| Last week’s 603,000 head federally inspected harvest total marked the second consecutive week larger than 600,000 head. These head counts align with the volume harvested in the same two weeks last year, but the 2022 slaughter volume averaged 650,000 head for the period. Focusing only on fed cattle shows a two-week average of 484,500 head harvested. This is a rare occurrence in 2024 with a 2.5% increase over fed cattle totals a year ago. April 2023 fed cattle processing was notably smaller than the two years prior. |

|

| The second half of April is typified by smaller slaughter head counts and market conditions suggest no increase this week as wholesale cutout prices struggle. Last confirmed average fed cattle carcass weights (steers and heifers) were 891 lb. each, that’s 21 lb. heavier than a year ago and two lb. lighter than the week prior. Perhaps this signals a potential top in the multi-week trend which has culminated in an unseasonal 15 lb. increase from the low in late January. The current carcass weight excess per head over a year ago continues to generate the equivalent of roughly 11,500 head of added pounds to the fed cattle processed supply. Cash fed cattle values have struggled to find a bottom since the fallout from the Highly Pathogenic Avian Influenza (HPAI) news, now dubbed Bovine Influenza A Virus (BIAV). Since that first announcement, the April Live Cattle contract charted a $15/cwt. decline into what most observers agree is substantially oversold territory. Weekly cash fed cattle prices have retracted only $7/cwt. for the period yet the dismal futures are leading market sentiment lower. Wholesale cutout values also continued to trade in an unevenly lower direction with Choice and Select both lower while the CAB cutout was quoted higher by Urner Barry. The spreads between these cutouts have also been dynamic and seasonally narrow at various points in the past few weeks. To recap, Choice carcass supplies seem to be adequate as total USDA Choice carcasses are tenths of a point from the record for the latest week at 74% of the total graded. The CAB spread widening as it did last week indicates healthy demand and a return to the expected range of $15 to $17/cwt. premium for CAB over USDA Choice. |

| Prime Pops for Annual Quality Peak |

| March is the month that the industry’s fed steer and heifer quality grades tend to top out with the largest share of Prime, Certified Angus Beef ® brand and Choice carcasses. Reviewing the last five weeks of data shows an average of 84.7% combined for Prime and Choice carcasses. This is a six percentage point (ppt.) difference from the early September 2023 annual low of 78.7%. Breaking out the grades individually shows the total USDA Choice category underperforming prior year trends beginning last June. In the second half of the year % Choice trailed the prior year by half of a percentage point. In the first quarter of 2024, the year-over-year gap widened to 1.5 ppt. deficit. However, the dramatic recovery in carcass weights since January has driven a recovery in the Choice category to nearly equal the record highs charted in March 2023. The USDA Prime grade category captured the production share given up by Choice in the second half of 2023. The average annual increase of 0.78 ppt. in the Prime grade for that period over 2022 allowed Prime to average 9% of fed cattle carcasses. The fed cattle backlog in 2020 generated the record Prime rate of 10.19% for the year, followed closely with a 10.07% rate in the 2021 market year featuring similarly backed up supplies. |

|

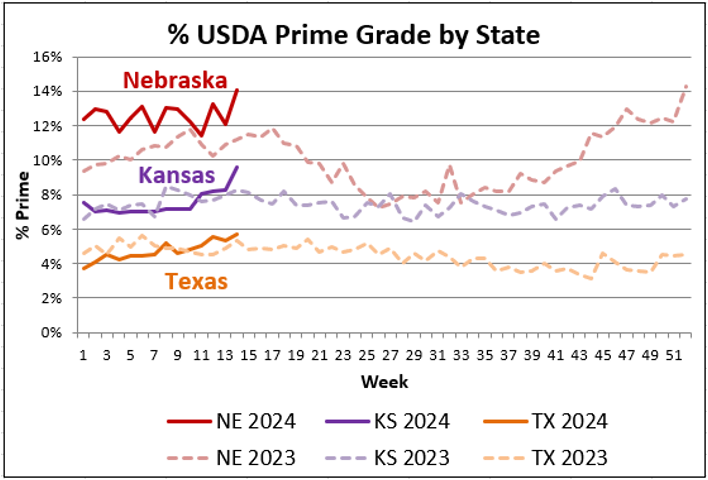

| Jumping back into 2024, the latest Prime grade trend shows a recent spike in all three major packing states. Nebraska packers enjoyed an average 12.5% Prime grade rate through March, two points higher than a year before. This impressive trend was recently topped with the first week in April data featuring an additional two-point jump to 14% Prime in Nebraska. The multi-state regions in the eastern U.S. posted an amazing 18.6% Prime grade for the same week. Back to the largest packing base, Kansas gained 1.3 ppt. in the Prime grade last week to average 9.6% Prime overall. This is the culmination of a longer trend in Kansas where Prime carcasses are up 2.7 points from their late January low. Texas packers had a rough start to the year with a 3.2 ppt. deficit on the prior year creating an average of just 69.9% Choice and Prime carcasses combined. Since mid-March, however, the tide has changed to pull the Texas Choice grade to 67% of fed cattle carcasses and the Prime percentage up to 5.7%. This Prime number is the top end of the historical range for Texas packers outside of a few weeks in during the 2020 backlog. It’s likely that the Texas quality grade trend has been impacted by an increase in Mexican feeder cattle imports with less genetic propensity to achieve higher marbling scores. |

Apr 17