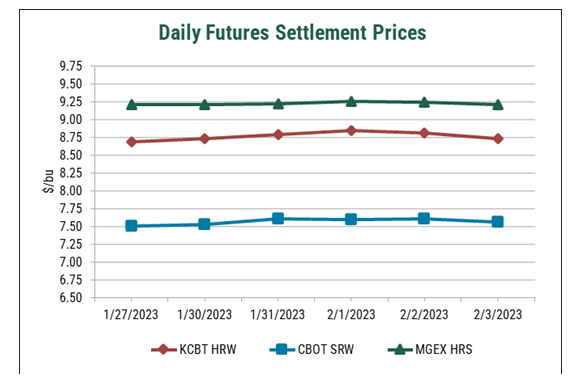

March ’23 wheat futures ended the week little changed. CBOT soft red winter (SRW) futures were up 9 cents on the week, closing at $7.57/bu. KCBT hard red winter (HRW) futures were up 4 cents, at $8.73/bu. MGE hard red spring (HRS) futures were unchanged at $9.22/bu. CBOT corn futures were down 5 cents, at $6.83/bu. CBOT soybean futures were up 23 cents, at $15.32/bu.

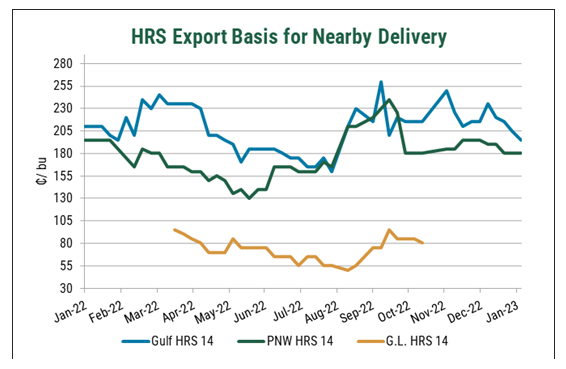

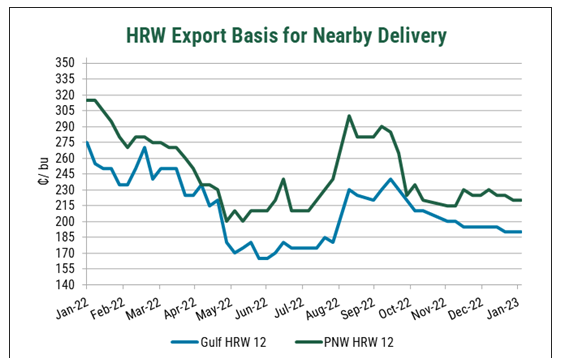

• Basis levels were mostly unchanged across classes and export regions due to little new information and a lack of export demand. HRW basis was steady in the PNW and Gulf as slow farmer-selling and limited demand leaves exporters stalled. HRS basis was down in the Gulf as improved rail performance takes pressure off freight markets. Likewise, PNW HRS from April forward benefitted from cheaper freight, though it remains steady nearby. Both SRW basis and SW prices increased, driven by increased CBOT futures prices after last week’s dip to the lowest levels since before Russia invaded Ukraine.

• Pro Farmer reported that individual U.S. state crop conditions ratings showed further deterioration of the HRW wheat crop ratings during January. The “good” to “excellent” ratings for HRW wheat stood at 21% in Kansas (up two points from the end of December), 17% in Oklahoma (down 21 points), 14% in Texas (no December rating), 38% in Colorado (down 12 points), 22% in Nebraska (up four points), 22% in South Dakota (up six points) and 16% in Montana (down six points).

• U.S. flour production hit a record high in 2022 at 430.3 million hundredweights (cwt), up 2.2% from 2021, or 9.1 million cwt.

Commercial Sales

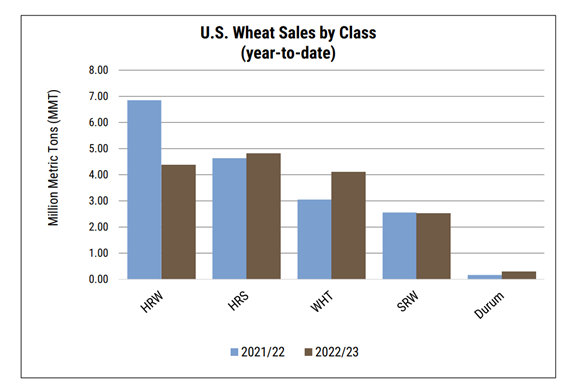

• For the week ending Jan. 26, 2023, net U.S. commercial wheat sales of 136,400 metric tons (MT) were reported for delivery in 2022/23, down 73% from last week and below trade expectations of 300,000 to 600,000 MT. Year-to-date 2022/23 commercial sales total 16.2 million metric tons (MMT), 6% behind last year’s pace. USDA expects 2022/23 U.S. wheat exports of 21.09 MMT.

• Indian wheat prices have dropped 13% since the release of wheat stocks to bulk users to 28,290 rupees or $347.11/MT, though domestic prices are still higher than the minimum support price of 21,250 rupees or $303.88/MT. Due to the elevated open market price, government purchases of wheat for the country’s subsidized feeding program dropped 53% to 18.8 MMT.

• Following USDA’s estimated wheat production of 91.0 MMT for the 2022/23 crop year in Russia, production may decrease to between 84.0 and 87.0 MMT in 2023/24, according to IKAR. Weather has been generally favorable; however, analysts are monitoring the impact of dryness across the southern region and frosts in the central Black Soil and Volga regions.

• The U.S. Department of Agriculture attaché in Turkey reported that dry weather could impact wheat yields in the country for the 2023/23 crop. Turkey continues to face food price inflation and as a result the government has extended zero duties on some imported grain and pulses in addition to trading domestic and imported grain, including wheat, at discounted prices.

Baltic and U.S. Dollar Indices

• The Baltic Dry Index (BDI), an assessment of the average cost to ship raw materials such as grains, coal, and iron ore, decreased by 8% on the week to end at 621.

• The U.S. Dollar Index increased slightly from last week’s 101.9 to 102.5. On Wednesday the U.S. Federal Reserve raised U.S. interest rates by 25 basis points.