Winter holidays are upon us, and consumers across the country are decking out their tables to celebrate. But will high food prices put a damper on all that merriment? In this post, we share results from the Gardner Food and Agricultural Policy Survey to unpack how consumers are keeping costs of their holiday meals down. Additionally, particularly relevant to farmers and ranchers, we also discuss consumers’ protein preferences for Christmas meals and whether inflation is affecting these choices.

The Gardner Food and Agriculture Policy Survey is an online survey conducted quarterly. Each quarter, a new panel of approximately 1,000 participants is recruited to match the US population in terms of gender, age, annual household income, and US census region. Results below are from the seventh wave of the survey, conducted in November 2023.

Results

‘Tis the season for inflation

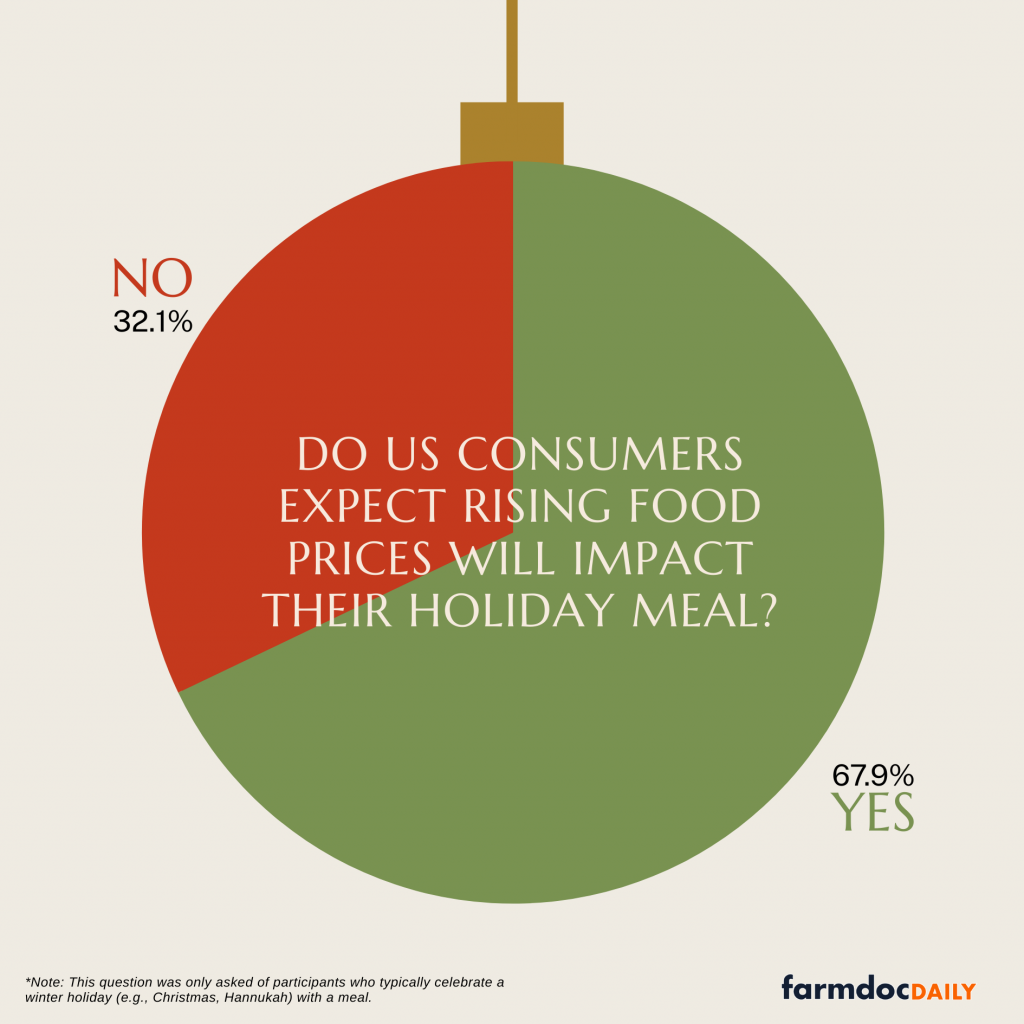

Inflation has been a key topic for much of the last two years. We have explored inflation’s impact previously using results from this survey (e.g., farmdoc daily September 1, 2022, January 19, 2023). The latest update from the US Bureau of Labor Statistics shows that inflation continues to cool. For food prices, the report shows that prices rose 0.2% in the last month and are 2.9% higher now than 12 months ago (BLS, 2023). However, months of sticker shock combined with the increased demands of the holidays, means that not all consumers are feeling so jolly. In this survey, we asked participants who typically celebrate a winter holiday with a meal, whether they expected rising food prices to impact their meal plans. We find that over two-thirds thought their meals would be affected (see Figure 1).

Figure 1. Do US Consumers Expect Rising Food Prices Will Impact Their Holiday Meal?

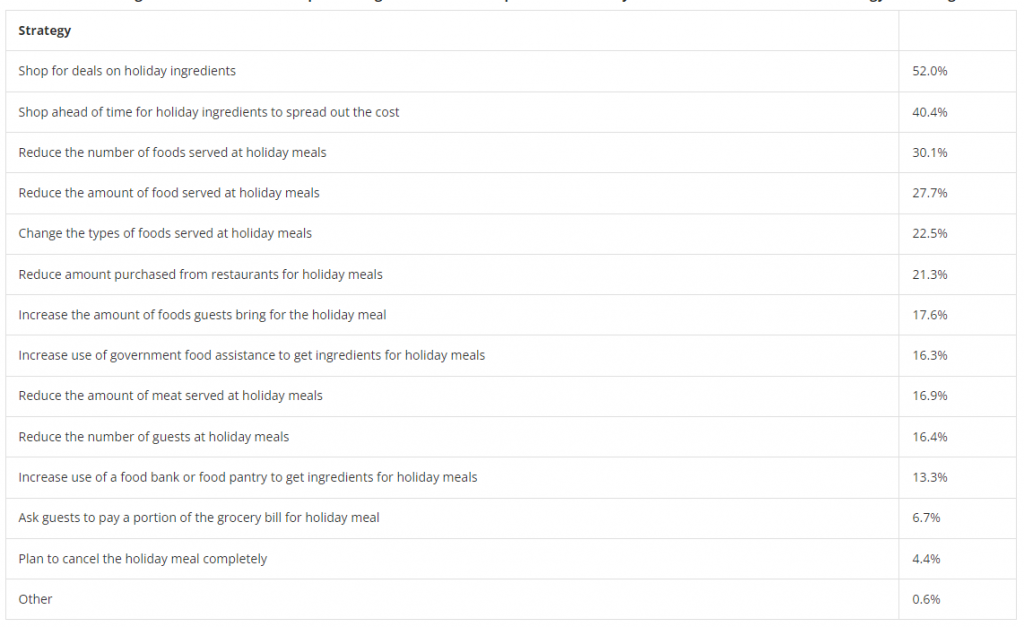

For those who indicated rising food prices would impact their meal, we asked about several potential strategies they might use to manage the cost of the meal. Table 1 shows the proportion of these consumers who plan to use each strategy. Participants could select multiple strategies. The most common strategies were shopping for deals on ingredients (52.0%) and shopping ahead of time to spread out the cost (40.4%). However, reducing the number of foods and amounts of foods were also quite common. In open-responses, consumers also mentioned the potential to cut back on certain food items – most commonly desserts, appetizers, and sides.

Table 1. Percentage of Consumers (Who Expect Rising Food Prices to Impact Their Holiday Meal) That Plan to Use Each Strategy To Manage Costs

Note: This question was only asked of consumers who expected rising food prices to affect their holiday meal (n=675). Consumers could select multiple strategies; thus options will not sum to 100%.

Relevant for many farmers and ranchers, we also asked about reducing the amount of meat. We find that 16.9% of consumers who expect rising food prices to impact their holiday meal planned reduce the amount of meat they serve. In open-ended responses, some consumers mentioned scaling down the size of their proteins. For example, one person said, “Food prices will even have us substituting main course meals with something cheaper. Turkey? Probably will have to get chicken if we cannot find a deal.” Another noted they planned to “buy a smaller turkey and a smaller ham.”

Others, though, indicated that their traditional meal was too important to change. One said they did not plan to change anything except shopping for deals, “Not much at all. These meals are important to my family, and we always follow the same traditions when it comes to purchasing foods for these meals. We will just look for deals.” Another noted, “Spending less on gifts and travel. The family meal is the most important part of the holidays.”

What’s for Christmas Dinner?

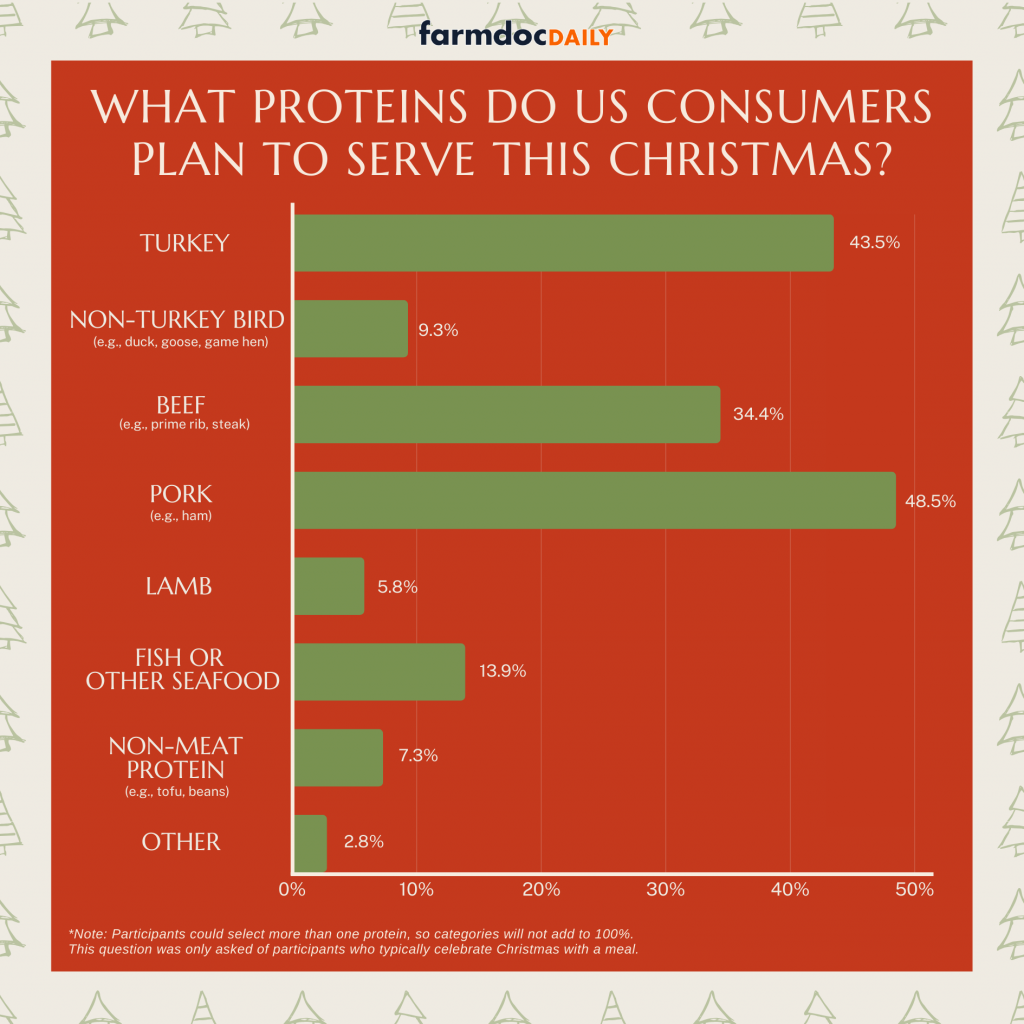

To further understand consumers’ plans for protein this holiday season, we got a bit more specific and explored what those who typically celebrate Christmas with a meal (n=849, 83.0%) planned to serve this year. In Figure 2, we show that pork (e.g., ham) was the most common protein, with nearly half of consumers saying they planned to have it at their Christmas meal. Turkey (43.5%) and beef (34.4%) were also quite popular. Fish and other seafood, non-turkey birds (e.g., duck, goose, game hen), and lamb were all less popular. Only 7.3% of consumers said they planned to serve non-meat protein (e.g., tofu, beans) this Christmas. Importantly, only 4.4% said they planned to skip a protein altogether.

Figure 2. What Proteins Do US Consumers Plan to Serve This Christmas?

As we saw in Table 1, reducing the amount of meat or changing up the types of foods served is one way consumers are managing food costs this holiday season. In Table 2, we show Christmas protein choices across consumers who expect rising prices to impact their holiday meal and those who do not. Generally, we find that these consumers tend to have quite similar plans. In both groups, pork was most popular, followed by turkey and beef. However, turkey, non-turkey birds, lamb, and non-meat proteins were preferred at higher rates by those who expected inflation to impact their meal.

Table 2. Consumers Expected Protein for Christmas Meal across Inflation Experiences

Note: This question was only asked of consumers who typically celebrate Christmas with a meal (n=849, 83.0%). Of these, 574 said they expected inflation to impact their winter holiday meal and 275 said they did not. Consumers could select multiple proteins; thus options will not sum to 100%.

Conclusions

Using results from the Gardner Food and Agricultural Survey, we find that over two-thirds of consumers expect rising food prices to impact their holiday meal plans. However, our results show that most plan to adjust with savvy shopping habits (e.g., looking for deals, shopping early to spread out costs). Some also plan to scale down their meals or cut back on certain items (e.g., reduce the number of dishes).

Especially relevant for farmers and ranchers this season, we also explore consumers’ preferences for protein and whether they are making changes in response to inflation. First, we show that some consumers are indeed reducing the amount of meat as a way to keep their costs lower, although it was not the most popular cost management strategy. Second, we looked more specifically at consumer’s plans for Christmas proteins. Here, we find that although many of the top choices – ham, turkey, beef – are popular across inflation concerns, consumers who expected rising food prices to impact their holiday meal were more likely to choose birds, lamb, and non-meat proteins as their main dish.

While inflation and high food prices may again be adding fog to the holidays for many American families, the importance of the meal remains undiminished, and many seek out ways to adjust or adapt.

References

Coppess, J., M. Kalaitzandonakes and B. Ellison. “Gardner Food and Agricultural Policy Survey: 2nd Quarter, Views on Inflation.” farmdoc daily (12):133, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 1, 2022.

Kalaitzandonakes, M., B. Ellison and J. Coppess. “How Us Consumers Say They’re Coping With Rising Food Prices: Results From the Gardner Food and Agricultural Policy Survey.” farmdoc daily (13):10, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 19, 2023.