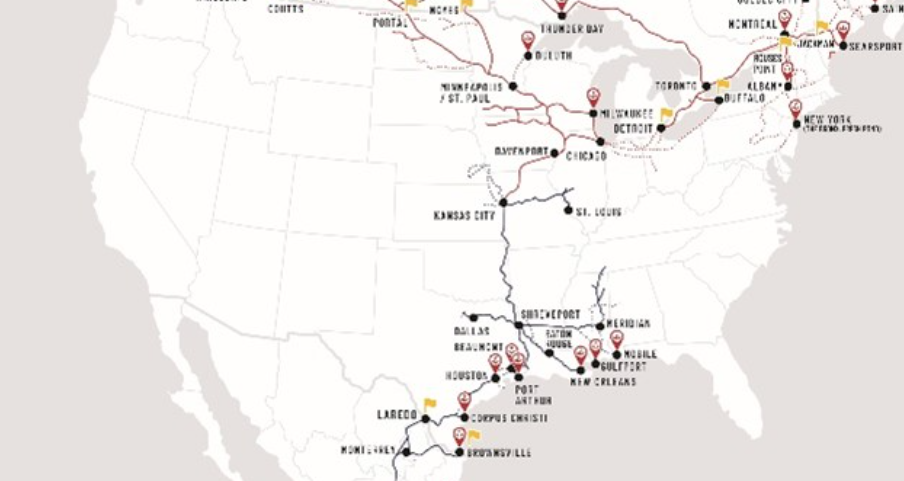

On April 18, 2023, Kansas City Southern Railway Company (KCS) and Canadian Pacific Railway Limited (CP) officially merged to create a new Class 1 railroad CPKS, the first single-line service across Canada, the U.S., and Mexico (map above from Trains.com).

Rail logistics comprise a sizeable portion of U.S. wheat export basis, encompassing the costs of transporting wheat from the vast growing region in the central U.S. to export hubs in the Great Lakes, Gulf of Mexico, and the Pacific Northwest. The acquisition brings the total number of Class 1 railroads in North America from seven to six and may potentially impact wheat exports as the industry restructures in response to the merger.

In this article, we will summarize the importance of domestic rail for U.S. wheat buyers and look at the current trends in bulk rail as we look ahead to the merger’s implications.

Historical Perspective

Since the 1980s, the railroad industry has seen significant consolidation, going from 33 North American Class 1 railroads in 1980 to six in 2023.

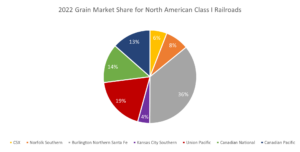

In 2022 the four largest rail companies, Burlington Northern Santa Fe (BNSF), Union Pacific (UP), Canadian Pacific (CP), and Canadian National (CN), held 82% of the market share for grain origination in North America, creating an oligopoly in the U.S. rail transportation sector. The increased consolidation decreased the number of firms in the market competing for business, shifting the market power to favor rail service providers.

The top four Class 1 railroads in North America control 82% of the grain market share. The merger of CP and Kansas City Southern brings the total number of Class I railroads from seven to six. Source: U.S. Department of Agriculture, Agricultural Marketing Service. Grain Transportation Report. April 20, 2023. Web: http://dx.doi.org/10.9752/TS056.04-20-2023

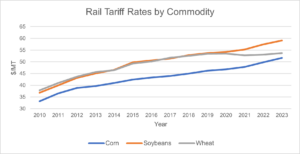

A potential consequence of increased concentration in the industry, tariff rates for all grains have steadily increased over the last 20 years; thus, making transportation costs greater for exporters who, in turn, increase basis for customers. A 2020 study by USDA found that from 2000 to 2014, rail rates increased by 30% for wheat, 31% for corn, and 30% for soybeans. Since 2014 wheat rail tariff rates have increased by an additional 18%. As rates rise, it erodes the competitiveness of U.S. wheat classes in the export market and makes U.S.-origin wheat more expensive for importers.

Rail tariff rates have been on the rise for all bulk grains since 2010. Rates continued to increase even as shippers experience what they considered poor performance through most of 2022. Source: USDA AMS Rail Dashboard

Ongoing Issues

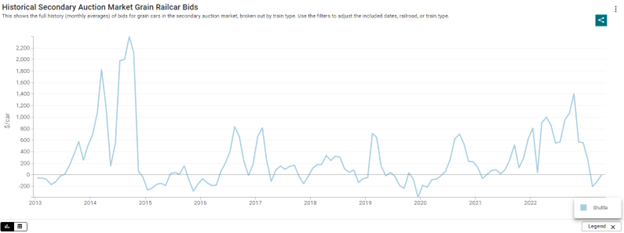

Throughout 2022 rail logistics faced considerable challenges that impacted the quality of performance throughout the bulk rail sector, including service interruptions and crew shortages. In October 2022, Secondary Railcar Auction Market Bids hit their highest level since 2014, reflecting massive demand for rail freight and an insufficient supply to meet the demand.

Secondary auction market rates move more quickly than tariff rates and better reflect current supply and demand shifts as shippers buy and sell claims for guaranteed service. If demand is high during a particular period, bids increase, meanwhile when supplies are adequate secondary rates will hover near zero or negative if demand hits a low threshold. In the fall of 2022, Secondary Railcar Auction Market Bids hit their highest level since 2014. Source: USDA AMS Rail Dashboard

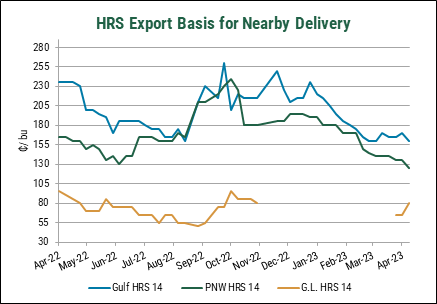

Performance issues and subsequent demand for rail cars contributed to elevated export basis throughout the fall of 2022. Strong basis levels and elevated wheat futures, a response to the geopolitical tensions brought on by the Russian invasion, created enormous price risk for U.S. wheat importers and further diminished U.S. wheat’s competitiveness in the world market.

Though wheat basis levels often increase during the fourth quarter of the calendar year as exporters focus on corn and soybean export programs, in the fall of 2022 basis levels skyrocketed. Basis levels jumped to $0.50/bu ($18.40/MT) over the previous five-year average, combined with historically high futures prices. Source: U.S. Wheat Associates Price Report

A Look Ahead

The Surface Transportation Board approved the merger on the grounds of efficiency, positive environmental impacts, improved rail performance, and increased employment; still, the STB necessitated additional oversight to ensure the preservation of competition. Despite the approval, the U.S. wheat industry remains skeptical of the merger’s effects on wheat export competitiveness, taking into account performance issues from major railroads, basis and logistics costs, and the oligopoly of the U.S. railroads.

On the other hand, CPKCS could help increase competition in some regions, due to increased access routes previously unserved by individual companies. Nevertheless, U.S. Wheat Associates will continue to support oversight from the STB and policies such as reciprocal switching that help preserve competition and contribute to our dependable, reliable supply chain.