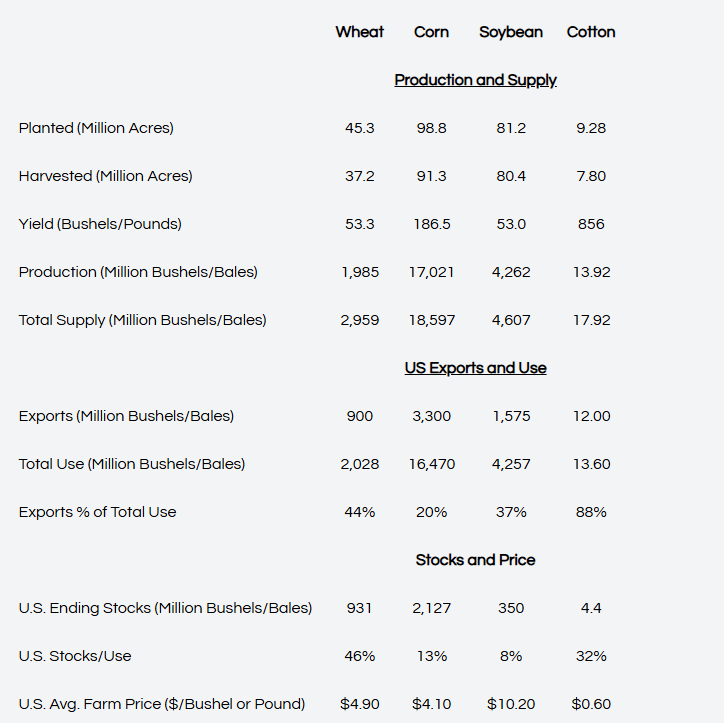

Adam Rabinowitz, Southern Ag Today– The USDA released the February World Agricultural Supply and Demand Estimates (WASDE) report yesterday with relatively little fanfare, especially compared to January. Wheat showed a little lower domestic use, resulting in higher ending stocks. Alternatively, corn showed greater exports and a lower ending stock, down to 2.1 billion bushels. Both the wheat and corn price projections remained unchanged at $4.90 per bushel for wheat and $4.10 per bushel for corn. The futures market for wheat and corn was essentially flat in response.

The most active part of a quiet report day was with soybeans. While domestic supply and use projections remained unchanged, production in Brazil was increased 2.0 million tons to 180.0 million tons. This was as a result of both greater reporting area in Brazil and favorable weather conditions, contributing to an increase in global production and ending stocks. However, the nearby futures market for soybeans maintained its upward trajectory, increasing roughly 11-12 cents per bushel, continuing the trend that started February 4 when soybean futures increased over 26 cents on comments by President Trump about China purchasing more soybeans. Regarding China, the WASDE report indicated that, “China is reported to be considering buying more U.S. soybeans, … [but] if China bought more from the United States, global soybean exports will likely be shifted with more U.S. shipments to China and less to other markets.” Thus, no change in global soybean demand was made in this report.

Meanwhile, the balance sheet for cotton remained basically unchanged, with exports reduced 200,000 bales and the marketing year average price decreasing 1 cent to 60 cents per pound. Table 1 details the current balance sheet for the four major crops. Upcoming USDA activity to watch includes the release of the USDA Agricultural Baseline Projections to 2035, the 102nd Agricultural Outlook Forum, and then the March WASDE and Prospective Plantings reports.