42,357 mt, up 22%), with Malaysia surging into the #2 spot at 3,935 mt – up more than 1,500% from a year ago. Exports also trended higher to Vietnam (3,714 mt, up 43%) and Indonesia (581 mt, up 38%).

- Pork exports to Taiwan continued to trend higher in September, climbing 184% from a year ago to 736 mt. Export value doubled to $2.1 million. Through September, exports climbed nearly 400% to 14,775 mt, with value increasing almost 500% to $47.5 million. U.S. pork recently suffered a setback, however, due to incidents of mislabeling that led to heightened inspections of imported pork. While no food safety issues were involved, the findings generated unwelcome negative publicity for U.S. pork that will likely dampen fourth-quarter demand.

- Pork variety meat exports performed well in September, despite significantly lower shipments to leading destination China. September exports reached 46,044 mt, down only slightly from a year ago, while export value increased 3% to $108.7 million. January-September variety meat exports established a record pace at 438,190 mt, up 15% from a year ago, while export value increased 13% to $1.03 billion. In addition to the above-mentioned growth in Mexico and the DR, exports also trended higher to the ASEAN region, Canada, Chile, Peru, Trinidad and Tobago and Taiwan.

- September pork export value equated to $61.94 per head slaughtered, down 1% from a year ago, while the January-September average was up 5% to $63.16. Export value per head is on a record pace and share of production exported is at the record levels seen in 2020-21. Exports accounted for 28.1% of total September pork production and 24% for muscle cuts only, up from 27.4% and 23.2%, respectively, a year ago. The January-September ratios were 29.4% of total production (up from 27.1%) and 25.2% for muscle cuts (up from 23.5%).

Beef exports struggling in Asia, climbing in Western Hemisphere

U.S. beef exports to Mexico continued to shine in September, climbing 7% from a year ago to 16,435 mt, with value up 17% to $93.9 million. Through the first three quarters of the year, shipments to Mexico increased 15% to 152,943 mt, valued at $867.4 million (up 24%). Mexico is the leading volume destination for U.S. beef variety meat, and these shipments increased at a similar rate, climbing 16% to 79,312 mt, valued at $227.4 million (up 22%).

Strong growth in Guatemala, Costa Rica, El Salvador and Nicaragua pushed September beef exports to Central America 24% above last year at 1,779 mt, while value soared 49% to $13.9 million. For January through September, exports to the region pulled within 1% of last year’s pace in both volume (15,040 mt) and value ($105.4 million), led by growth in Guatemala, Honduras, El Salvador and Nicaragua.

Beef export volume to Canada trended slightly higher in September, up 2% from a year ago to 8,176 mt. But export value increased very impressively, climbing 23% to $79.7 million. January-September exports to Canada increased 1% to 78,951 mt, valued at $663.8 million (up 4%).

Other January-September results for U.S. beef exports include:

- Beef exports to Africa, most of which are variety meat items, have rebounded strongly in 2023. Led by a near-doubling of shipments to South Africa, exports reached 16,978 mt through September, up 56% from a year ago, with value up 25% to $20.5 million. In addition to South Africa, exports trended higher to Cote D’Ivoire, Gabon and Morocco.

- Although beef shipments to the Dominican Republic edged lower in September, exports are still on a record pace in 2023. Through September, exports to the DR increased 4% to 7,286 mt, with value up 10% to $80.6 million.

- Beef exports to South America have generally trended lower in 2023, with only shipments to Peru posting a year-over-year increase. But exports to Colombia showed renewed momentum in September, climbing 80% from a year ago to 1,012 mt. September export value soared 151% to $5.4 million – the highest this year. Beef exports to Peru were lower in September but January-September shipments remained 18% ahead of last year’s pace at 5,842 mt, with value up 6% to $23.7 million.

- September beef exports were lower to the ASEAN region but increased to leading volume market Indonesia. Shipments to Indonesia increased 22% to 1,658 mt, while value edged slightly higher to $7.6 million. Nearly 40% of exports to Indonesia are beef variety meat.

- With the exception of Hong Kong, September beef exports to major Asian markets were lower across the board, falling well below last year’s large totals in South Korea, Japan, China and Taiwan. Korea remains the largest destination for U.S. beef exports, but January-September shipments to Korea were 15% below last year’s record pace at 188,652 mt. Export value for Korea was down 26% to $1.57 billion. Exports to Japan fell 21% to 186,943 mt, with value down 26% to $1.39 billion. Shipments to China followed a similar trend, down 23% in volume (146,327 mt) and 27% in value ($1.23 billion) from the record pace of 2022. Exports to Taiwan, which had regained some momentum in the summer months, also took a step back in September, pushing January-September shipments 7% below last year at 48,081 mt, valued at $484.8 million (down 20%). Australia’s exports have rebounded sharply in 2023, with shipments through October increasing by 24% year-over-year. This growth has mostly been in grass-fed beef, as grain-fed exports were up a more modest 6%. Australia’s exports increased strongly to China, Korea, Taiwan and Indonesia, but continued to decline to Japan.

- Beef export value per head of fed slaughter was strong in September, down just 2% from a year ago to $398.73. The January-September average was $396.03, down 15% from the record pace of 2022. Exports accounted for 13.4% of total September beef production and 11.1% for muscle cuts, down from 14.2% and 12.2%, respectively, a year ago. The January-September ratios were 14.2% of total production (down from 15.4%) and 11.9% for muscle cuts (down from 13.2%).

September lamb exports higher to Caribbean but lower overall

September exports of U.S. lamb totaled 245 mt, down 9% from a year ago, while export value fell 11% to $1.17 million. Exports trended higher to the Caribbean, including increases to Trinidad and Tobago, the Bahamas, the Dominican Republic and the Leeward-Windward Islands, but were lower to Mexico and Canada. For January through September, lamb exports were down 5% to 1,872 mt, valued at $9.5 million (down 10%).

Recent reports from USMEF have included only lamb muscle cut exports because corrections were being made to past years’ variety meat data, making year-over-year comparisons difficult. Corrected data is now available, however, so monthly export reports will now include both lamb muscle cuts and variety meat, unless otherwise indicated.

Complete January-September export results for U.S. pork, beef and lamb are available from USMEF’s statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

- Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

- One metric ton (mt) = 2,204.622 pounds.

- U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place).