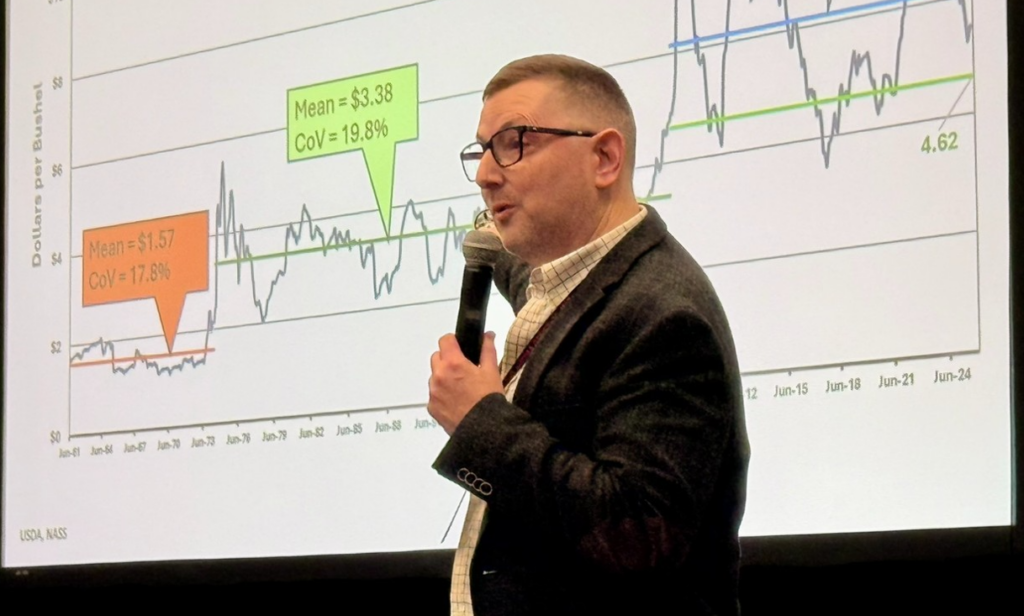

2026 Grain Market Outlook: The agricultural market is currently navigating a complex landscape shaped by persistent weather patterns, shifting government regulations, and global trade dynamics. Insights from Dr. Todd Hubbs at Oklahoma State University, while talking to Farm Director KC Sheperd, highlight how these factors are driving trends in the wheat, corn, and soybean sectors.

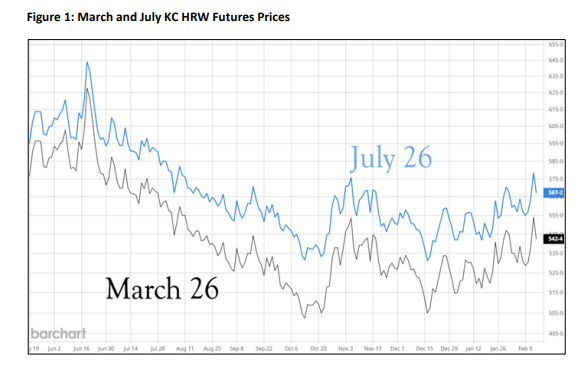

Wheat Markets Face Drought Pressure

The wheat market has been characterized by mid-week rallies followed by corrections. These movements are largely tied to technical factors and the ongoing dryness across the Southern Plains. While there were hopes for moisture from recent weather fronts in Oklahoma, the actual rainfall totals proved disappointing.

Dr. Todd Hubbs notes that the situation is becoming critical. “We’re brutally dry,” he says, pointing out that USDA data shows 45% to 46% of winter wheat acreage is currently in drought conditions. He emphasizes that while this occurs periodically, the current outlook for the winter wheat crop is increasingly “sketchy” due to the lack of precipitation.

While global reports from the Black Sea region have been positive, domestic concerns remain high. The dryness isn’t limited to the Southern Plains; it also extends to the “biscuit belt” in the East. Hubbs warns that “we’re going to continue to build on this drought,” and unless significant rainfall occurs soon, the market should expect continued weather-driven rallies.

Biofuels Drive Soybean Strength

Soybeans have seen a significant upward trend, primarily fueled by the biofuel sector. Anticipation regarding the Environmental Protection Agency’s (EPA) renewable volume obligations for the Renewable Fuel Standard has created a bullish atmosphere.

“The rumors coming out are pretty bullish for vegetable oils and fats moving into biodiesel and renewable diesel,” explains Dr. Hubbs. This sentiment has driven soybean oil prices back to levels last seen in late 2025. Furthermore, a massive expansion in crushing facilities, particularly in the North, has led to what Hubbs describes as an “unbelievable crush pace” for soybean processing this year.

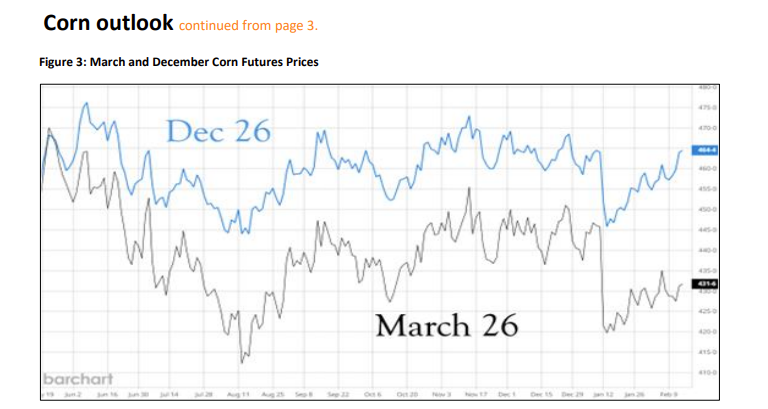

Corn and the Ethanol Narrative

The corn market is currently defined by its relationship with ethanol. Because corn prices have remained relatively low, buyers have been more active. However, the overall price movement is restricted by a massive domestic supply estimated at over 18.5 billion bushels.

Hubbs describes the current state of the market as “basically a trading ethanol story right now.” The finalization of rules for the 45Z tax credit is expected to offer further support to the industry. This credit system, based on carbon intensity scoring, encourages “climate-smart” agricultural practices. Hubbs points out that some ethanol facilities in the Eastern Corn Belt are already expanding production in response to these incentives.

Global Trade and Sorghum Stability

Sorghum remains a stable component of the export market, with China maintaining a high volume of outstanding sales. Despite competition from Argentina and Australia, U.S. sorghum—particularly from Oklahoma—remains globally competitive.

“I think they’re going to stick to the sales because the prices are still really competitive,” Hubbs says regarding China’s interest. Looking ahead, he notes that geopolitical factors in the Middle East and North Africa could introduce new volatility, as any disruption in trade routes like the Strait of Hormuz could significantly impact how grain moves around the world.