PORTFOLIO PERFORMANCE, DIVERSIFICATION, AND STRATEGY

January portfolio yielded 3.12% with a weighted average maturity of 1,002 days.

Total portfolio market value of $16.2 billion, up $1.7 billion in comparison to January 2023.

Total portfolio contained 68% in U.S. Treasurys, 7% in U.S. government agencies,

16% in mortgage-backed securities, 8% money market mutual funds, 0.3% in certificates of deposit,and 0.6% in state bond issues and foreign bonds, comprising the balance of funds invested.

TOTAL FUNDS INVESTED Funds available for investment at market value include the State Treasurer’s investments at $12,587,938,228 and State Agency balances in OK Invest at $3,654,967,354 for a total of $16,242,905,582.

MARKET CONDITIONS

The 10-year treasury closed the month of January up 3.3 basis points to 3.91%. January saw the 10-year rate break the key 4% figure prior to the Federal Reserve’s January 31 meeting. The 2-year rate ended the month down 4.2 basis points to 4.21%, whereas the 30-year jumped 13.9 basis points to 4.17%.

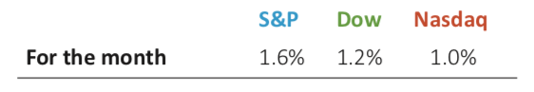

The three major indexes began the year in the green, but only with modest gains. The S&P 500, Nasdaq, and Dow closed with earnings of 1.6%, 1.0%, and 1.2%, respectively. January was off to a much more optimistic start prior to the Federal Reserve’s meeting. Despite recent woes, the US economy is still following a theme of resilience, with the S&P once again reaching record highs.

The Federal Reserve left interest rates unchanged while the federal funds rate sits at a 22-year high of 5.25%- 5.5%. Federal Reserve Chair Jerome Powell noted that it is not appropriate to reduce the target range until more data confirms a downward trend in the rate of inflation towards the target of 2%. Powell acknowledged positive inflation progress but warned that cutting rates too soon could be highly consequential.

ECONOMIC DEVELOPMENTS

The unemployment rate for December held at 3.7% in contrast to market forecasts of 3.8%. The nonfarm payroll increased by 216,000, which compares to a downwardly revised 173,000 for November. Nonfarm payroll also exceeded forecasts, which estimated an increase of 170,000.

The consumer price index (CPI) increased 0.3% in December and 3.4% over the last 12 months. Core CPI (all items less energy and food) increased 0.3% and 3.9% annualized. Most of the increase can be attributed to shelter costs, which rose 6.2% on an annual basis.

According to CNBC, “Fed officials largely expect shelter costs to decline through the year as renewed leases reflect lower rents.” Food was up 0.2%, the same as the prior month. Energy rose 0.4% compared to a 2.3% decrease in November. The producer price index (PPI) unexpectedly fell 0.1% for December and ended the year up 1%. Core PPI increased by 0.2%, level with November’s rise.

Retail sales continued to show strength climbing 0.6% in December, which was the largest increase in 3 months. Core retail sales, which exclude autos, gas, building materials and food services, gained 0.8% being the most since July.

Existing-home sales, which are comprised of completed transactions that include single-family homes, townhomes, condominiums, and co-ops, fell 1% to a seasonally adjusted annual rate of 3.78 million in December. In comparison to December 2022 sales declined 6.2%.

In 2023 existing-home sales were at 4.09 million, reflecting a 30-year low. On the flip side, the median price reached a record high of $389,800.

The fourth quarter real gross domestic product (GDP) increased at an annual rate of 3.3%. This reflected a decrease from the previous quarter which gained 4.9%. On an annualized basis, GDP grew at 3.1%. The fourth quarter gains were attributed to household and government spending.

COLLATERALIZATION

All funds under the control of this office requiring collateralization were secured at rates ranging from 100% to 110%, depending on the type of investment.

PAYMENTS, FEES AND COMMISSIONS

Securities were purchased or sold utilizing competitive bidding. Bank fees and money market mutual fund operating expenses are detailed in the attached pages, as is the earnings split between the State Treasurer and the master custodian bank on securities lending income.

Best regards,

View the full report below: