With recent breaks in U.S. and global wheat futures and lower freight rates, the wheat market seems to have turned a corner to favor buyers after two years of volatility and risk.

Despite the improved general outlook, inflationary pressures persist, influencing macroeconomic conditions both in the U.S. and for our customers overseas. For example, major runups in the U.S. dollar in the second and third quarter of 2022 impeded wheat trade. Yet even with recent strengthening, the U.S. dollar index has decreased 7% from the highs hit in September 2022, providing some relief for wheat importers.

As world wheat importers are keenly aware, a strong dollar erodes the purchasing power of foreign currencies, making U.S. commodities more expensive to customers.

While the U.S. dollar index has decreased 7% from the highs hit in September 2022, though it remains elevated from pre-war levels, continued strength and fluctuations remain a concern for wheat importers. The U.S. dollar index measures the dollar’s strength against a basket of six major currencies, including the Euro, Pound, Yen, Canadian Dollar, Swedish Kroner, and Swiss Franc. Source: DTN ProphetX

The factors driving currency markets are often complex, but the recent dollar strength can be primarily attributed to the U.S. Federal Reserve’s reaction to the rising inflation triggered by Russia’s unprovoked invasion of Ukraine and the lingering impacts of the COVID-19 pandemic.

Federal Reserve Policy

The U.S. has faced inflation not seen since the 1980s, at an annualized inflation rate of 8.0% for 2022. To combat the inflationary pressures, the U.S. Federal Reserve (Fed) began an aggressive series of interest rate increases, bringing Federal Fund Rates from 0.2% per year in March 2022 to 4.57% annually by February 2023. The hawkish policy added strength to the dollar as investors earned higher returns, making the currency more attractive.

As interest rates have risen, U.S. inflation has since slipped to 6.0%, signaling that inflation may be easing. Current market sentiment and comments from Federal Reserve leadership indicate that though interest rates may still increase, a slower pace could also ease the strength of the U.S. dollar.

Global Reaction

In uncertain times, global investors often turn to the U.S. dollar as a haven currency, generating greater demand for a currency already supported by the Federal Reserve’s hawkish policy. As fears regarding a global recession began to mount following the onset of Putin’s war, many major central banks had to weigh their economic outlook against inflation risk, generally maintaining a looser monetary policy than their U.S. counterpart. These policy decisions allowed the dollar to strengthen more quickly than other world currencies.

As recession fears have slowed and the global economy has normalized, central banks have become increasingly hawkish, moving their monetary policy in line with Federal Reserve. As interest rates rise around the world, future gains in the dollar will be curbed.

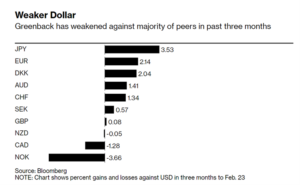

The dollar has weakened against many other currencies in the last few months, potentially signaling a more hawkish stance in other major central banks. Source: Bloomberg

Bears or Bulls, What’s Next for the Dollar?

As the global economy stabilizes, many investors are increasingly bearish for the dollar, though the path will be far from straightforward. Analysts believe the recent dollar strength is temporary, and the currency could weaken if the Federal Reserve tapers its interest rate increases. Nevertheless, the underlying geopolitical risk of Putin’s war will continue to prop up the dollar as it remains the haven currency in times of volatility. Likewise, the resilience of the U.S. economy will continue to drive dollar strength as robust jobs data, and stubborn increases in consumer and producer prices, underpin the need for hawkish policy and elevated interest rates.

By USW Market Analyst Tyllor Ledford