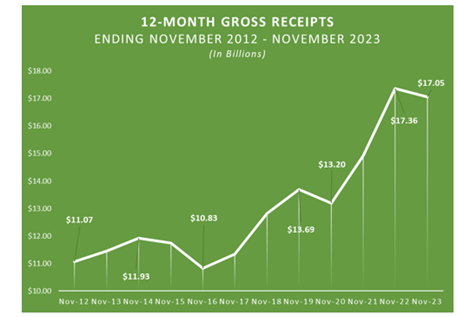

As expected, declining revenues from oil and gas production push gross receipts slightly down. Receipts to the Treasury for the last 12 months of $17.05 billion are $312 million, or 1.8 percent, below collections from the previous year.

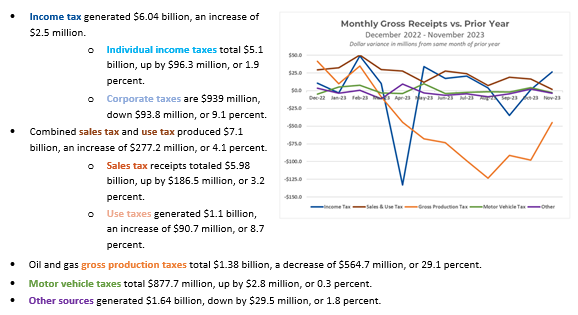

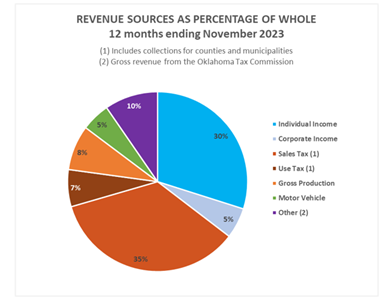

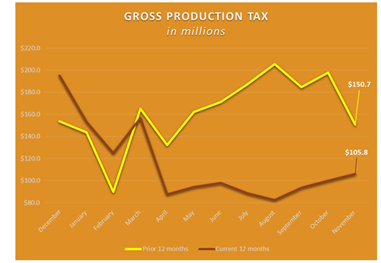

Revenue from the state’s Gross Production Tax dropped $565 million over last 12 months, down by 29 percent for the year.

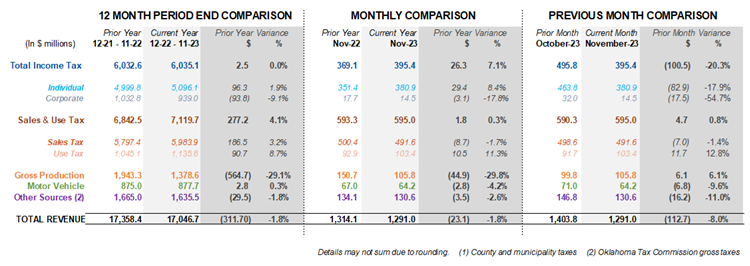

All tax sources in November total $1.3 billion. Continuing recent monthly trends, the November total receipts are down by $23 million, or 1.8 percent.

In addition, the previous month comparison shows a decline from October to November of $113 million, or 8 percent.

The Oklahoma Business Conditions Index plunged in November falling below growth neutral for the first time in three months. The November index was set at 43.2, compared to 53.0 in October. Numbers below 50 indicate the expectation of economic contraction over the next three to six months, but it should be noted that the index has been very volatile in recent months.

According to the U.S. Bureau of Labor Statistics, the October unemployment rate in Oklahoma was reported as 3.2 percent. The state’s jobless rate ticked up 0.2 percent from 3.0 percent in September. Meanwhile, the U.S. unemployment rate rose to 3.9 percent in October, up 0.1 percent from the previous month. As measured by the Consumer Price Index, the U.S. Bureau of Labor Statistics reports the annual inflation rate decreased to 3.2 percent in October. The energy component of the index continued to show a decline over the year, dropping 4.5 percent, but the food index grew just above the overall inflation rate, ending the month at 3.3 percent.

Twelve-Month Revenue

Combined gross receipts for the past 12 months compared to the prior year show gross revenue totaled $17.05 billion. That amount is $311.7 million, or 1.8 percent, below the previous 12 months.

- Income tax generated $6.04 billion, an increase of $2.5 million.

- Individual income taxes total $5.1 billion, up by $96.3 million, or 1.9 percent.

- Corporate taxes are $939 million, down $93.8 million, or 9.1 percent.

- Combined sales tax and use tax produced $7.1 billion, an increase of $277.2 million, or 4.1 percent.

- Sales tax receipts totaled $5.98 billion, up by $186.5 million, or 3.2 percent.

Use taxes generated $1.1 billion, an increase of $90.7 million, or 8.7 percent.

November Revenue

Comparing gross receipts from November 2023 to 2022 show total monthly gross revenue is $1.29 billion, down by $23.1 million, or 1.8 percent.

Income tax, a combination of individual income and corporate income taxes, generated $395.4 million, an increase of $26.3 million, or 7.1 percent.

Individual income taxes total $380.9 million, up by $29.4 million, or 8.4 percent.

Corporate taxes total $14.5 million, down by $3.1 million, or 17.8 percent.

Combined sales tax and use tax – including remittances on behalf of cities and counties – total $595 million, an increase of $1.8 million, or 0.3 percent.

Sales tax revenues are $491.6 million, down by $8.7 million, or 1.7 percent.

Use tax receipts, received on out-of-state purchases including internet sales, $103.4 million, up by $10.5 million, or 11.3 percent.

Gross production taxes on oil and natural gas total $105.8 million, a decrease of $44.9 million, or 29.8 percent.

Motor vehicle taxes produced $64.2 million, a decrease of $2.8 million, or 4.2 percent.

Other sources, composed of 60 different sources, produced $130.6 million, a decrease of $3.5 million, or 2.6 percent.

Previous Month Comparison

October 2023 compared to receipts from November 2023 show total monthly gross revenues are $1.3 billion, down by $112.7 million, or 8 percent.

Gross income tax receipts of $395.4 million are down by $100.5 million, or 20.3 percent.

Total sales and use tax generated $595.0 million, an increase of $4.7 million, or 0.8 percent.

About Gross Receipts to the Treasury

The monthly Gross Receipts to the Treasury report, developed by the State Treasurer’s Office, provides a timely and broad view of the state’s economy.

It is released in conjunction with the General Revenue Fund report from the Office of Management and Enterprise Services, which provides information to state agencies for budgetary planning purposes.

The General Revenue Fund, the state’s main operating account, receives less than half of the state’s gross receipts with the remainder apportioned to other state funds, remitted to cities and counties, and paid in rebates and refunds.Later this month, look for the Oklahoma Economic Report, providing a broader economic overview.

View full PDF report below.