Agricultural markets witnessed a week of rallies followed by late-week corrections as shifting weather patterns in the Southern Plains and updated federal reports influenced trader sentiment. According to the latest Crop Outlook Newsletter from Oklahoma State University’s Dr. Todd Hubbs, the market is currently navigating a complex landscape of steady demand and looming environmental factors.

Wheat Market: Range-Bound Despite Drought Concerns

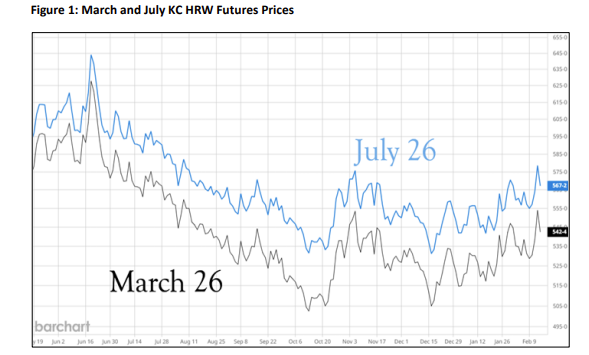

The wheat market remains locked in a specific trading range that has persisted since late October. While prices recently tested the upper limits of this range, sustained breakouts appear unlikely without significant external shocks.

“Last week’s rally ended at the top of the range HRW futures prices have been in since November,” Hubbs noted, adding that “breaking out of this range over the next couple of months remains difficult barring a major geopolitical event”.

Key factors currently influencing wheat include:

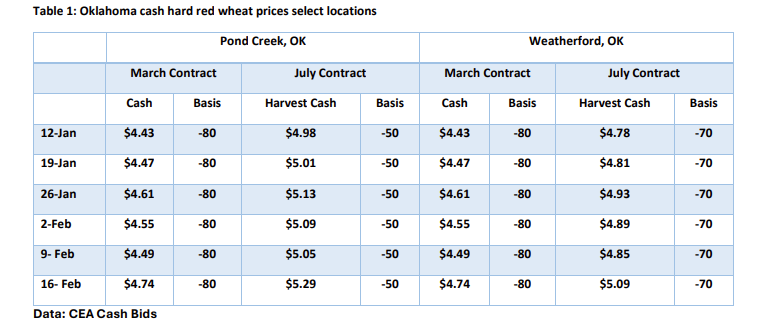

- Price Performance: March HRW futures reached $5.55 last Thursday before falling back to close at $5.42 on Friday.

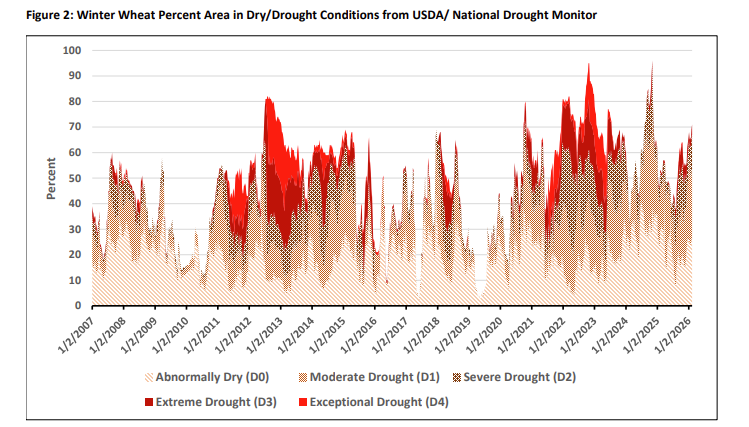

- Environmental Pressure: Drought conditions for winter wheat recently sat at 45 percent, though a weekend weather system brought “much needed moisture” to the Southern Plains.+1

- International Competition: Black Sea prospects remain a bearish factor, with Russia reporting better crop conditions than last year and Ukraine projecting a 4 percent increase in acreage.+1

Corn and Sorghum: Demand Strength Meets “Fragile” Rallies

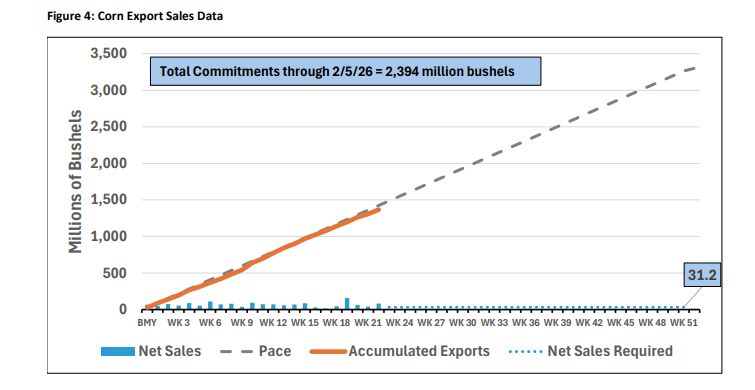

In the corn market, demand remains the primary engine for price stability. The USDA recently increased marketing year corn export forecasts by 100 million bushels, bringing the total to 3.3 billion.

However, Dr. Hubbs warns that the recent upward movement in long-term futures might not be permanent. “The recent run up in December corn futures may be fragile,” Hubbs stated, noting that market uncertainty will likely persist until the release of the March 31 USDA reports.

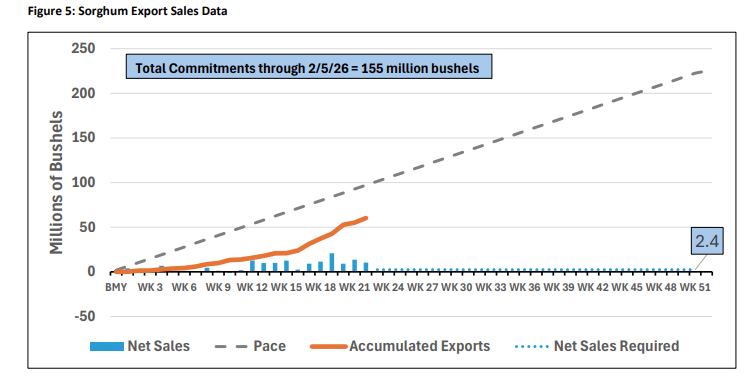

For sorghum producers, the outlook is a mixture of improved demand and low basis levels. While export sales to China remain a factor and ethanol usage of sorghum has tripled compared to the last marketing year, prices remain weighed down by overall grain supplies. Hubbs observed that “Sorghum price remains tied to corn and remains weak given large sorghum and corn supplies”.+2

Export Trajectory and Outlook

Both wheat and corn exports are currently on pace to meet or exceed USDA forecasts. HRW total commitments have reached 90.5 percent of the federal forecast, while corn commitments sit at 72 percent, which Hubbs describes as “typical levels this far through the cycle”