Farm Director, KC Sheperd, caught up with Allendale’s Rich Nelson and talked about the numbers in the latest WASDE report.

“Biggest issue we were kind of watching for today was on the wheat side,” Nelson said. “I think the trade was a bit relieved to see that USDA did not hit the export sale numbers for old crop like they could have and left those unchanged.”

USDA is implying some tightness in wheat supply for the U.S. balance sheet, Nelson said, and he expects those to stay tight.

“The Hard Red Crop- 514 million bushels- the trade expected 591, so in this case, a good 70 million bushel plus change,” Nelson said.

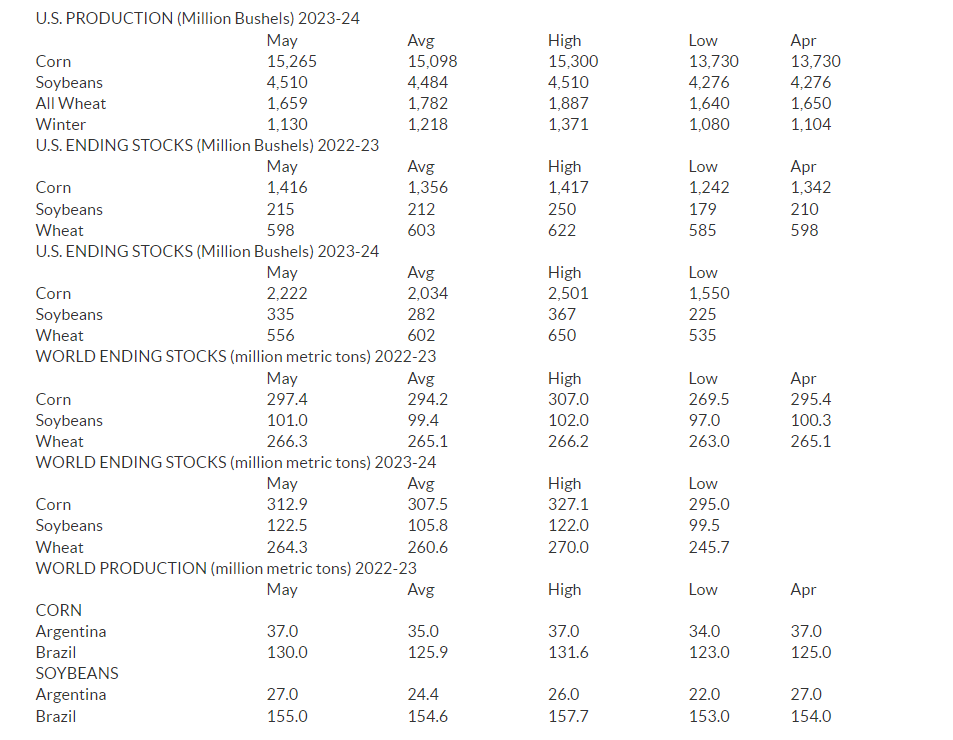

USDA projects farmers are in the midst of planting the country’s largest corn crop on record at 15.265 billion bushels (bb) and a record soybean crop at 4.51 bb with 2023-24 “new-crop” ending stocks for corn projected at 2.22 bb and soybeans pegged at 335 million bushels (mb).

Friday’s U.S. ending new-crop stocks estimates were bearish for corn and soybeans, but bullish for wheat. Hultman sees the world ending stocks estimates from USDA as slightly bearish for corn, soybeans and wheat.

Farm Director KC Sheperd caught up with Allendale’s Rich Nelson after the report and he said we did see some bearish numbers for Corn, “USDA did cut export sales and the old crop side by 75 million bushels, and therefore we now have old crop stocks up to 1.417. So certainly a bit higher than the average trade estimate here. New crop stocks, of course with trend yield and with those March planting numbers 2.222 billion bushels. So this is the largest in seven years for stocks to use in five years. So right now, a little negative discussion on the corn side .”

When talking about the Wheat Numbers Nelson said it seems the trade was a bit relieved that USDA didn’t hit the export sales numbers for old crop numbers like they could have “They could have left those unchanged. But the new crop numbers certainly with the small unexpected production which was posted 1.659, This was quite a bit lower than the trade estimate here and certainly with a smaller stock number 556, they are right now implying some some tightness of supply for the US balance sheet at least.”

Nelson belives wheat stocks will stay tight for awhile, “The hard red crop 514 million bushels, the trade expected 591. So in this case, a good 70 million bushel+ change and certainly giving a lot discussion as we go into summer here.”

You can also access the full reports here:

— Crop Production: https://www.nass.usda.gov/…

— World Agricultural Supply and Demand Estimates (WASDE): http://www.usda.gov/…

WHEAT

USDA projects domestic 2023-2024, or new-crop, wheat production at 1.659 bb with an average yield set at 44.7 bushels per acre.

New-crop ending stocks are expected to land at 556 mb. Food, seed and residual use for new crop are pegged at 1.112 bb, with exports at 725 mb. U.S. farm gate prices were pegged at $8.00.

USDA estimates U.S. wheat for 2022-2023, or old crop, ending stocks at 598 mb. Old-crop wheat production is estimated at 1.650 bb. U.S. farm gate old-crop prices were pegged at $8.85.

Winter wheat production in the new crop is forecast at 1.13 bb, up 2% from 2022.

As of May 1, the United States yield is forecast at 44.7 bushels per acre, down 2.3 bushels from last year’s average yield of 47.0 bushels per acre. Area expected to be harvested for grain or seed is forecast at 25.3 million acres, up 8% from last year.

Of those acres, hard red winter production is projected at 514 mb down 3% from a year ago. Soft red winter at 406 mb, is up 21% from 2022. White winter at 210 mb, is down 11% from last year. Of the white winter production, 10.2 mb are hard white and 200 mb are soft white.

Globally, USDA pegged new-crop wheat production at 789.76 mmt, with new-crop ending stocks at 264.34 mmt.

USDA estimates the old-crop ending stocks at 266.28 mmt. On old-crop world ending wheat stocks excluding China, USDA estimates 127.20 mmt.

New world wheat crop production in 2023-2024 is estimated at 139.00 mmt in the European Union; 81.5 mmt in Russia; 16.5 mmt in Ukraine; 37.00 mmt in Canada; 29.00 mmt in Australia; and 19.5 mmt in Argentina.

CORN

For the 2023-24 new crop corn, USDA came in with its initial production forecast at a record 15.265 bb – if realized that would top 2016’s record production. USDA projects farmers will plant 92 million acres with a record yield of 181.5 bushels per acre.

USDA also pegged 2023-24 ending stocks at 2.222 bb, which would come in as the largest ending stocks in the last five years.

On the demand side, USDA projects the 2023-24 Food, Seed and Industrial use at 6.735 bb. Ethanol use is forecast at 5.3 bb. Total domestic use is forecast at 12.385 bb. Exports for the new crop are pegged at 2.1 bb.

The farmgate price for the 2023-24 crop is projected at $4.80 a bushel.

Globally, beginning stocks for the 2023-24 new crop start at 297.41 million metric tons (mmt). Production globally was pegged at 1,219.63 mmt. Global exports were forecast at 195.26 mmt. Global ending stocks for the new crop are forecast at 312.9 mmt.

Ukraine’s production for the new crop was pegged at 22 mmt, down an estimated 5 mmt from the old crop year. Keep in mind estimates for 2023-24 South American production are nearly a year away. Brazil’s new crop production was pegged at 129 mmt. Argentina was forecast at 54 mmt.

In the 2022-23 “old crop” corn, USDA raised ending stocks 75 mb to 1.417 bb.

The cut in demand came from exports, which were lowered 75 mb to 1.775 bb.

Food, Seed and Industrial use held pat at 6.68 bb. Ethanol use also held pat at 5.25 bb. Total use came in at 13.73 bb.

The farmgate price for the old crop was pegged at $6.60 a bushel, the same as April.

Globally, beginning stocks for 2022-23 corn were increased 1.24 mmt to 308.15 mmt Total production was raised 5.7 mmt estimated at 1,150.2 mmt. Global ending stocks for 2022-23 were raised 2.06 mmt to 297.41 mmt.

Eyes remain on South America’s current crop. Brazil’s production was raised 5 mmt to 130 mmt and exports were increased 3 mmt to 53 mmt. Argentina production was held pat at 37 mmt, despite drought concerns, and Argentina’s exports held at 25 mmt as well. Ukraine’s production held firm at 27 mmt and Ukraine’s exports held pat at 25.50 mmt.

SOYBEANS

USDA said farmers will produce 4.51 bb of soybeans in the new-crop marketing year, based on an acreage estimate of 87.5 million and yield estimate of 52 bushels per acre.

For the 2023-24 marketing year, USDA sees ending stocks growing to 335 mb. The first forecast for new-crop crush demand is 2.31 bb; exports, 1.975 bb; seed, 101 mb, and residual, 25 mb. The result is total usage of 4.411 bb. USDA said favorable crush margins for biofuel production will shift crush demand higher, while South American competition in the export market will cause U.S. sales oversees to decline compared to the current season. The national average farm gate price is forecast at $12.10.

On the old-crop, or 2022-23, ledger, USDA estimates ending stocks at 215 mb, up 5 mb from last month. The shift is a result of a 5 mb increase in imports. The national average farm gate price was lowered by a dime to $14.20.

Globally, most traders and farmers follow the old-crop marketing year estimates as South America is just finishing up harvest. For the 2022-23 season, USDA adjusted world ending stocks higher by .75 million metric tons to 101.04 mmt. Brazil’s production forecast was bumped up 1 mmt to 155 mt, while Argentina’s was left unchanged at 27 mmt.

Looking ahead to the 2023-24 season, USDA forecast ending stocks at 122.5 mmt. Crops in Brazil and Argentina are both forecast to be larger at 163 mmt and 48 mmt, respectively, but those crops won’t be planted until fall. USDA sees China’s import demand climbing by 4 mmt to 100 mmt.

LIVESTOCK

Friday’s WASDE Report was rather favorable to the cattle and beef markets again this month. Beef production for 2023 was raised by 146 million pounds as both fed cattle and non-feed cattle slaughter speeds have been more aggressive than originally assumed. This isn’t expected to hinder quarterly steer prices, however.

For the remaining three quarters of the year, every single quarter saw a higher anticipated price point than what April’s WASDE report shared. The second quarter is now expected to average $172 (up $3.00), the third quarter is now expected to average $164 (up $2.00) and the fourth quarter is expected to average $169 (up $2.00). Beef imports for 2023 were increased by one million pounds, but 2023 beef exports rose by 89 million pounds.

Friday’s WASDE report shared mixed news for the hog and pork markets. Pork production for 2023 was raised by 21 million pounds based on recent slaughter data. Unfortunately, quarterly price projections were pulled back from what April’s WASDE report depicted. Barrow and gilt prices in the second quarter are expected to average $56 (down $4.00), prices in the third quarter are expected to average $60 (down $7.00) and prices in the fourth quarter are expected to average $55 (down $7.00). Pork imports for 2023 were raised by 4 million pounds, but 2023 pork exports were increased by 123 million pounds.