Authors: Will Maples; Mississippi State University; Grant Gardner; University of Kentucky

As the calendar year comes to a close, U.S. soybean exports remain one of the more disappointing components of the soybean balance sheet. USDA currently projects soybean exports at 1.635 billion bushels, down 13 percent from last year. This weakness has been evident throughout the marketing year, with export commitments consistently running below historical norms and showing little of the typical seasonal acceleration.

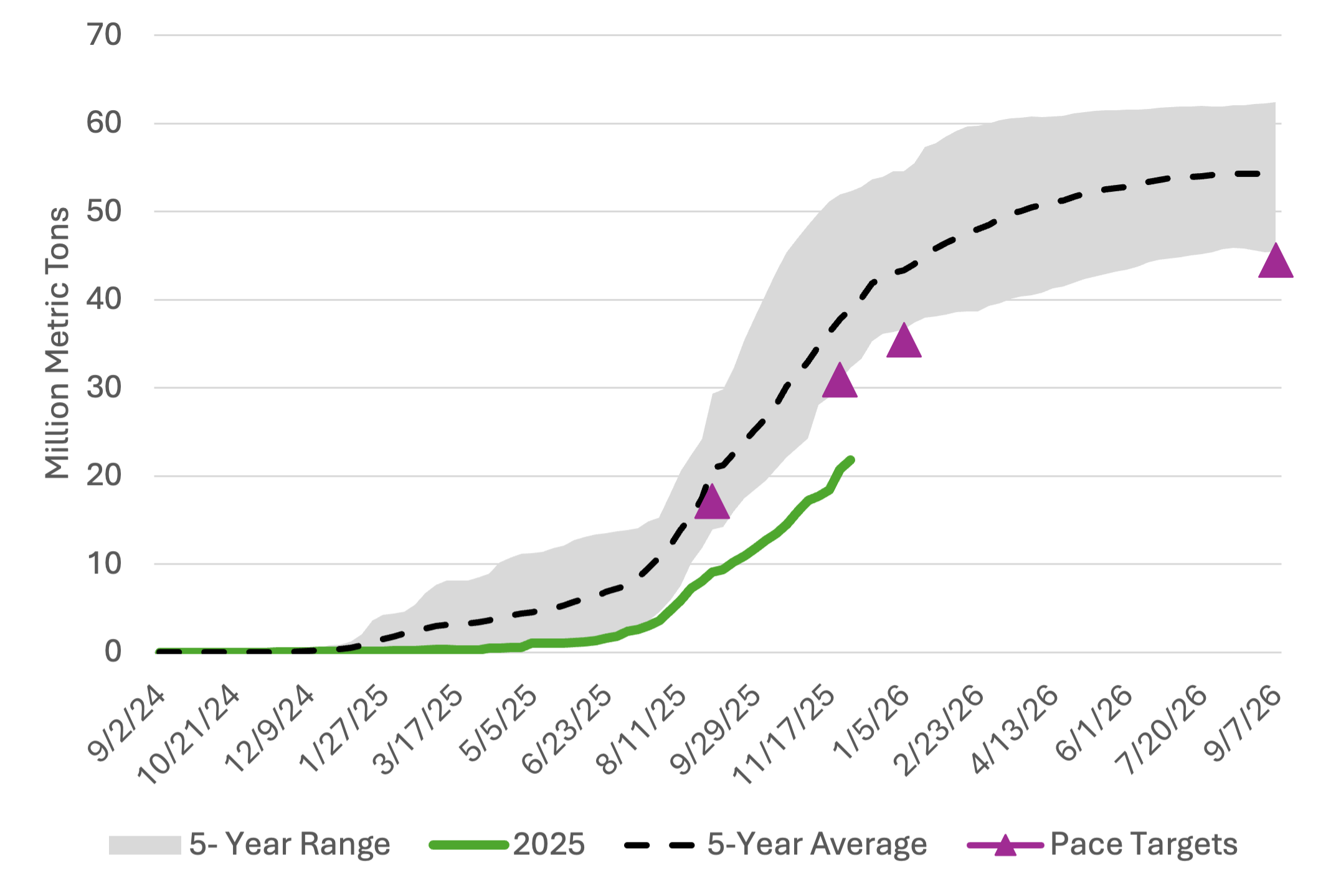

Figure 1 shows that U.S. soybean export commitments for the 2025-2026 marketing year have consistently trailed historical benchmarks. Commitments remained near the bottom of the five-year range through the winter and spring, reflecting limited early-season booking activity. Although export sales began to improve in late summer and early fall, the pace remains well below both the five-year average and USDA pace targets. Historically, roughly 70 percent of total soybean export commitments are in place by this point in the marketing year. Based on the five-year average pace, the U.S. would need approximately 30.9 million metric tons of commitments to meet USDA’s export projection. Currently, commitments total just 21.8 million metric tons, highlighting the substantial gap that remains.

The largest wildcard for U.S. soybean exports is China. Historically, China has been the single largest buyer of U.S. soybeans, accounting for 25% of U.S. soybean production (Gardner, 2025). However, Chinese purchases effectively halted last spring following the onset of the trade war. After the U.S. and China reached a trade agreement in October, China resumed soybean purchases. Under the agreement, China committed to purchase at least 12 million metric tons of U.S. soybeans in 2025, with an additional 25 million metric tons to be purchased in each of the following three years. Putting these numbers in perspective, 12 million metric tons account for 10% of U.S. soybean production this year.

Initially, the 2025 commitment was expected to be met by the end of the calendar year, though the timeline has since become less clear, with the administration later indicating the target could be reached by the end of February. Regardless of the exact deadline, progress to date suggests the original target will not be met by year-end. For the export report ending November 27, USDA reports China had purchased 3.0 million metric tons of soybeans. While recent announcements of additional sales to China suggest this figure is now higher than officially reported, purchases remain well short of trade deal commitments.

Despite the Chinese trade agreement, questions remain about the economic feasibility of large-scale Chinese purchases of U.S. soybeans relative to Brazilian soybeans. China has already sourced a substantial volume of soybeans from South America, and overall import demand is likely to remain limited regardless of trade commitments. With USDA projecting another increase in Brazilian soybean production, U.S. soybeans will likely remain trading at a premium to Brazil.

The lag in exports creates downside risk for producers with unpriced soybeans in storage if marketing decisions are based solely on the expectation of a late-season surge in Chinese purchases. Rather than relying on a potential export-driven price rally, producers should consider establishing price floors or incorporating other risk management strategies to protect against continued export weakness. As producers consider marketing old-crop soybeans for 2026 delivery, price recovery remains uncertain. Periodic sales at or above breakeven can help mitigate downside price risk, particularly if export demand continues to lag.

Figure 1. U.S. Total Soybean Export Commitments for 2025-2026 Marketing Year Compared to Previous Five Years (2020-2024)

Sources:

Gardner, Grant. “Major Players in US Trade and Grain Market Volatility.” Southern Ag Today 5(15.3). April 9, 2025. Permalink

Maples, William E., and Grant Gardner. “Soybean Exports Continue to Lag.” Southern Ag Today 5(52.3). December 24, 2025. Permalink