In this week’s Cow Calf Corner, , Kellie Curry Raper, Oklahoma State University Extension Livestock Marketing Specialist, talks about data collection on OQBN and non-OQBN cattle as it relates to the market.

An important aspect of the Oklahoma Quality Beef Network is detailed data collection on OQBN sale dates for both OQBN and non-OQBN cattle. And one thing that data is telling us is that more lots of uncastrated males have come through the sale ring as of late. The charts below illustrate data from the 2019-2023 fall sale seasons and indicates a sharp increase in the number of bulls marketed as feeder calves beginning in 2021. Note that OQBN certified cattle are required to be castrated and healed prior to marketing, so this increase in bulls is coming from non-program cattle.

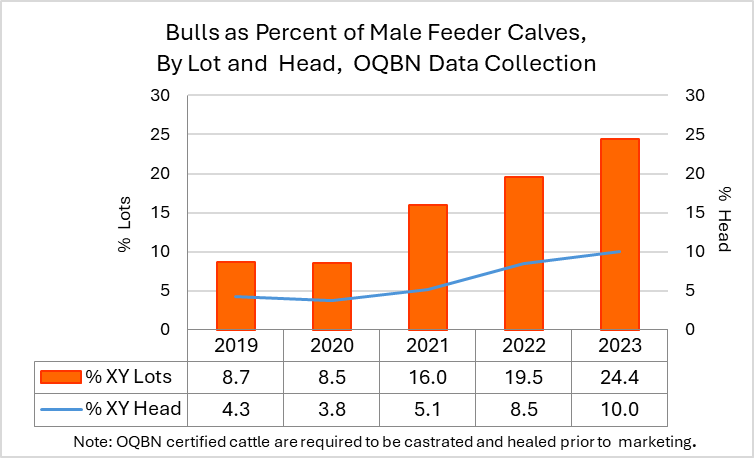

The numbers in Figure 1 indicate that the share of bulls as a percent of male feeder calves increased – both in terms of number of lots and as measured by head count.

Figure 1. Bulls as Percent of Male Feeder Calves, 2019-2023

In fact, the proportion of bull lots nearly tripled from 8.7% in 2019 to 24.4% in 2023, while the proportion of bulls as measured by head more than doubled from 4.3% to 10% over the same time period. These numbers reflect an overall increase in the proportion of bulls coming through feeder calf sales.

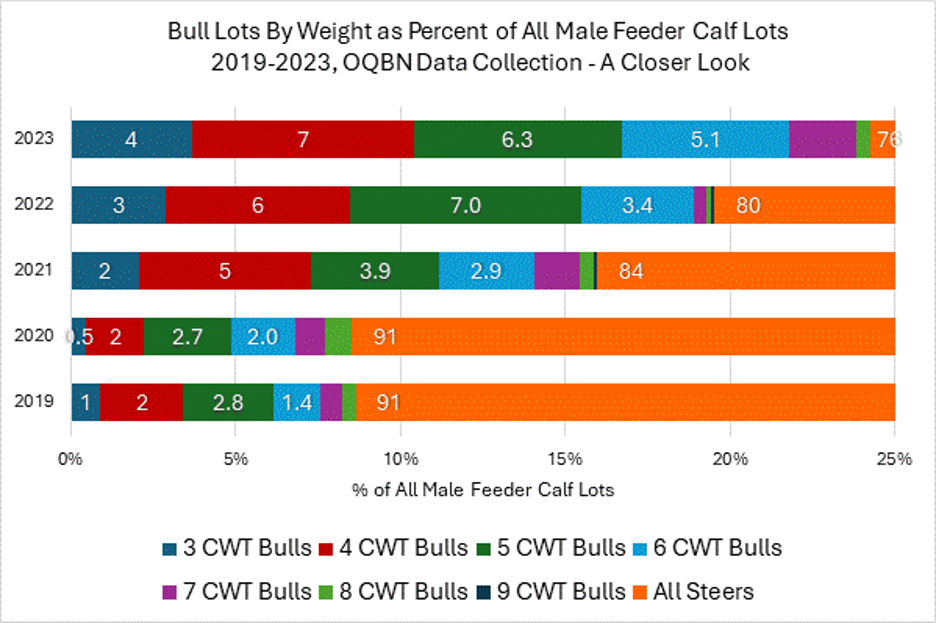

Research indicates multiple animal performance benefits linked to earlier castration (birth to 3 months), including shorter initial weight loss periods, lower disease susceptibility, and higher post-weaning ADGs. Additionally, the process is less stressful for calves at younger ages when the calves are lighter, posing less risk of harm to both the calf and the producer. Figure 2 takes a closer look at how the increase in bull lots is distributed across weight classes.

The far right segment of each bar represents steers as a proportion of all male feeder calf lots in that year, falling from 91% in 2019 to only 76% in 2023. Note that the bar truncates at 25% to provide a closer look at how the proportion of bulls has changed across weight classes. In 2019, the highest proportion of bull lots in the OQBN data were 4- and 5-weight lots. This holds true as the proportion of bull lots in all weight categories increased in general by 2023. However, the accompanying increase in the other weight classes, including 6- and 7-weights, is substantial.

Perhaps some of the increase in the number of bull feeder calf lots can be explained by weather events. Management protocols may get delayed or discarded because of extended periods of extreme cold stress during calving season, such as in 2021. Drought-induced marketing decisions may prioritize the urgent need to move cattle over implementation of typical management practices. Beyond weather, the enticement of higher feeder calf prices may also play a role in that producers are satisfied with earning revenue substantial enough to be willing to ‘take the money and run’ rather than taking time to castrate those bull calves. Even so, calves coming to the sale ring as bulls are discounted by buyers. An analysis of recent OQBN data puts that value at $11.25/cwt. That’s over $56/head for a 500 pound animal. Whatever the reason, if you are marketing uncastrated bulls as feeder calves, the market will charge you for it.