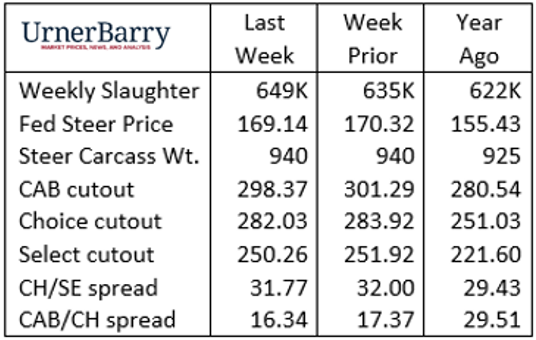

| Live Cattle futures began a recovery from their oversold position beginning Friday, December 8. The uptrend has added $6.20/cwt. to the current December contract and $5.73/cwt. to the February 2024 contract, which has settled slighly lower the past three days. Despite confirmation that futures had finally found a bottom, cash fed cattle prices continued to slip last week with a negotiated steer average of $169.14/cwt. The negotiated trade volume wasnotably the smallest so far this year. Wholesale cutout values drifted slightly lower last week as well with a net 4% price decline since the first of November. In the same timeline cash cattle prices are down roughly 8%. Packer spot market margins have consequently made an important move into the black. One analyst’s estimates suggest those margins range from $20/cwt. to $60/cwt. in the last five days. |

|

| Supply and demand fundamentals cannot be singularly credited for the recent cash fed cattle price degradation. However, fundamentals do come sharply into focus now that packers are profitable, at least on a cash basis. Incentive for increased weekly slaughter throughput is now back on the table which has improved supply chain currentness implications. Last week’s fed cattle slaughter was estimated at 508,000 head, a big leap forward from the 490,000 head average in the six previous weeks excluding the week of Thanksgiving. This week’s head count total will be measured with the understanding that two holiday-shortened production weeks will follow. Cutout price weakness was not severe last week but reflected adequate supplies and softer demand for some chuck items and especially round items, such as peeled knuckles and outside rounds. Boneless CAB ribeye prices pulled slightly lower to $13.90/lb. wholesale, capping a convincing holiday run-up. Tenderloins stubbornly maintain their $18.73/lb. wholesale price, just three cents back from their recent all-time high for the period. Strip loins have traded sideways for four weeks averaging $8.38/lb. Retailers have actively substitued the lower priced premium roast alternative to it’s pricier middle meat cohorts. |

| Carcass Premium Spreads Continue Strength |

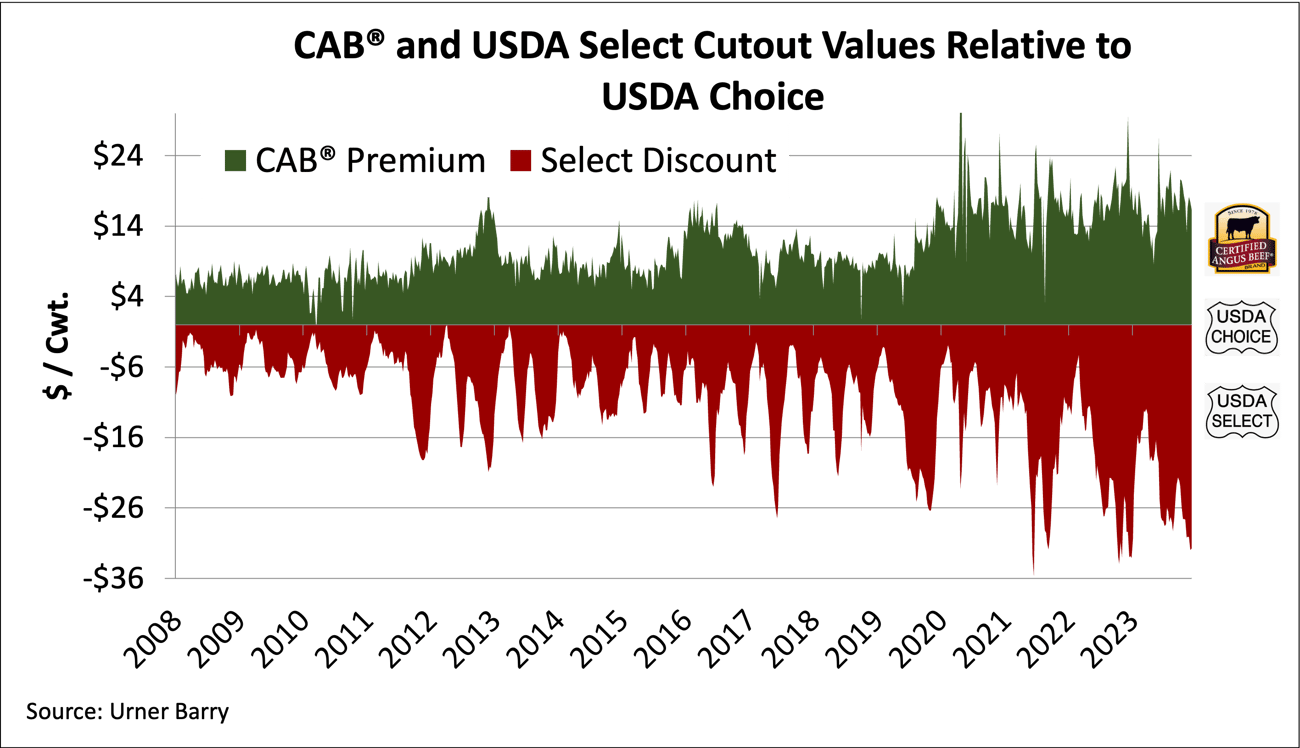

| As the calendar quickly marches toward the new year, it’s an opportunity to briefly review 2023 cutout value spreads. The shift to tighter fed cattle supplies and smaller slaughter head counts pushed year to date (YTD) fed cattle prices up 22% on average for the year. Resulting smaller boxed beef volume and narrowing packer margins followed the trend to push the comprehensive cutout value up just half of the change seen in cattle prices to average 12% higher through mid-December. A more detailed look across quality grades and CAB trends reveals a mix of predictable and unexpected price trend outcomes. First, the total USDA Choice carcass share fell a mere 0.7 percentage points below 2022 for the second half of the year. Although the decline was marginally smaller, the combined effect of that decline and a smaller year-over-year slaughter drove the Choice/Select price spread up 19% in 2023. The spread averaged $23.07/cwt. for the year. The YTD average Choice premium created a $201/head value differential above Select carcasses, up $32.60/head over the prior year without consideration to carcass weight changes. The CAB/Choice cutout spread behaved within expectation in 2023, charting a narrower range than the prior year. Through the current week the 2023 CAB cutout premium has averaged $16.74/cwt., down 1% on the year. The widest spread of $25.45/cwt. came in early June, coinciding with active grilling season demand following the Memorial Day week that curtailed boxed beef production. |

|

| Premium Choice branded carcasses (traditional CAB, for example) have charted a 1.6 percentage point increase through early December 2023 to average 32.2% of all Choice carcasses. This improvement is a noted departure from the weaker total Choice trend noted above. This has assisted in CAB carcass supplies for the brand’s traditional Premium Choice product line. Smaller fed cattle slaughter has challenged CAB carcass supply at times in 2023. But the upward trend in Modest and higher marbling scores assisted by record-large proportions of Angus-type cattle in the mix kept product availability much healthier for Premium Choice CAB product compared to the total USDA Choice grade. Since 2020, the CAB cutout has found an annual average premium ranging between $16.37/cwt. and $17.37/cwt., a major shift from the $9 to $10/cwt. premium over Choice captured in 2018-2019. USDA Prime and CAB Prime cutout values found exceptional premium levels above Choice carcasses in 2019, 2021 and 2022, with the pandemic narrowing that opportunity in 2020. This was largely driven on new demand and utilization in the grocery sector unlocked through broader Prime product availability. However, the 2023 Prime premium has drawn down 37% compared to 2022, averaging $35.52/cwt. with two weeks left to chart this year. Through early May, Prime carcass tonnage was 8% lower than 2022, but strong shift in the Prime grading percentage put production in line and slightly higher than 2022 for the remainder of the year. Healthy Prime product supplies for nearly 70% of the year, coupled with record-high total retail beef prices are likely drivers moving the Prime cutout premium much lower in 2023 compared to the record-wide Prime/Choice premium level marked the year before. |

Dec 20